Carlyle Capital Corp said late on Wednesday it expected its creditors to seize all of the fund's remaining assets after unsuccessful negotiations to prevent its liquidation.

The London-based fund shook financial markets last week after missing margin calls from banks on its US$21.7 billion portfolio of residential-mortgage-backed bonds. Carlyle's troubles have amplified fears that billions of dollars of depressed mortgage-backed securities will flood the market, reducing their value even further.

More than US$5 billion of Carlyle's securities have already been sold, but the fund tried to negotiate with the banks to prevent the liquidation of the remaining US$16 billion.

"Although it has been working diligently with its lenders, the company has not been able to reach a mutually beneficial agreement to stabilize its financing," Carlyle said in a news release.

More than a year ago, the fund leveraged its US$670 million equity 32 times to finance a US$21.7 billion portfolio of AAA-rated residential mortgage-backed securities issued by Freddie Mac and Fannie Mae. It borrowed money from at least a dozen banks and firms, including Bank of America Corp, Citigroup Inc and Merrill Lynch & Co.

Carlyle posted the securities as collateral under repurchase agreements, so if the value of the securities fall, the lender has the right to ask for more collateral -- a margin call -- to secure the loan. If the borrower does not meet the margin call, the lender may sell the security.

The value of mortgage-backed securities plummeted as US home prices fell and foreclosures surged, prompting the banks to ask Carlyle for more than US$400 million in additional capital. The fund was unable to come up with the money, prompting lenders to start foreclosing on the securities.

As of Wednesday, Carlyle said it has defaulted on about US$16.6 billion of its debt and the rest is expected to go into default soon.

Carlyle Capital is one of 55 funds managed by Washington-based Carlyle Group, one of the largest private equity firms in the world with approximately US$76 billion in assets.

Carlyle Group "participated actively" in the fund's negotiations with its lenders to refinance its portfolio and was prepared to provide substantial additional capital if sustainable terms could be achieved, the fund's statement said.

But hopes for refinancing fell apart after some lenders said that the value of the collateral had declined further, which was expected to result in additional margin calls yesterday of about US$97.5 million.

Carlyle Capital is registered in Britain but managed by New York-based executives. It was the first Carlyle Group fund to go public, at US$19 a share in July on the Euronext exchange.

Trading of the fund's shares was suspended last week after tumbling more than 50 percent to US$5 apiece on the news that the fund wasn't able to meet the margin calls.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

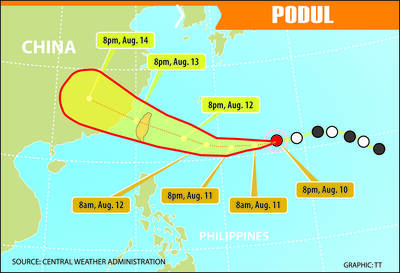

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest