Crude oil prices rose to a new record above US$99 a barrel yesterday, lifted by worries about inadequate supplies as the Northern Hemisphere enters winter and on news of refinery problems.

The declining US dollar and speculation that the US Federal Reserve will again cut interest rates also boosted prices. Some investors put their money into oil contracts, betting that gains in their price will offset the dollar's weakness.

"The market is now really looking at US$100 a barrel as the next target to hit," said Victor Shum, an energy analyst with Purvin & Gertz in Singapore. "The fact that we are having this surge in pricing in this short trading week underscores the strength of this bull run for oil."

Light, sweet crude for January delivery rose as high as US$99.29 a barrel in electronic trading after the New York Mercantile Exchange closed, breaking the previous intraday record of US$98.62 on Nov. 7. Midafternoon in Singapore, oil was trading at US$98.64 a barrel.

The contract surged US$3.39 during the floor session on Tuesday in New York to a record close of US$98.03 a barrel. The Nymex is closed today for Thanksgiving and will close early tomorrow.

Energy futures got a boost on news of problems at two oil facilities on Tuesday. A Valero Energy Corp refinery in Memphis, Tennessee, that processes 180,000 barrels of crude a day has shut down for 10 days of unplanned maintenance. A Royal Dutch Shell PLC plant that converts bitumen from Alberta's oil sands region into 155,000 barrels a day of synthetic crude oil was also temporarily shut down because of a fire.

Beyond these temporary concerns, investors are anxious that as global demand for energy grows, fueled by China and India's rapid development, oil supplies won't be able to keep up.

Oil producers turn out about 85 million barrels a day, while the US Department of Energy says consumption is between 85 million and 86 million barrels a day.

"The long-term underlying trend is that demand is powering forward and the supply situation looks tight," said Jeff Brown, managing director and chief economist at FACTS Global Energy in Singapore.

Oil prices also got support after the Fed said US economic growth would slow next year to between 1.8 percent and 2.5 percent, lower than its previous projections. It also expects US inflation to slow next year to between 1.8 percent and 2.1 percent.

That could mean the Fed would cut interest rates further, which could weigh on the dollar. On Tuesday, the euro broke through the US$1.48 mark for the first time and climbed as high as US$1.4856, a new record, yesterday.

"When the US dollar hit a record low, oil also surged ahead. It's been an inverse relationship," Shum said. "Also, the Fed indicating worries about the US economy has caused worry that the Fed will cut interest rates."

Traders were also closely watching for the release of the petroleum inventory report from the US Energy Department's Energy Information Administration yesterday.

Analysts surveyed by Dow Jones Newswires, on average, predict that crude oil inventories rose by 800,000 barrels last week.

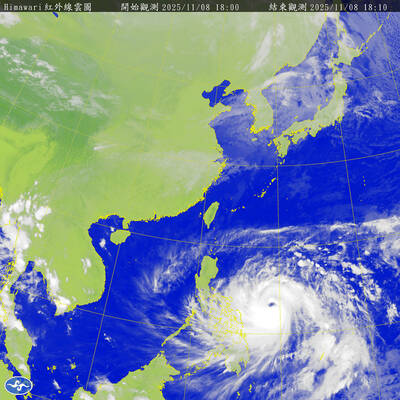

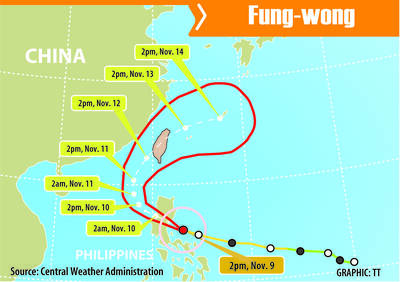

The Central Weather Administration (CWA) yesterday said it expected to issue a sea warning for Typhoon Fung-Wong tomorrow, which it said would possibly make landfall near central Taiwan. As of 2am yesterday, Fung-Wong was about 1,760km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, moving west-northwest at 26kph. It is forecast to reach Luzon in the northern Philippines by tomorrow, the CWA said. After entering the South China Sea, Typhoon Fung-Wong is likely to turn northward toward Taiwan, CWA forecaster Chang Chun-yao (張峻堯) said, adding that it would likely make landfall near central Taiwan. The CWA expects to issue a land

Taiwan’s exports soared to an all-time high of US$61.8 billion last month, surging 49.7 percent from a year earlier, as the global frenzy for artificial intelligence (AI) applications and new consumer electronics powered shipments of high-tech goods, the Ministry of Finance said yesterday. It was the first time exports had exceeded the US$60 billion mark, fueled by the global boom in AI development that has significantly boosted Taiwanese companies across the international supply chain, Department of Statistics Director-General Beatrice Tsai (蔡美娜) told a media briefing. “There is a consensus among major AI players that the upcycle is still in its early stage,”

The Central Weather Administration (CWA) yesterday said it is expected to issue a sea warning for Typhoon Fung-wong this afternoon and a land warning tomorrow. As of 1pm, the storm was about 1,070km southeast of Oluanpi (鵝鑾鼻), Taiwan’s southernmost point, and was moving west-northwest at 28 to 32kph, according to CWA data. The storm had a radius of 250km, with maximum sustained winds of 173kph and gusts reaching 209kph, the CWA added. The storm is forecast to pass near Luzon in the Philippines before entering the South China Sea and potentially turning northward toward Taiwan, the CWA said. CWA forecaster Chang Chun-yao (張峻堯) said

PREPARATION: Ferry lines and flights were canceled ahead of only the second storm to hit the nation in November, while many areas canceled classes and work Authorities yesterday evacuated more than 3,000 people ahead of approaching Tropical Storm Fung-wong, which is expected to make landfall between Kaohsiung and Pingtung County this evening. Fung-wong was yesterday morning downgraded from a typhoon to a tropical storm as it approached the nation’s southwest coast, the Central Weather Administration (CWA) said, as it issued a land alert for the storm. The alert applies to residents in Tainan, Kaohsiung, Pingtung and Taitung counties, and the Hengchun Peninsula (恆春). As of press time last night, Taichung, Tainan, Kaohsiung, and Yilan, Miaoli, Changhua, Yunlin, Pingtung and Penghu counties, as well as Chiayi city and county had