The management of the Public Service Pension Fund is not transparent and its risk control is lax, according to an investigation by the Control Yuan, which is in charge of monitoring the behavior of government officials.

In a report on the investigation presented on Friday, the Control Yuan said the fund, which manages the pensions of nearly 700,000 military personnel, civil servants and teachers, lost more than NT$86 billion (US$2.73 billion) because of the global financial crisis in 2008.

The Control Yuan launched an investigation after public misgivings over the viability of the fund’s investments.

Control Yuan member Chao Chang-ping (趙昌平) said that between 1999 and 2008, the fund’s portfolio had an average rate of return of minus 4.58 percent and lost more than NT$48.7 billion (US$1.54 billion).

The rate was lower than that of Taiwan’s weighted stock index average return of negative 0.92 percent and also lower than the average rate of return of 2.5 percent had the money been kept in a time deposit over the same period, Chao said.

He said the fund management board was trying to rationalize its long-term poor performance by citing the global financial crisis, which Chao instead described as a “failure to fulfill its duty of professional investment and management.”

The public also often wonders whether the government is “propping up stock prices or dumping stocks” on the stock market when the fund buys or sells stocks.

Chao said that “propping up sagging stocks” was not the mission of the pension fund.

If the fund can formulate a “take-profit point” or “stop-loss point” quantitative assessment, where specific targets for cutting losses or locking in profits are set, it would help dispel speculation about improper intervention by the fund management board, Chao said.

Meanwhile, Tsai Feng-ching (蔡豐清), deputy chairman of the fund management board, said regulations of the fund have followed set procedures and that the rate of return of 19.5 percent last year was the highest ever.

He also dismissed allegations that the fund was operated privately without supervision in a “secret room,” saying it was just an ordinary room set up to trade stocks located on the third floor of the Examination Yuan building.

The Control Yuan has questioned two former chairmen of the fund management board — Chu Wu-shien (朱武獻) and Chang Che-shen (張哲琛).

The report said Chu had intervened too much in the fund’s investments and set up certain professional equipment on his office desk, which the report described as improper.

Chu, a former head of the Ministry of Civil Service, said he set up the equipment because he was in charge of management of the fund and that he needed to pay attention to it from time to time.

The brilliant blue waters, thick foliage and bucolic atmosphere on this seemingly idyllic archipelago deep in the Pacific Ocean belie the key role it now plays in a titanic geopolitical struggle. Palau is again on the front line as China, and the US and its allies prepare their forces in an intensifying contest for control over the Asia-Pacific region. The democratic nation of just 17,000 people hosts US-controlled airstrips and soon-to-be-completed radar installations that the US military describes as “critical” to monitoring vast swathes of water and airspace. It is also a key piece of the second island chain, a string of

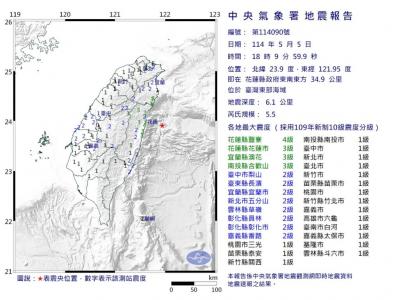

A magnitude 5.9 earthquake that struck about 33km off the coast of Hualien City was the "main shock" in a series of quakes in the area, with aftershocks expected over the next three days, the Central Weather Administration (CWA) said yesterday. Prior to the magnitude 5.9 quake shaking most of Taiwan at 6:53pm yesterday, six other earthquakes stronger than a magnitude of 4, starting with a magnitude 5.5 quake at 6:09pm, occurred in the area. CWA Seismological Center Director Wu Chien-fu (吳健富) confirmed that the quakes were all part of the same series and that the magnitude 5.5 temblor was

The Central Weather Administration has issued a heat alert for southeastern Taiwan, warning of temperatures as high as 36°C today, while alerting some coastal areas of strong winds later in the day. Kaohsiung’s Neimen District (內門) and Pingtung County’s Neipu Township (內埔) are under an orange heat alert, which warns of temperatures as high as 36°C for three consecutive days, the CWA said, citing southwest winds. The heat would also extend to Tainan’s Nansi (楠西) and Yujing (玉井) districts, as well as Pingtung’s Gaoshu (高樹), Yanpu (鹽埔) and Majia (瑪家) townships, it said, forecasting highs of up to 36°C in those areas

IN FULL SWING: Recall drives against lawmakers in Hualien, Taoyuan and Hsinchu have reached the second-stage threshold, the campaigners said Campaigners in a recall petition against Chinese Nationalist Party (KMT) Legislator Yen Kuan-heng (顏寬恒) in Taichung yesterday said their signature target is within sight, and that they need a big push to collect about 500 more signatures from locals to reach the second-stage threshold. Recall campaigns against KMT lawmakers Johnny Chiang (江啟臣), Yang Chiung-ying (楊瓊瓔) and Lo Ting-wei (羅廷瑋) are also close to the 10 percent threshold, and campaigners are mounting a final push this week. They need about 800 signatures against Chiang and about 2,000 against Yang. Campaigners seeking to recall Lo said they had reached the threshold figure over the