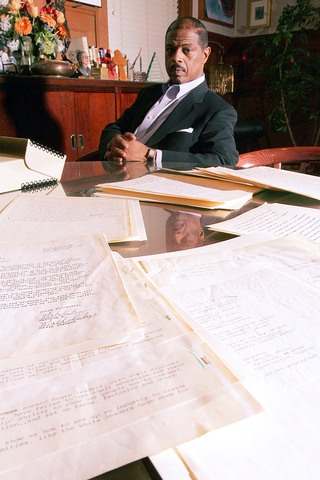

For more than two decades, Gregory Reed, an entertainment lawyer in Detroit, has been collecting materials that document black history. His ultimate goal, he says, is to put the materials to work in educational exhibits.

But an early foray into lending his collection turned litigious last month when his foundation sued the Charles H. Wright Museum of African American History in Detroit, accusing it of damaging 15 sheets from unpublished portions of Alex Haley's original manuscript of The Autobiography of Malcolm X.

The documents, which were on display at the museum for about five years starting in 1997, went from white to brownish-yellow, and have a white stripe from the band holding them down, Reed said. He wants the museum to reimburse him US$168,000 for the loss in value to the documents, which were appraised at US$285,000 before the loan.

PHOTO: NY TIMES NEWS SERVICE

The museum disputes its responsibility for the damage, said Mark Shreve, a lawyer for the museum. But, he said, if a payment is to be made, the documents should be restored first and then a determination made on whether there is any loss in value.

Reed said: "The lesson is, you take greater precautions." More people are lending out art, he said, and they "need to know the ins and outs from a business side."

Art values have been escalating rapidly, particularly for contemporary works. And two high-profile accidents this year have called attention to the possibility that art and collectibles can be damaged. Stephen A. Wynn, the casino developer, accidentally put his elbow through a Picasso he had just sold for US$139 million (killing the deal), and a guard dog in England mauled a valuable collection of teddy bears, including one that had been owned by Elvis Presley.

The situation is further complicated by newcomers to collecting and changes in the way collections are used.

"Art is being looked at as the newest asset class," said Elizabeth von Habsburg, president of Gurr Johns Masterson, appraisers and fine-art consultants. "Everyone seems to be collecting these days, and different people seem to collect different things. Hedge funders are collecting primarily contemporary art and photographs. Russians are repatriating Russian works of art. Chinese are buying contemporary Chinese art and anything Imperial."

An increasing number of art owners are viewing their purchases as investments — and are putting them to work by lending them to galleries or museums with an eye toward enhancing their value.

The value of some art has surged as much as 500 percent in the last two years, according to insurance brokers, so owners should consider whether their works are adequately covered.

"Unfortunately, that's kind of a full-time occupation these days, given the fact that prices are increasing so rapidly," said William Ehrlich, a New York City real estate developer who has been collecting art for more than four decades. "We use an inventory system that allows us to keep track of things. When prices seem to ratchet up, we will ask for updated appraisals from dealers or auction houses or such."

Ehrlich said he was finding greater scrutiny by insurance companies in documenting their exposure.

"I just had an experience where something had gone up dramatically, and we had to have it reinsured," he said. "I submitted something from a dealer, and they immediately questioned whether the dealer was a certified appraiser."

While those in the art world may be on top of what's happening, owners of just a few pieces may not be checking whether they have enough insurance coverage.

Brian Frasca, an insurance broker at the New England Brokerage Corp in Providence, Rhode Island, told of a new client who bought a work of art for a million dollars in 1991. The piece had been insured under a homeowner's policy, which seemed adequate, providing about US$2.5 million of property coverage. But the work was recently appraised at US$10 million.

"We had a US$10 million painting 90 percent underinsured," Frasca said.

Insurance companies typically request appraisals every one to three years on pieces valued at more than US$75,000, but some collectors get appraisals every six months because of the market's volatility, he said.

There are many approaches to insuring fine art and collections, but a typical policy may now provide 150 percent of the insured value, to provide an inflation guard. The typical rate for such insurance is about US$1.20 per US$1,000 in value, according to several insurance brokers.

Some owners balk, however, at keeping appraisals updated.

"One of the most difficult things I have to deal with is trying to convince collectors they should get updated valuations," said Dorit Straus, worldwide fine art manager for the Chubb Group.

A much greater problem, insurance specialists said, is underinsurance on the part of collectors. "The problem is convincing people that anything is going to happen," said Claire Marmion, director of art collection management at the AIG Private Client Group. "They don't think the teddy bear will be eaten by the guard dog or that the elbow will go through the Picasso."

But anything can happen — sometimes where it may be least expected.

May 18 to May 24 Pastor Yang Hsu’s (楊煦) congregation was shocked upon seeing the land he chose to build his orphanage. It was surrounded by mountains on three sides, and the only way to access it was to cross a river by foot. The soil was poor due to runoff, and large rocks strewn across the plot prevented much from growing. In addition, there was no running water or electricity. But it was all Yang could afford. He and his Indigenous Atayal wife Lin Feng-ying (林鳳英) had already been caring for 24 orphans in their home, and they were in

On May 2, Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), at a meeting in support of Taipei city councilors at party headquarters, compared President William Lai (賴清德) to Hitler. Chu claimed that unlike any other democracy worldwide in history, no other leader was rooting out opposing parties like Lai and the Democratic Progressive Party (DPP). That his statements are wildly inaccurate was not the point. It was a rallying cry, not a history lesson. This was intentional to provoke the international diplomatic community into a response, which was promptly provided. Both the German and Israeli offices issued statements on Facebook

Even by the standards of Ukraine’s International Legion, which comprises volunteers from over 55 countries, Han has an unusual backstory. Born in Taichung, he grew up in Costa Rica — then one of Taiwan’s diplomatic allies — where a relative worked for the embassy. After attending an American international high school in San Jose, Costa Rica’s capital, Han — who prefers to use only his given name for OPSEC (operations security) reasons — moved to the US in his teens. He attended Penn State University before returning to Taiwan to work in the semiconductor industry in Kaohsiung, where he

President William Lai (賴清德) yesterday delivered an address marking the first anniversary of his presidency. In the speech, Lai affirmed Taiwan’s global role in technology, trade and security. He announced economic and national security initiatives, and emphasized democratic values and cross-party cooperation. The following is the full text of his speech: Yesterday, outside of Beida Elementary School in New Taipei City’s Sanxia District (三峽), there was a major traffic accident that, sadly, claimed several lives and resulted in multiple injuries. The Executive Yuan immediately formed a task force, and last night I personally visited the victims in hospital. Central government agencies and the