Following criticism over its proposed changes to the Labor Pension Fund, which would see higher premium payments and lower payouts for private-sector workers, the Cabinet yesterday countered that the opposition’s proposal would place workers at a greater disadvantage.

In an interview with Hit FM radio early yesterday, Vice Premier Jiang Yi-huah (江宜樺), the architect behind the Cabinet’s reform proposal, said that he was “shocked” at the Democratic Progressive Party’s (DPP) proposal, which he said would “double the premium burden on workers compared with the Cabinet’s proposal.”

“Is that the DPP’s way of taking care of the working class?” Jiang asked.

Photo: Taipei Times

“I’ve read criticism in newspapers saying that our proposal would drive employees to death, but I was shocked when I saw the DPP’s proposal. Isn’t the DPP the one that’s trying to drive employees to death?” he asked.

Later, at a press conference at the Executive Yuan, Council of Labor Affairs Minister Pan Shih-wei (潘世偉) said the DPP’s proposal would put “the working class at a disadvantage, while giving capitalists a greater advantage.”

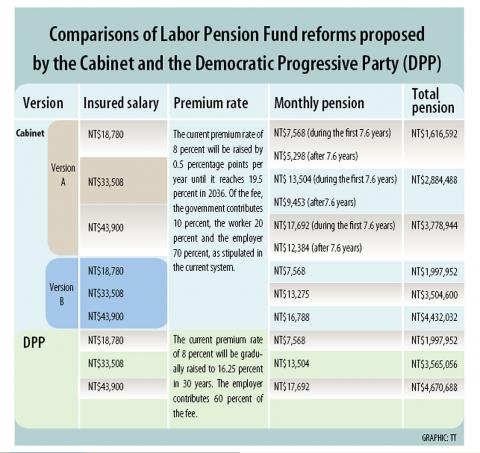

The Cabinet and the DPP on Wednesday unveiled their respective plans to reform the nation’s pension systems, which cover more than 10 million private-sector employees, military personnel, civil servants and public school teachers.

On labor pension reform, the Cabinet presented two proposals on the methods for calculating pension payments. However, premium payment would remain the same, with employers contributing 70 percent, the government 10 percent and employees 20 percent.

Under the DPP’s proposal, employers would be responsible for 60 percent of the insurance premiums and employees 40 percent, which the party said was “in line with international trends.”

Jiang cast doubt on the DPP’s formula, saying that exempting the government from the premium- sharing burden was “against the spirit of the pension scheme.”

The Labor Pension Fund is a social insurance, and therefore the government should be held to a certain level of responsibility to contribute to the premium; otherwise it would be commercial insurance, Jiang said.

Taking as an example an employee with an insured salary of NT$43,900, Jiang said that under the Cabinet’s proposal, the worker will have to contribute NT$1,712 per month to the fund when the premium rate rises to its highest level, at 19.5 percent, in 2036.

However, under the DPP’s proposal, the worker will have to pay NT$2,854 per month when the premium rate rises to its highest at 16.5 percent 30 years after the policy change. That is an additional NT$1,142 a month, or NT$13,704 a year, compared with the Cabinet’s proposal, he said.

“The DPP said our proposal would cut employees’ pension claims to a significant extent, but the DPP’s would impose a much heavier burden on employees,” he said.

Meanwhile, Pan said that the DPP’s proposal was designed “in favor of capitalists rather than employees.”

When the premium rate rises to 16.5 percent under the DPP’s proposal, companies will have to pay an extra NT$74.7 billion for their workers’ premiums, much lower than the NT$124.5 billion they would incur under the Cabinet’s proposed premium rate of 19.5 percent, Pan said.

DPP Chairman Su Tseng-chang (蘇貞昌) rebutted Jiang’s criticism of the ratio proposed by the DPP.

Su said Jiang “made negative comments without a complete understanding of the DPP’s proposal.”

The document released by the DPP shows that the party “recommended a 6:4 ratio to correspond to international trends,” adding that the ratios of various pension programs should be the same, but it would take “a dialogue between all involved parties to determine the final ratio,” Su said.

