Oil futures soared on Friday after Turkish airstrikes on Kurdish rebel bases in Iraq injected some supply concerns into the market and the US Labor Department’s employment report gave investors reason to be optimistic about the US economy.

Light, sweet crude for June delivery rose US$3.80 to settle at US$116.32 a barrel on the New York Mercantile Exchange.

In London, June Brent crude futures gained US$4.06 to settle at US$114.56 a barrel on the ICE Futures exchange.

Turkish warplanes bombed Kurdish rebel bases inside Iraq for three hours overnight, a rebel spokesman said on Friday. When conflict breaks out in the Middle East, investors often buy on concerns that supplies will be disrupted.

Some investors were also buying crude on a view that the economy is improving, analysts said. The US Labor Department said employers cut far fewer jobs last month than expected.

“If the jobs [situation] isn’t as bad, maybe we’d see a snap back in demand,” said Phil Flynn, an analyst at Alaron Trading Corp in Chicago.

For a change, investors shrugged off the US dollar, which rose on a theory that the employment data means the US Federal Reserve is less likely to cut interest rates further this year; falling rates tend to weaken the dollar.

A rising dollar undercuts the appeal of commodities such as oil as a hedge against inflation, and makes oil more expensive to investors overseas. The rising greenback helped pull oil prices back to nearly US$110 a barrel on Thursday. Oil’s climb to almost US$120 on Monday from about US$64 a year ago was largely due to a protracted decline by the dollar, analysts say.

However, oil’s connection to the dollar can be broken when other factors predominate, as they did on Friday.

“It’s not a perfect relationship, and on any given day, oil will choose to go its own way,” said Jim Ritterbusch, president of energy consultancy Ritterbusch and Associates in Galena, Illinois.

Still, analysts think the market’s decision to shrug off Friday’s stronger dollar will be short-lived, particularly if the Fed holds interest rates steady and the dollar continues to gain.

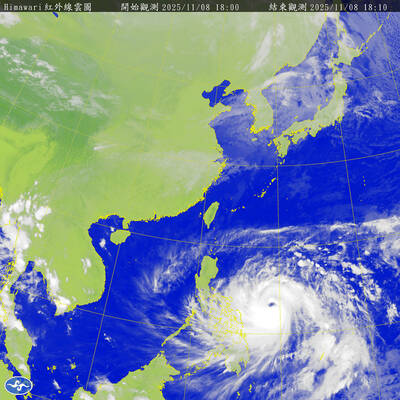

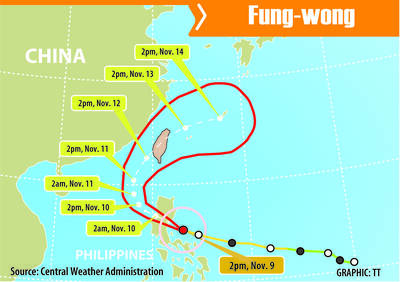

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had