The Legislative Yuan resolved yesterday to refer a bill that would lower the interest rates for credit and cash cards to 12.5 percent to a one-month cross-party negotiation period.

The resolution was made on the legislative floor after party caucuses failed to reach a consensus on accepting the proposal by Chinese Nationalist Party (KMT) Legislator Hsieh Kuo-liang (謝國樑) and others.

The legislature must complete the review or reject the proposal before the negotiation period ends.

The proposal had been stalled after Hsieh and Financial Supervisory Commission (FSC) Chairman Sean Chen (陳冲) said last Tuesday night that they had reached a consensus to lower the interest rate ceiling from around 20 percent to 12.5 percent.

The Democratic Progressive Party (DPP) caucus had expressed dissatisfaction with Hsieh and Chen for announcing the consensus without negotiating the bill with the DPP.

The interest rate ceiling has been the subject of debate since the Judiciary and Organic Laws and Statutes Committee completed a preliminary review of a KMT proposal on March 19 that would cut the cap on all contracted interest rates from 20 percent to 9 percent above the central bank’s rate for three-month loans without collateral.

With the central bank’s short-term lending rate at 3.5 percent, that would be 12.5 percent.

The bill, however, drew strong opposition from foreign and domestic banks and analysts.

The Cabinet on March 23 said that the ceiling on interest rates for credit cards and cash cards should be capped at 15.5 percent instead, based on the maximum 12 percent interest rate for non-collateralized loans set by the central bank, plus a floating annual rate currently set at 3.5 percent. KMT lawmakers opposed the Cabinet’s decision.

Meanwhile, legislators approved an amendment to the Administrative Enforcement Act (行政執行法), allowing those who owe less than NT$100,000 in taxes to travel abroad.

However, those who have traveled abroad twice, even without knowing they have not paid off their tax, could still be banned from traveling.

The legislature also passed amendments to the Act Regulating Foreign Exchange (管理外匯條例) and the Act Governing International Financial Business (國際金融業務條例) that would authorize the Central Bank and the FSC to freeze accounts suspected of being used for money laundering or terrorist activity.

The amendment also authorized the legislature to reject bank and FSC decisions to freeze an account.

Lawmakers also agreed to abolish the minimum capital threshold for those starting a new company.

Under the current regulations in the Corporation Act (公司法), the minimum capital for a limited liability company is NT$500,000, while the minimum capital for an ordinary company is NT$250,000.

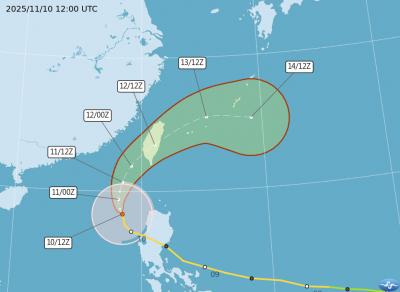

The Central Weather Administration (CWA) today issued a sea warning for Typhoon Fung-wong effective from 5:30pm, while local governments canceled school and work for tomorrow. A land warning is expected to be issued tomorrow morning before it is expected to make landfall on Wednesday, the agency said. Taoyuan, and well as Yilan, Hualien and Penghu counties canceled work and school for tomorrow, as well as mountainous district of Taipei and New Taipei City. For updated information on closures, please visit the Directorate-General of Personnel Administration Web site. As of 5pm today, Fung-wong was about 490km south-southwest of Oluanpi (鵝鑾鼻), Taiwan's southernmost point.

Almost a quarter of volunteer soldiers who signed up from 2021 to last year have sought early discharge, the Legislative Yuan’s Budget Center said in a report. The report said that 12,884 of 52,674 people who volunteered in the period had sought an early exit from the military, returning NT$895.96 million (US$28.86 million) to the government. In 2021, there was a 105.34 percent rise in the volunteer recruitment rate, but the number has steadily declined since then, missing recruitment targets, the Chinese-language United Daily News said, citing the report. In 2021, only 521 volunteers dropped out of the military, the report said, citing

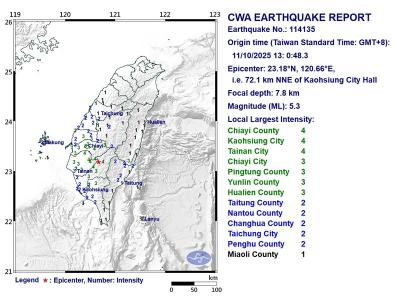

A magnitude 5.3 earthquake struck Kaohsiung at 1pm today, the Central Weather Administration said. The epicenter was in Jiasian District (甲仙), 72.1km north-northeast of Kaohsiung City Hall, at a depth of 7.8km, agency data showed. There were no immediate reports of damage. The earthquake's intensity, which gauges the actual effects of a temblor, was highest in Kaohsiung and Tainan, where it measured a 4 on Taiwan's seven-tier intensity scale. It also measured a 3 in parts of Chiayi City, as well as Pingtung, Yunlin and Hualien counties, data showed.

Nearly 5 million people have signed up to receive the government’s NT$10,000 (US$322) universal cash handout since registration opened on Wednesday last week, with deposits expected to begin tomorrow, the Ministry of Finance said yesterday. After a staggered sign-up last week — based on the final digit of the applicant’s national ID or Alien Resident Certificate number — online registration is open to all eligible Taiwanese nationals, foreign permanent residents and spouses of Taiwanese nationals. Banks are expected to start issuing deposits from 6pm today, the ministry said. Those who completed registration by yesterday are expected to receive their NT$10,000 tomorrow, National Treasury