The signing of the Economic Cooperation Framework Agreement (ECFA) between Taiwan and China was just the start of a wide range of economic and political tasks for the Taiwanese government to overcome and cautiously review, academics said.

Almost all discussions before the signing of the ECFA were focused on the “early harvest list,” which pinpoints sectors that benefit or suffer from the agreement.

The pursuit of a bilateral investment agreement (BIA) and the implementation of the ECFA, however, are now two of the most important issues at hand, said Jack Lee (李允傑), a professor of economics at the National Open University.

The BIA is not a new issue and it’s especially important for Taiwan because signing one with China would not only protect Taiwanese investors and businesspeople in China, where laws and regulations are not frequently respected or implemented, but also attract foreign investment as the BIA would ensure the protection of foreign investors, Lee said.

Moreover, cross-strait business disputes that have led to the filing of complaints with the Straits Exchange Foundation, a quasi-official organization that handles negotiations between Taiwan and China, have increased from 291 in 2007 to 784 last year.

The issue of sovereignty — one of the most sensitive and controversial topics in Taiwan-China relations — would come into play if the sides tried to settle disputes through the WTO, Lee said, adding that the method does not look feasible because it would take too long.

Lee also said that Taiwan’s and China’s goals after the signing of the ECFA are different.

While Taiwan is looking to protect its businesses with investment protection mechanisms, China is eyeing investment promotion, which means Taiwan would need to allow in more Chinese investment.

“Current Chinese investment in Taiwan is less than US$100 million. China wants Taiwan to further open its door, but Taiwan is not ready yet, fearing its national security would be jeopardized and its knowledge would be ‘stolen’ if more Chinese investment came in,” he said.

If these concerns can be resolved by putting every detail down in writing, Lee said Taiwan would be able to attract more foreign investors by allowing more Chinese investment.

William Lin (林蒼祥), a professor of finance at Tamkang University, said Taiwan’s plan to develop its service sectors in China would likely hit a snag in the financial and air transport industries.

“Financial service is such a sensitive and complicated sector that it’s difficult to open to foreign investment in any country,” Lin said.

“And Taiwan’s businesses have been disappointed at China’s unwillingness to open its air transportation market so far,” Lin added.

Chang Wu-yueh (張五岳), a political scientist at Tamkang University, said that politically, the “success” of ECFA negotiations reduces cross-strait tensions and lays the foundation for more exchanges, but it doesn’t mean both sides are ready to engage in a comprehensive dialogue, especially a political one.

“In cross-strait negotiations, some see business opportunities and some see more than 1,300 missiles directed at Taiwan. The real answer probably lies somewhere in between,” Chang said.

He advised the Taiwanese government to assess China’s mindset and goals in bilateral exchanges using a three stage framework: the period when the ECFA was signed; the time between the ratification and implementation of the deal up to the 2012 presidential election; and after 2013, when Chinese President Hu Jintao (胡錦濤) has retired and handed power to his successor.

Taiwan’s China policy has always been controversial and partisan domestically. That is why support for bilateral political talks is far weaker than for trade talks, Chang said.

Moreover, he said, the results of more bilateral trade exchange have not yet trickled down to benefit the general public, nor have they boosted Taiwan’s economy.

Chang said that with people growing impatient, key factors to help the Taiwanese government win support for future negotiations include its success in landing more free-trade agreements with major trading partners, boosting GDP growth, lowering the unemployment rate and bridging the wealth gap.

The first global hotel Keys Selection by the Michelin Guide includes four hotels in Taiwan, Michelin announced yesterday. All four received the “Michelin One Key,” indicating guests are to experience a “very special stay” at any of the locations as the establishments are “a true gem with personality. Service always goes the extra mile, and the hotel provides much more than others in its price range.” Of the four hotels, three are located in Taipei and one in Taichung. In Taipei, the One Key accolades were awarded to the Capella Taipei, Kimpton Da An Taipei and Mandarin Oriental Taipei. Capella Taipei was described by

EVA Airways today confirmed the death of a flight attendant on Saturday upon their return to Taiwan and said an internal investigation has been launched, as criticism mounted over a social media post accusing the airline of failing to offer sufficient employee protections. According to the post, the flight attendant complained of feeling sick on board a flight, but was unable to take sick leave or access medical care. The crew member allegedly did not receive assistance from the chief purser, who failed to heed their requests for medical attention or call an ambulance once the flight landed, the post said. As sick

Minister of Economic Affairs Kung Ming-hsin (龔明鑫) yesterday said that private-sector refiners are willing to stop buying Russian naphtha should the EU ask them to, after a group of non-governmental organizations, including the Centre for Research on Energy and Clean Air (CREA), criticized the nation’s continued business with the country. While Taiwan joined the US and its Western allies in putting broad sanctions on Russia after it invaded Ukraine in 2022, it did not explicitly ban imports of naphtha, a major hard-currency earner for Russia. While state-owned firms stopped importing Russian oil in 2023, there is no restriction on private companies to

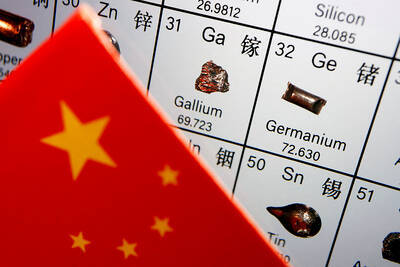

INDUSTRY: Beijing’s latest export measures go beyond targeting the US and would likely affect any country that uses Chinese rare earths or related tech, an academic said Taiwanese industries could face significant disruption from China’s newly tightened export controls on rare earth elements, as much of Taiwan’s supply indirectly depends on Chinese materials processed in Japan, a local expert said yesterday. Kristy Hsu (徐遵慈), director of the Taiwan ASEAN Studies Center at the Chung-Hua Institution for Economic Research, said that China’s latest export measures go far beyond targeting the US and would likely affect any country that uses Chinese rare earths or related technologies. With Japan and Southeast Asian countries among those expected to be hit, Taiwan could feel the impact through its reliance on Japanese-made semi-finished products and