Overexposure of Taiwanese banks to the Chinese financial sector by allowing Taiwanese financial services providers into China, as stipulated under the cross-strait service trade agreement, would expose Taiwan to potential Chinese financial market upheaval, according to a government national security assessment report.

The trade agreement was signed in Shanghai, China, in June last year.

Under the agreement, Chinese investors would be able to hold up to a 10 percent stake in Taiwanese banks, but of the 16 Taiwanese financial institutions, more than half are privately managed — including heavyweights such as CTBC Financial Holding Co — the report says.

This means that theoretically more than half of the financial sector could end up in China’s pocket, the report says.

Chinese-funded banks would be able to increase the Taiwanese banking sector’s reliance on Chinese funds by offering large loans at low interest rates, after which China could, through threats to deny loan extensions or pull their money out, force the banks to voice opinions on certain issues to try to influence national policy, the report says.

Personal information is also at risk as Chinese-funded banks could obtain such information through the joint credit information center, posing considerable risk to the security of people’s livelihoods and assets, the report says.

However, former national policy adviser Huang Tien-lin (黃天麟) said that the report focuses more on internal matters and downplays the potential negative consequences of allowing Taiwanese banks to establish themselves in China.

If enough funding from Taiwan has been “exposed,” China would have the ball in its court and have a complete say over Taiwan’s financial security, Huang said, adding that would be the greatest risk of liberalizing the financial system.

Huang said the report only states the risk of bankruptcy for Taiwanese banks with too much capital invested in China if they run into obstacles with their Chinese branches.

Huang said that as long as the boards of the financial institutions remain in Taiwanese hands — which should be the case unless the companies’ management has critically failed beyond even a government bailout — Chinese investors would have next to no chance to influence the boards.

As for the report’s claim that Taiwanese personal information would be available to China, Huang said that was the price you pay for liberalization and the same principle applies around the world.

Huang said Taiwan has already been hurt by its industry moving to China, directly causing lower economic growth and lower real wages, adding that if the banking sector were to move to China, all financial development and assets would also move to China.

The move would make it even more difficult for Taiwanese small and medium-sized enterprises to access funding, rubbing salt in Taiwan’s economic wounds, Huang said.

A group of Taiwanese-American and Tibetan-American students at Harvard University on Saturday disrupted Chinese Ambassador to the US Xie Feng’s (謝鋒) speech at the school, accusing him of being responsible for numerous human rights violations. Four students — two Taiwanese Americans and two from Tibet — held up banners inside a conference hall where Xie was delivering a speech at the opening ceremony of the Harvard Kennedy School China Conference 2024. In a video clip provided by the Coalition of Students Resisting the CCP (Chinese Communist Party), Taiwanese-American Cosette Wu (吳亭樺) and Tibetan-American Tsering Yangchen are seen holding banners that together read:

UNAWARE: Many people sit for long hours every day and eat unhealthy foods, putting them at greater risk of developing one of the ‘three highs,’ an expert said More than 30 percent of adults aged 40 or older who underwent a government-funded health exam were unaware they had at least one of the “three highs” — high blood pressure, high blood lipids or high blood sugar, the Health Promotion Administration (HPA) said yesterday. Among adults aged 40 or older who said they did not have any of the “three highs” before taking the health exam, more than 30 percent were found to have at least one of them, Adult Preventive Health Examination Service data from 2022 showed. People with long-term medical conditions such as hypertension or diabetes usually do not

POLICE INVESTIGATING: A man said he quit his job as a nurse at Taipei Tzu Chi Hospital as he had been ‘disgusted’ by the behavior of his colleagues A man yesterday morning wrote online that he had witnessed nurses taking photographs and touching anesthetized patients inappropriately in Taipei Tzu Chi Hospital’s operating theaters. The man surnamed Huang (黃) wrote on the Professional Technology Temple bulletin board that during his six-month stint as a nurse at the hospital, he had seen nurses taking pictures of patients, including of their private parts, after they were anesthetized. Some nurses had also touched patients inappropriately and children were among those photographed, he said. Huang said this “disgusted” him “so much” that “he felt the need to reveal these unethical acts in the operating theater

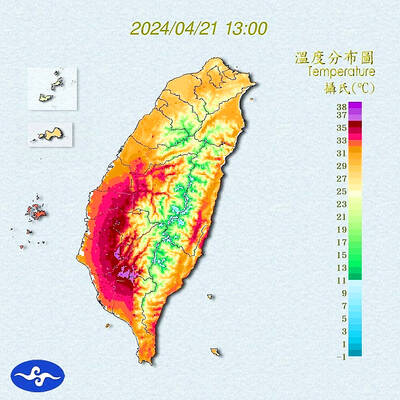

Heat advisories were in effect for nine administrative regions yesterday afternoon as warm southwesterly winds pushed temperatures above 38°C in parts of southern Taiwan, the Central Weather Administration (CWA) said. As of 3:30pm yesterday, Tainan’s Yujing District (玉井) had recorded the day’s highest temperature of 39.7°C, though the measurement will not be included in Taiwan’s official heat records since Yujing is an automatic rather than manually operated weather station, the CWA said. Highs recorded in other areas were 38.7°C in Kaohsiung’s Neimen District (內門), 38.2°C in Chiayi City and 38.1°C in Pingtung’s Sandimen Township (三地門), CWA data showed. The spell of scorching