The government’s plan to push through an amendment that would lower the interest rate cap for credit cards and cash cards to 12.5 percent was delayed yesterday by the Democratic Progressive Party (DPP).

The Chinese Nationalist Party (KMT) caucus and the Financial Supervisory Commission (FSC) announced late on Monday that they had reached a consensus to lower the interest rate ceiling from around 20 percent to 12.5 percent.

Judiciary and Organic Laws and Statutes Committee convener Wu Ching-chih (吳清池), KMT Legislator Hsieh Kuo-liang (謝國樑) and KMT caucus deputy secretary-general Lu Hsueh-chang (呂學樟) had voiced confidence on Monday that the caucus would push the bill through by prioritizing it in yesterday’s plenary session, thus allowing the amendment to take effect at the end of this month.

However, the plenary session was stalled yesterday morning as the KMT tried to seek DPP support for the bill.

Lu later told reporters that the caucus would do its best to negotiate with the DPP caucus, while Legislative Speaker Wang Jin-pyng (王金平) said the KMT should have sought the DPP’s consent before announcing its “consensus” with the FSC.

Wang said the bill could be stalled for up to one month if the DPP proposes more negotiations.

The interest rate ceiling has been the subject of debate since the committee completed a preliminary review of a KMT proposal on March 19 that would cut the cap on all contracted interest rates from 20 percent to 9 percent above the central bank’s rate for three-month loans without collateral.

With the central bank’s short-term lending rate at 3.5 percent, that would be 12.5 percent.

The bill, however, drew strong opposition from foreign and domestic banks and analysts.

The Cabinet on March 23 said that the ceiling on interest rates for credit cards and cash cards should instead be capped at 15.5 percent, based on the maximum 12 percent interest rate for non-collateralized loans set by the central bank, plus a floating annual rate that is currently set at 3.5 percent.

But KMT lawmakers had voiced disagreement with the Cabinet’s announcement, saying that the Cabinet should take responsibility for alleviating the suffering of debtors.

DPP caucus secretary-general Gao Jyh-peng (高志鵬) lashed out at FSC Chairman Sean Chen during a press conference yesterday, saying that the caucus would never accept the KMT’s decision to push the bill through without negotiating with the DPP.

Also See: FSC to negotiate with DPP caucus on credit card rate cap

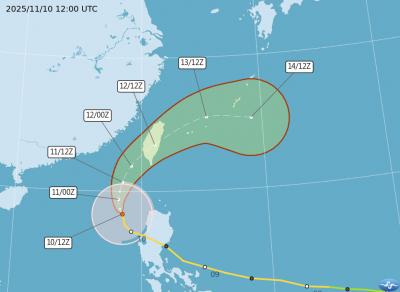

The Central Weather Administration (CWA) today issued a sea warning for Typhoon Fung-wong effective from 5:30pm, while local governments canceled school and work for tomorrow. A land warning is expected to be issued tomorrow morning before it is expected to make landfall on Wednesday, the agency said. Taoyuan, and well as Yilan, Hualien and Penghu counties canceled work and school for tomorrow, as well as mountainous district of Taipei and New Taipei City. For updated information on closures, please visit the Directorate-General of Personnel Administration Web site. As of 5pm today, Fung-wong was about 490km south-southwest of Oluanpi (鵝鑾鼻), Taiwan's southernmost point.

Almost a quarter of volunteer soldiers who signed up from 2021 to last year have sought early discharge, the Legislative Yuan’s Budget Center said in a report. The report said that 12,884 of 52,674 people who volunteered in the period had sought an early exit from the military, returning NT$895.96 million (US$28.86 million) to the government. In 2021, there was a 105.34 percent rise in the volunteer recruitment rate, but the number has steadily declined since then, missing recruitment targets, the Chinese-language United Daily News said, citing the report. In 2021, only 521 volunteers dropped out of the military, the report said, citing

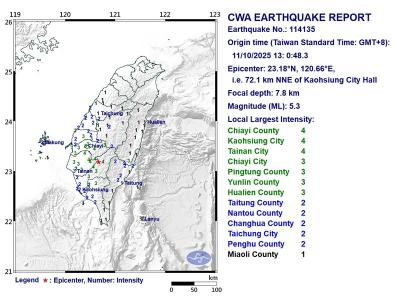

A magnitude 5.3 earthquake struck Kaohsiung at 1pm today, the Central Weather Administration said. The epicenter was in Jiasian District (甲仙), 72.1km north-northeast of Kaohsiung City Hall, at a depth of 7.8km, agency data showed. There were no immediate reports of damage. The earthquake's intensity, which gauges the actual effects of a temblor, was highest in Kaohsiung and Tainan, where it measured a 4 on Taiwan's seven-tier intensity scale. It also measured a 3 in parts of Chiayi City, as well as Pingtung, Yunlin and Hualien counties, data showed.

Nearly 5 million people have signed up to receive the government’s NT$10,000 (US$322) universal cash handout since registration opened on Wednesday last week, with deposits expected to begin tomorrow, the Ministry of Finance said yesterday. After a staggered sign-up last week — based on the final digit of the applicant’s national ID or Alien Resident Certificate number — online registration is open to all eligible Taiwanese nationals, foreign permanent residents and spouses of Taiwanese nationals. Banks are expected to start issuing deposits from 6pm today, the ministry said. Those who completed registration by yesterday are expected to receive their NT$10,000 tomorrow, National Treasury