Like the tides, the wave of good feelings that swept over Wall Street and Main Street with the Federal Reserve's big interest rate cut could ebb just as quickly.

Homeowners opening up statements for their adjustable-rate mortgages come next month will experience a jolt when the rates jump, but not as severe a jolt as it could have been.

And, Wall Street's mood swings -- reflecting bouts of panic and then some relief -- are expected to linger.

That is because the Fed's action, while perhaps providing some help, will not cure problems in the ailing housing market, which are still expected to drag well into next year.

It will take time for builders to work off a glut of unsold homes. That means the housing slump will continue to hold back the economy and probably lead to more job cuts in construction, manufacturing and other industries.

The Fed's action also won't stop home foreclosures and late mortgage payments from rising in the months ahead.

In a bold move, Fed Chairman Ben Bernanke and his colleagues on Tuesday sliced a key interest rate by half a percentage point to 4.75 percent. It was the first rate cut in more than four years.

Their aim is to prevent the economy from being thrown into a recession by a housing meltdown and a credit crunch. Lower rates should induce people and businesses to boost spending and investing, which would help energize economic activity.

Wall Street investors were cheered by the move, sending the Dow Jones industrial average zooming 335.97 points. It was the Dow's biggest one-day point jump in nearly five years.

Over the short term, the rate cut can provide an important psychological boost. It could make investors, businesses and others less inclined to clamp down or make drastic changes in their behavior that would hurt the economy.

"This does not heal the financial markets, but it can help in the process of healing. But we're not there yet," said Ken Mayland, economist at ClearView Economics.

The improved mind set, though, could turn out to be fleeting.

"I think the honeymoon is going to be pretty short for the euphoria of this Fed cut," said Greg McBride, senior financial analyst for Bankrate.com. "A half-point cut can only do so much. It doesn't transform the housing market into sunshine and daffodils."

The housing market is suffering through its worst slump in 16 years. Home sales are expected to keep on sagging. Home prices, which saw double-digit gains in many areas during the boom, have cooled off significantly. Affordability is still an issue for would-be home buyers, experts say.

Pain will continue to be felt by borrowers, lenders and investors of "subprime" mortgages -- higher-risk loans made to people with spotty credit or with low incomes.

Analysts estimate that 2 million adjustable-rate mortgages will jump from very low initial teaser rates to higher rates this year and next. Steep prepayment penalties have made it difficult for some to get out of their mortgages. Some overstretched homeowners can't afford to refinance or even sell their homes.

The Fed's action does provide a bit of relief. For owners facing a reset on Oct. 1, their new rate will rise to 6.75 percent, versus 7.50 if it had reset a few months earlier, McBride said.

"The payment is still going up by hundreds of dollars a month. So people are not going to feel warm and fuzzy," he said.

For consumers, whose confidence has been rattled by the housing and credit problems, much turns on whether employment conditions continue to deteriorate.

The economy lost 4,000 jobs last month, the first decline in four years. The unemployment rate, now at 4.6 percent, is expected to climb close to 5 percent by the end of the year. A softening job market eventually will probably mean slower wage growth.

Howard Chernick, economic professor at Hunter College, doesn't think the Fed's rate cut will make people rush to the malls.

"Consumer spending is influenced by employment and wages," Chernick said. "Aside from the euphoria some might now feel, I don't think there is going to be a big effect."

It will take months for the Fed's rate cut to ripple through the economy, with the hope that it will bolster activity.

Analysts expect the economy to slow to a rate of about 2 percent in the current quarter. That would be just half the pace of the previous three months.

A Ministry of Foreign Affairs official yesterday said that a delegation that visited China for an APEC meeting did not receive any kind of treatment that downgraded Taiwan’s sovereignty. Department of International Organizations Director-General Jonathan Sun (孫儉元) said that he and a group of ministry officials visited Shenzhen, China, to attend the APEC Informal Senior Officials’ Meeting last month. The trip went “smoothly and safely” for all Taiwanese delegates, as the Chinese side arranged the trip in accordance with long-standing practices, Sun said at the ministry’s weekly briefing. The Taiwanese group did not encounter any political suppression, he said. Sun made the remarks when

PREPAREDNESS: Given the difficulty of importing ammunition during wartime, the Ministry of National Defense said it would prioritize ‘coproduction’ partnerships A newly formed unit of the Marine Corps tasked with land-based security operations has recently replaced its aging, domestically produced rifles with more advanced, US-made M4A1 rifles, a source said yesterday. The unnamed source familiar with the matter said the First Security Battalion of the Marine Corps’ Air Defense and Base Guard Group has replaced its older T65K2 rifles, which have been in service since the late 1980s, with the newly received M4A1s. The source did not say exactly when the upgrade took place or how many M4A1s were issued to the battalion. The confirmation came after Chinese-language media reported

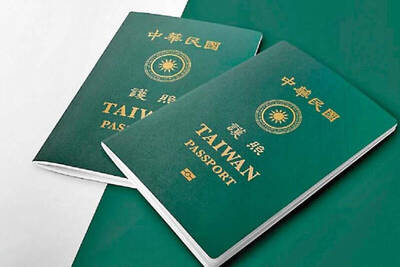

The Taiwanese passport ranked 33rd in a global listing of passports by convenience this month, rising three places from last month’s ranking, but matching its position in January last year. The Henley Passport Index, an international ranking of passports by the number of designations its holder can travel to without a visa, showed that the Taiwan passport enables holders to travel to 139 countries and territories without a visa. Singapore’s passport was ranked the most powerful with visa-free access to 192 destinations out of 227, according to the index published on Tuesday by UK-based migration investment consultancy firm Henley and Partners. Japan’s and

BROAD AGREEMENT: The two are nearing a trade deal to reduce Taiwan’s tariff to 15% and a commitment for TSMC to build five more fabs, a ‘New York Times’ report said Taiwan and the US have reached a broad consensus on a trade deal, the Executive Yuan’s Office of Trade Negotiations said yesterday, after a report said that Washington is set to reduce Taiwan’s tariff rate to 15 percent. The New York Times on Monday reported that the two nations are nearing a trade deal to reduce Taiwan’s tariff rate to 15 percent and commit Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to building at least five more facilities in the US. “The agreement, which has been under negotiation for months, is being legally scrubbed and could be announced this month,” the paper said,