The nation’s financial regulator unexpectedly signed a financial memorandum of understanding (MOU) with Beijing at 6pm via a document exchange yesterday, sealing the much awaited pact.

Financial Supervisory Commission (FSC) chairman Sean Chen (陳冲) announced in the evening that he represented Taiwan in signing the documents — one in traditional Chinese and one in simplified Chinese — with Chinese authorities through a document exchange at 6pm.

“The MOU will take effect in 60 days,” he told a media briefing yesterday.

The agreements were signed by Chen and Liu Mingkang (劉明康), head of the China Banking Regulatory Commission, the regulators said in separate statements.

The two sides agreed on issues including cross-strait financial supervision, information-sharing and risk management, giving Taiwan and China wider access to each other’s banks, insurers and securities brokerages.

After the accord takes effect, financial institutions in Taiwan and China can officially apply to tap into each other’s market by either setting up liaison offices or applying to upgrade their liaisons offices into branches.

However, before banking rules are revised in Taiwan and China to determine terms on market access, no banks can begin operations in the other side’s market.

The market access terms are expected to be addressed during the nation’s upcoming negotiations of an economic cooperation framework agreement (ECFA) with China.

Yesterday’s signing of the MOU came as a twist since Chen just told the legislature in the morning that the signing “won’t be later than county elections scheduled for Dec. 5.”

He made the comments while briefing the legislature’s Financial Committee on the MOU, which was signed without the mention of official titles of either side because of political sensitivities.

At a separate briefing at the Economic Committee yesterday, lawmakers raised doubts about the impact of a possible influx of Taiwanese banks to China after the MOU goes into effect, saying the number of local lenders’ branches would be outnumbered by Chinese rivals.

“We’ve already entered the [Chinese] market late and it is not going to be easy,” FSC vice chairwoman Lee Jih-chu (李紀珠) said. “Lenders should have strategies to make profits before expanding their foothold in the mainland.”

The signing of the MOU only opens the doors to China’s financial services industry, while the proposed ECFA — which is expected to be signed before spring — would help local banks compete with much better conditions, Lee said.

To enjoy competitiveness across the Taiwan Strait, local financial institutions should create a niche by bringing over their more mature financial services and use their language and cultural advantages, she said.

The large number of Taiwanese businesses in China are also expected to utilize services tendered by branches of Taiwanese banks, she said.

Bank of China Ltd (中國銀行) president Li Lihui (李禮輝) aims to set up a Taipei branch once an MOU is signed, the Economic Daily News reported yesterday, citing an interview with the executive.

Industrial & Commercial Bank of China Ltd (中國工商銀行, ICBC), the world’s most profitable bank, needs a presence in Taiwan and wants to expand here in future, chairman Jiang Jianqing (姜建清) said on Nov. 13 at the APEC business leaders meeting in Singapore.Beijing-based ICBC has a market capitalization of 1.82 trillion yuan (US$267 billion), more than three times the value of Taiwan’s 37 listed financial and insurance companies.

The accord could pave the way for banks to set up branches in each other’s markets and Taiwan’s lenders may have their representative offices in China upgraded to full service branches, skipping the usual three-year wait, said Tseng Fan-jen, an analyst at KGI Securities.

Earlier yesterday, Lee said that Chinese financial institutions planning to invest in the Taiwanese market would not be subject to WTO rules or the treatment enjoyed by local banks.

“Chinese financial institutions in Taiwan will be treated as neither foreign institutional investors nor as their local counterparts, in order to minimize the impact on the development of the local financial sector or its investment prospects in China,” Lee told a joint meeting of the legislative economic and energy committees while reporting on the MOU.

Lee said Taiwan should not grant Chinese financial institutions the same treatment as that stipulated in the WTO regulations and she predicted that there will be no disputes on the matter as long as both sides accept the terms they agree upon.

Last night, Democratic Progressive Party Legislator William Lai (賴清德) criticized the signing of the MOU.

Lai said the move would put Taiwan at a major disadvantage.

“Taiwan is losing too much ground in the international arena, but the government is in such a hurry to sign an MOU and an ECFA,” he said.

“As a result, Taiwan will be isolated and its economy will depend on China,” he said.

ADDITIONAL REPORTING BY CNA AND SHELLEY HUANG

NATIONAL SECURITY THREAT: An official said that Guan Guan’s comments had gone beyond the threshold of free speech, as she advocated for the destruction of the ROC China-born media influencer Guan Guan’s (關關) residency permit has been revoked for repeatedly posting pro-China content that threatens national security, the National Immigration Agency said yesterday. Guan Guan has said many controversial things in her videos posted to Douyin (抖音), including “the red flag will soon be painted all over Taiwan” and “Taiwan is an inseparable part of China,” while expressing hope for expedited “reunification.” The agency received multiple reports alleging that Guan Guan had advocated for armed reunification last year. After investigating, the agency last month issued a notice requiring her to appear and account for her actions. Guan Guan appeared as required,

Japan and the Philippines yesterday signed a defense pact that would allow the tax-free provision of ammunition, fuel, food and other necessities when their forces stage joint training to boost deterrence against China’s growing aggression in the region and to bolster their preparation for natural disasters. Japan has faced increasing political, trade and security tensions with China, which was angered by Japanese Prime Minister Sanae Takaichi’s remark that a Chinese attack on Taiwan would be a survival-threatening situation for Japan, triggering a military response. Japan and the Philippines have also had separate territorial conflicts with Beijing in the East and South China

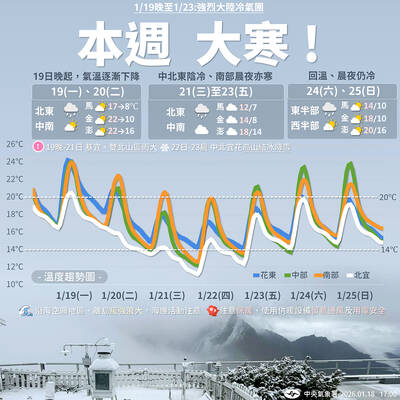

A strong cold air mass is expected to arrive tonight, bringing a change in weather and a drop in temperature, the Central Weather Administration (CWA) said. The coldest time would be early on Thursday morning, with temperatures in some areas dipping as low as 8°C, it said. Daytime highs yesterday were 22°C to 24°C in northern and eastern Taiwan, and about 25°C to 28°C in the central and southern regions, it said. However, nighttime lows would dip to about 15°C to 16°C in central and northern Taiwan as well as the northeast, and 17°C to 19°C elsewhere, it said. Tropical Storm Nokaen, currently

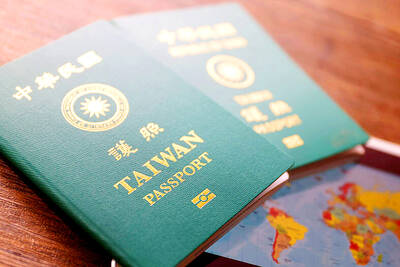

PAPERS, PLEASE: The gang exploited the high value of the passports, selling them at inflated prices to Chinese buyers, who would treat them as ‘invisibility cloaks’ The Yilan District Court has handed four members of a syndicate prison terms ranging from one year and two months to two years and two months for their involvement in a scheme to purchase Taiwanese passports and resell them abroad at a massive markup. A Chinese human smuggling syndicate purchased Taiwanese passports through local criminal networks, exploiting the passports’ visa-free travel privileges to turn a profit of more than 20 times the original price, the court said. Such criminal organizations enable people to impersonate Taiwanese when entering and exiting Taiwan and other countries, undermining social order and the credibility of the nation’s