India's central bank unexpectedly ordered lenders to set aside larger reserves for the third time in a year to remove excess money that may stoke inflation.

Reserve Bank of India Governor Yaga Venugopal Reddy will lift the cash reserve ratio, or the proportion of cash commercial banks must put aside against deposits, to 7 percent from 6.5 percent. The Mumbai-based central bank yesterday also held its benchmark interest rate at a five-year high of 7.75 percent.

Reddy's move comes a day after China's government curbed bank lending for a sixth time this year. The world's two fastest growing major economies are both struggling to prevent floods of cash from fueling asset bubbles and fanning inflation.

"It's a similar problem of excess liquidity in both China and India," said Ramya Suryanarayanan, an economist at DBS Bank Ltd in Singapore.

"The difference is that India is using currency appreciation as well to curb inflation. We will see more cash reserve ratio hikes in India," Suryanarayanan said.

Interest rates in India's call market have stayed near zero for three weeks as the central bank stepped up dollar purchases to prevent the local currency from advancing from a nine-year high.

In the process, it injected rupees faster than it could mop up.

A stronger rupee could hurt exports, which make up one-third of the country's US$854 billion economy.

Capital inflows are increasing as foreign investors are buying more stocks in India, encouraged by unprecedented economic growth since 2003.

Overseas funds have bought a record US$10.4 billion stocks and bonds in India this year, surpassing the net US$8.87 billion in stocks and bonds bought last year and US$9.46 billion in 2005.

India's benchmark Sensitive index has more than tripled in the past three years.

"Surges in capital inflows and large changes in liquidity conditions are obscuring an accurate assessment of risks," the central bank said in yesterday's statement. "It is necessary to note that while there is an abatement of inflation in the recent period, upward pressures persist."

Additions to foreign-currency reserves, which are an indication of the Reserve Bank's dollar purchases, rose US$8.7 billion this month after a $5.1 billion increase in June.

Dollar purchases in March and April were US$2.3 billion and US$2.1 billion respectively, according to the central bank.

The central bank yesterday also scrapped the 30 billion rupees (US$740 million) cap on funds it will absorb each day from lenders through its reverse-repurchase auction.

The limit spurred banks with spare cash to lend more in the money market, making borrowing cheaper. The cap will be lifted effective on Monday, while the increase in the cash reserve ratio takes effect on Saturday.

China also has excess cash from record trade surpluses that threatens to fuel inflation, create asset bubbles and overcapacity in manufacturing.

China yesterday ordered banks to set aside 12 percent of deposits as services to curb lending and investment after the economy grew at the fastest pace since 1994.

China is under pressure from trade partners, particularly the US, to allow faster appreciation of the yuan to slow the inflow of money from exports.

India's central bank in April twice increased the limit on the sale of so-called market stabilization bonds, used to drain surplus cash.

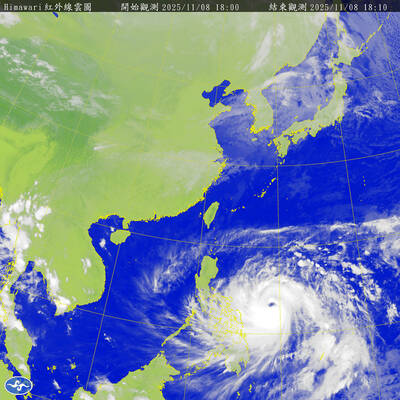

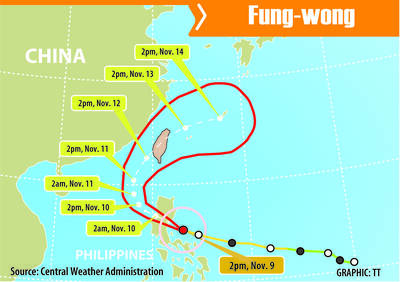

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had