The DPP submitted the ratio after learning that the government was recommending a 5:5 ratio, which the DPP opposed, he said.

The government’s proposal would lower private-sector employees’ income replacement rate to between 30 and 40 percent, “which would leave workers with no choice but to commit suicide,” Su said.

Lin Wan-i (林萬億), executive director of the DPP’s think tank and the primary author of the proposal, reaffirmed that the party did not recommend a specific ratio and had always maintained that the ratio should be negotiated by all parties

On the government’s pension reform proposal, former premier Frank Hsieh (謝長廷) told reporters that the core issues should be the income replacement rate for public employees and the 18 percent preferential interest rate, but the government failed to address the issues, especially in regards to the preferential treatment for government officials with high incomes.

DPP Legislator Lee Ying-yuan (李應元) said the government’s proposal was not likely to clear the legislature without major adjustments because it failed to meet people’s expectations.

The government’s proposal appears to favor current public-sector employees while cutting the benefits of private-sector workers and future government employees as former civil servants who retired before 1995 will not be not affected by the proposed changes, Lee said.

Under the current government proposal, annual retirement payment for civil servants would be almost twice of those for private sector employees, Lee said.

The US government has signed defense cooperation agreements with Japan and the Philippines to boost the deterrence capabilities of countries in the first island chain, a report by the National Security Bureau (NSB) showed. The main countries on the first island chain include the two nations and Taiwan. The bureau is to present the report at a meeting of the legislature’s Foreign Affairs and National Defense Committee tomorrow. The US military has deployed Typhon missile systems to Japan’s Yamaguchi Prefecture and Zambales province in the Philippines during their joint military exercises. It has also installed NMESIS anti-ship systems in Japan’s Okinawa

‘WIN-WIN’: The Philippines, and central and eastern European countries are important potential drone cooperation partners, Minister of Foreign Affairs Lin Chia-lung said Minister of Foreign Affairs Lin Chia-lung (林佳龍) in an interview published yesterday confirmed that there are joint ventures between Taiwan and Poland in the drone industry. Lin made the remark in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper). The government-backed Taiwan Excellence Drone International Business Opportunities Alliance and the Polish Chamber of Unmanned Systems on Wednesday last week signed a memorandum of understanding in Poland to develop a “non-China” supply chain for drones and work together on key technologies. Asked if Taiwan prioritized Poland among central and eastern European countries in drone collaboration, Lin

ON ALERT: Taiwan’s partners would issue warnings if China attempted to use Interpol to target Taiwanese, and the global body has mechanisms to prevent it, an official said China has stationed two to four people specializing in Taiwan affairs at its embassies in several democratic countries to monitor and harass Taiwanese, actions that the host nations would not tolerate, National Security Bureau (NSB) Director-General Tsai Ming-yen (蔡明彥) said yesterday. Tsai made the comments at a meeting of the legislature’s Foreign Affairs and National Defense Committee, which asked him and Minister of National Defense Wellington Koo (顧立雄) to report on potential conflicts in the Taiwan Strait and military preparedness. Democratic Progressive Party (DPP) Legislator Michelle Lin (林楚茵) expressed concern that Beijing has posted personnel from China’s Taiwan Affairs Office to its

BACK TO WORK? Prosecutors said they are considering filing an appeal, while the Hsinchu City Government said it has applied for Ann Kao’s reinstatement as mayor The High Court yesterday found suspended Hsinchu mayor Ann Kao (高虹安) not guilty of embezzling assistant fees, reducing her sentence to six months in prison commutable to a fine from seven years and four months. The verdict acquitted Kao of the corruption charge, but found her guilty of causing a public official to commit document forgery. The High Prosecutors’ Office said it is reviewing the ruling and considering whether to file an appeal. The Taipei District Court in July last year sentenced Kao to seven years and four months in prison, along with a four-year deprivation of civil rights, for contravening the Anti-Corruption