The Thai baht, which was battered by massive flight of capital in the 1997 Asian financial crisis, is again facing mounting pressure -- this time from large money inflows into the kingdom.

Since early this month, the Thai currency has remained at 10-year highs against the US dollar with investors pouring money into the stock market, where share prices have gained nearly 30 percent since the beginning of this year.

The strong baht has alarmed the army-backed government as it put pressure on the kingdom's export-driven economy, which was already in a slump due to political uncertainty following last September's coup.

Large money inflows also brought back bitter memories of the crisis 10 years ago when the kingdom was forced to float the baht after coming under massive speculative pressure.

Capital had poured into Thailand during the breakneck economic growth of the early 1990s, but investors began to fear the baht was overvalued and pulled their money out.

As large amounts of capital fled out of Thailand in 1997, the baht collapsed, setting off a chain of Asian currency devaluations that crippled economies from South Korea to Indonesia.

Last week Finance Minister Chalongphob Sussangkarn cautioned against current capital inflows, saying there was "contingent liability that the current inflows could become outflows if the stock market starts to decline."

"That's the kind of situation we should be aware of to make sure that our international reserves are enough," he said.

Analysts have warned against the dangers of large capital inflows but argued Thailand would unlikely repeat the 1997 crisis thanks to its solid economic fundamentals, including robust exports.

"The risk of large capital inflows and outflows is always there in an emerging market like Thailand," said Albin Liew, a senior economist at United Overseas Bank in Singapore. "But Thailand is not in a situation like '97 because its economic fundamentals are steady, the financial sector is strong, and it has strong current account surpluses."

Huang Yiping (

But the Citibank economist said the consequences of large capital inflows were "undesirable given the short-term nature of much of the capital flows and the painful memories of the financial crisis 10 years ago."

Woo Yuen Pau, president and chief executive of think-tank Asia Pacific Foundation of Canada, said in Bangkok that current capital inflows were focusing on the equity market, not short-term debts that led to the 1997 meltdown.

But Woo warned money inflows could quickly turn into capital flight if the government takes drastic measures, such as the capital controls it briefly imposed last December to halt the baht's rise.

The central bank was again under pressure last week to rein in the baht and cut its key interest rate on Wednesday by 25 basis points to 3.25 percent. Despite the rate cut, the baht closed again on Friday at a near 10-year high of 33.65-67 to the US dollar.

Central bank Governor Tarisa Watanagase has vowed to weaken the baht, but stressed the bank would take no extreme measures.

"We cannot do things that are extreme such as a currency peg system. We have to be moderate," she said last week.

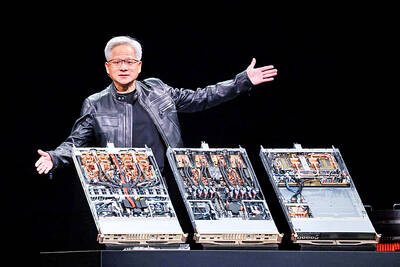

Nvidia Corp yesterday unveiled its new high-speed interconnect technology, NVLink Fusion, with Taiwanese application-specific IC (ASIC) designers Alchip Technologies Ltd (世芯) and MediaTek Inc (聯發科) among the first to adopt the technology to help build semi-custom artificial intelligence (AI) infrastructure for hyperscalers. Nvidia has opened its technology to outside users, as hyperscalers and cloud service providers are building their own cost-effective AI chips, or accelerators, used in AI servers by leveraging ASIC firms’ designing capabilities to reduce their dependence on Nvidia. Previously, NVLink technology was only available for Nvidia’s own AI platform. “NVLink Fusion opens Nvidia’s AI platform and rich ecosystem for

WARNING: From Jan. 1 last year to the end of last month, 89 Taiwanese have gone missing or been detained in China, the MAC said, urging people to carefully consider travel to China Lax enforcement had made virtually moot regulations banning civil servants from making unauthorized visits to China, the Control Yuan said yesterday. Several agencies allowed personnel to travel to China after they submitted explanations for the trip written using artificial intelligence or provided no reason at all, the Control Yuan said in a statement, following an investigation headed by Control Yuan member Lin Wen-cheng (林文程). The probe identified 318 civil servants who traveled to China without permission in the past 10 years, but the true number could be close to 1,000, the Control Yuan said. The public employees investigated were not engaged in national

CAUSE AND EFFECT: China’s policies prompted the US to increase its presence in the Indo-Pacific, and Beijing should consider if this outcome is in its best interests, Lai said China has been escalating its military and political pressure on Taiwan for many years, but should reflect on this strategy and think about what is really in its best interest, President William Lai (賴清德) said. Lai made the remark in a YouTube interview with Mindi World News that was broadcast on Saturday, ahead of the first anniversary of his presidential inauguration tomorrow. The US has clearly stated that China is its biggest challenge and threat, with US President Donald Trump and US Secretary of Defense Pete Hegseth repeatedly saying that the US should increase its forces in the Indo-Pacific region

ALL TOGETHER: Only by including Taiwan can the WHA fully exemplify its commitment to ‘One World for Health,’ the representative offices of eight nations in Taiwan said The representative offices in Taiwan of eight nations yesterday issued a joint statement reiterating their support for Taiwan’s meaningful engagement with the WHO and for Taipei’s participation as an observer at the World Health Assembly (WHA). The joint statement came as Taiwan has not received an invitation to this year’s WHA, which started yesterday and runs until Tuesday next week. This year’s meeting of the decisionmaking body of the WHO in Geneva, Switzerland, would be the ninth consecutive year Taiwan has been excluded. The eight offices, which reaffirmed their support for Taiwan, are the British Office Taipei, the Australian Office Taipei, the