Legislation designed to bail out debt-ridden cardholders was enacted last week, with activists hailing it as a step forward in creating a sound financial environment and detractors saying that the bill could deal a blow to the banking sector.

The legislature on Friday passed the Consumer Debt Clearance Regulation (消費者債務清理條例), which sets out procedures for courts to arbitrate debt settlements between debtors and creditor banks and to monitor settlement fulfillment.

"Given that creditor banks never put themselves in debtors' shoes, the intervention of the courts is expected to earn debtors some leeway on repaying loans," said Liu Pao-cheng (劉寶成), a leader of a financial watchdog organization.

Last year, of an estimated 500,000 indebted credit and cash cardholders, 227,000 applied for a special repayment program to pay off debts totaling NT$330 billion (US$9.97 billion) with lower interest rates over longer periods of time.

However, the Bankers Association said about 30 percent of the 227,000 cardholders had failed to service their debts on time by March 1.

That didn't come as a surprise, Liu said, as repayment schedules negotiated by creditor banks and borrowers are usually too difficult for borrowers to meet.

That partly explained why half of those in debt didn't join the program, he said.

The story of a woman nicknamed Yuan-Yuan offers a good example of the problem. Her residence was sold at auction after she failed to talk banks into charging her a monthly installment less than her salary of NT$20,000 a month, her family's only source of income.

With a child in senior high school, Yuan-Yuan borrowed NT$3 million on her cash card to undergo hip joint surgery.

She told a press conference that after the enactment of the debt regulation, she extremely happy to "receive a temporary reprieve" from repaying the loan, which, as a result of sky-high interest rates, had grown to NT$5 million.

Under the new regulation, cardholders whose unsecured debts or non-preferential debts are less than NT$12 million can go to court to negotiate a repayment schedule, while those unable to repay their debts can apply for bankruptcy.

Debtors will be given six to eight years to pay off reduced debts and will have the option of making payments every three months rather than every month.

However, debtors will face restrictions requiring them to live frugally while their debts are repaid.

Debtors applying for bankruptcy will face the liquidation of their assets, as they are required to submit their assets to courts in order to pay back creditor banks.

Those filing for bankruptcy will face lifestyle restrictions, limitations on leaving the country and be barred from taking 175 kinds of jobs after the liquidation process starts.

Their debts will be forgiven when the liquidation process finishes, but restrictions on their rights will not be restored without court approval.

The 227,000 debtors who applied for last year's special repayment program will not be covered by the new regulations, except for those who are unable to comply with their payback plan through no fault of their own.

However, concern remains that the regulations could encourage credit abusers and cause the 227,000 debtors in the special repayment program to renege on previous debt settlements, which would lead to a surge in bad debts and force lenders to tighten credit.

President of the Judicial Reform Foundation Lin Feng-jeng (

"I admit that there might be some moral hazard, but how many people would take risks with their credit to do that?" Lin asked. "People who have applied to renegotiate their repayment schedule or for bankruptcy would face great inconvenience in the future."

The increasing number of overwhelmed cardholders demonstrates that the old debt collection measures don't work, but they do increase the risk of suicide, he said.

"Why not give debtors an affordable way to repay debts?" he asked. "By doing that, borrowers wouldn't need to turn to underground lenders, which fuels the black-market economy, and the banking sector would, more or less, be able to retrieve loans."

The extent of the consumer debt problem became apparent in the summer of 2005 and was blamed on the failure of banks to perform strict credit reviews when issuing new cards.

The Financial Supervisory Commission said loans granted to cardholders increased by 250 percent from NT$13.8 billion in July 2005 to NT$34.1 billion in May last year.

Director of the Legal Aid Foundation's Taipei Branch Joseph Lin (林永頌) said that rising indebtedness is the result of poverty and an inefficient welfare system.

"In such a society, a person short of money is easily lured in by a bank loan, but then a rock is put on his back that is so heavy that he drowns in debt," Joseph Lin said.

The regulation is just part of the efforts to save debtors from drowning, he said.

"Debt relief is an indispensable revision to capitalism," he said. "Society would collapse if people are denied an opportunity to catch their breath."

"It would also be good if lenders hold applicants to stricter standards," he said. "For example, in Japan, banks can only loan an individual less than one-third of his or her annual income."

Also see story:

Editorial: The problem with popularity contests

Former president Tsai Ing-wen (蔡英文) on Monday called for greater cooperation between Taiwan, Lithuania and the EU to counter threats to information security, including attacks on undersea cables and other critical infrastructure. In a speech at Vilnius University in the Lithuanian capital, Tsai highlighted recent incidents in which vital undersea cables — essential for cross-border data transmission — were severed in the Taiwan Strait and the Baltic Sea over the past year. Taiwanese authorities suspect Chinese sabotage in the incidents near Taiwan’s waters, while EU leaders have said Russia is the likely culprit behind similar breaches in the Baltic. “Taiwan and our European

The Taipei District Court sentenced babysitters Liu Tsai-hsuan (劉彩萱) and Liu Jou-lin (劉若琳) to life and 18 years in prison respectively today for causing the death of a one-year-old boy in December 2023. The Taipei District Prosecutors’ Office said that Liu Tsai-hsuan was entrusted with the care of a one-year-old boy, nicknamed Kai Kai (剴剴), in August 2023 by the Child Welfare League Foundation. From Sept. 1 to Dec. 23 that year, she and her sister Liu Jou-lin allegedly committed acts of abuse against the boy, who was rushed to the hospital with severe injuries on Dec. 24, 2023, but did not

LIKE-MINDED COUNTRIES: Despite the threats from outside, Taiwan and Lithuania thrived and developed their economies, former president Tsai Ing-wen said Former president Tsai Ing-wen (蔡英文) on Saturday thanked Lithuania for its support of Taiwan, saying that both countries are united as partners in defending democracy. Speaking at a reception organized by the Lithuania-Taiwan Parliamentary Friendship Group welcoming her on her first visit to the Baltic state, Tsai said that while she was president from 2016 to last year, many Lithuanian “friends” visited Taiwan. “And I told myself I have to be here. I am very happy that I am here, a wonderful country and wonderful people,” Tsai said. Taiwan and Lithuania are in similar situations as both are neighbors to authoritarian countries, she

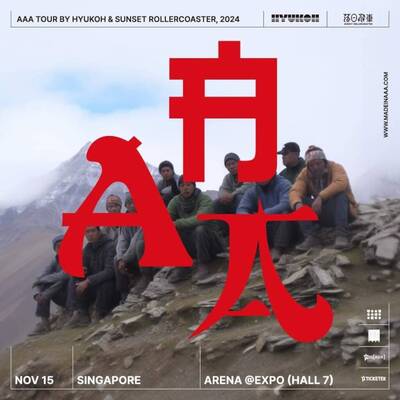

Taiwanese indie band Sunset Rollercoaster and South Korean outfit Hyukoh collectively received the most nominations at this year’s Golden Melody Awards, earning a total of seven nods from the jury on Wednesday. The bands collaborated on their 2024 album AAA, which received nominations for best band, best album producer, best album design and best vocal album recording. “Young Man,” a single from the album, earned nominations for song of the year and best music video, while another track, “Antenna,” also received a best music video nomination. Late Hong Kong-American singer Khalil Fong (方大同) was named the jury award winner for his 2024 album