Taiwan ranked 25th in Forbes magazine’s latest list of the world’s “Best Countries for Business,” one spot higher than a year earlier and the third-best showing in Asia behind Hong Kong and Singapore.

Although the rankings were primarily based on last year, when Taiwan’s economy contracted by 1.9 percent and per capita GDP fell, substantial improvement in removing red tape helped elevate Taiwan one spot in the rankings, ahead of Japan (27th) and South Korea (30th).

“Taiwan has a dynamic capitalist economy with gradually decreasing government guidance of investment and foreign trade,” the report said.

It noted, however, that Taiwan’s dependence on exports for 70 percent of its economic growth left it vulnerable to downturns in global demand, as was the case last year when it suffered a 20 percent year-on-year decline in exports.

The Forbes ranking also identified “Taiwan’s diplomatic isolation, low birth rate and rapidly aging population” as major long-term challenges.

Taiwan has so far been excluded from greater economic integration and its low birth rate raised the prospect of “future labor shortages, falling domestic demand and declining tax revenues,” the report said.

Taiwan’s best rating came in the area of innovation, where it was ranked eighth of the 128 economies surveyed, and was also highly regarded in the areas of monetary freedom (14th), technology (18th) and property rights (24th).

It was at its worst in investor protection, ranking 56th, and tax burden, ranking 63rd, but a drop in the corporate tax rate this year to 17 percent from the previous 25 percent is likely to dramatically improve Taiwan’s standing in that category.

In contrast, China fell precipitously from 63rd in 2008 to 90th last year, with substantial deterioration in the areas of market performance and investor protection.

Denmark topped the ranking for the third year, followed by Hong Kong, the report said.

The first global hotel Keys Selection by the Michelin Guide includes four hotels in Taiwan, Michelin announced yesterday. All four received the “Michelin One Key,” indicating guests are to experience a “very special stay” at any of the locations as the establishments are “a true gem with personality. Service always goes the extra mile, and the hotel provides much more than others in its price range.” Of the four hotels, three are located in Taipei and one in Taichung. In Taipei, the One Key accolades were awarded to the Capella Taipei, Kimpton Da An Taipei and Mandarin Oriental Taipei. Capella Taipei was described by

EVA Airways today confirmed the death of a flight attendant on Saturday upon their return to Taiwan and said an internal investigation has been launched, as criticism mounted over a social media post accusing the airline of failing to offer sufficient employee protections. According to the post, the flight attendant complained of feeling sick on board a flight, but was unable to take sick leave or access medical care. The crew member allegedly did not receive assistance from the chief purser, who failed to heed their requests for medical attention or call an ambulance once the flight landed, the post said. As sick

Minister of Economic Affairs Kung Ming-hsin (龔明鑫) yesterday said that private-sector refiners are willing to stop buying Russian naphtha should the EU ask them to, after a group of non-governmental organizations, including the Centre for Research on Energy and Clean Air (CREA), criticized the nation’s continued business with the country. While Taiwan joined the US and its Western allies in putting broad sanctions on Russia after it invaded Ukraine in 2022, it did not explicitly ban imports of naphtha, a major hard-currency earner for Russia. While state-owned firms stopped importing Russian oil in 2023, there is no restriction on private companies to

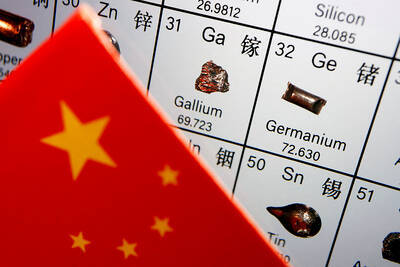

INDUSTRY: Beijing’s latest export measures go beyond targeting the US and would likely affect any country that uses Chinese rare earths or related tech, an academic said Taiwanese industries could face significant disruption from China’s newly tightened export controls on rare earth elements, as much of Taiwan’s supply indirectly depends on Chinese materials processed in Japan, a local expert said yesterday. Kristy Hsu (徐遵慈), director of the Taiwan ASEAN Studies Center at the Chung-Hua Institution for Economic Research, said that China’s latest export measures go far beyond targeting the US and would likely affect any country that uses Chinese rare earths or related technologies. With Japan and Southeast Asian countries among those expected to be hit, Taiwan could feel the impact through its reliance on Japanese-made semi-finished products and