Made in China says everything, economically, about the past decade. Sold in China tells you everything about the next.

Recent output figures from China were greeted with concern after the country reported its lowest GDP growth for three years, although, at 8.1 percent, it is magnificent compared to many. Still, there is much talk among economists about a “hard landing,” a “property bubble” and “bankrupt banks.”

However, there is one key fact to remember about the economy in China. It is that the minimum wage is going up 15 percent a year, every year, for the next five years. Take a billion workers and give them a 100 percent pay rise. It changes everything.

Within a generation, China is likely to displace the US as the biggest consumer market in the world. At Tianjin Port, the world’s fifth-biggest, container ships used to export Chinese goods to the rest of the world, but come back empty. Now they return with the finished and semi-finished goods from the rest of the world to satisfy a ravenous consumer appetite.

In Tianjin’s vast factory zone (across the road from a Foxconn plant making the next wave of Apple iPhones), the Master Kong factory makes more pot noodles than anywhere else in the world. The huge automated production lines, with machine tools imported from Japan and Germany, churn out 5 billion noodle packets a year — enough to reach to the moon and back. All the raw materials come from China, all of the finished product is consumed in China. It is just one of 23 Master Kong plants on the mainland.

Further south in the “groundscraper” (and weirdly Hogwarts-esque) Shanghai offices of Ping An, China’s second-biggest insurer, 12,000 commission-led telesales agents make 1 million sales calls every day. It is the largest telemarketing operation on the planet, feeding on the explosive growth of domestic car sales.

Last year 14.5 million cars were sold in China — or 2 million more than in the US, previously the world’s biggest auto market. Nine in 10 were to people who had never bought a car before. Ping An now insures 32 million private cars, raking in premiums of £2.2 billion (US$3.6 billion) a year. Four years ago, that revenue was below £100 million.

As the Beijing auto show opened (it has replaced Detroit as the barometer of the industry), Ford said it was pressing ahead with its fifth giant factory in the country, and Volkswagen its seventh. Industry experts say sales will rise to 40 million a year by 2020.

In a country where air quality is staggeringly bad, the environmental consequences are terrifying. So is the outlook for the price of gasoline, which sells in China for about half the price in Britain. If the country reaches US levels of car ownership, China alone will need to import more oil than is currently produced from every well in the world.

It does not appear to concern the 4S showroom in Beijing, the biggest BMW dealership in Asia. Sales of luxury cars were up 30 percent in the first quarter of this year, and after signing a deal to distribute Range Rovers, they are selling every (UK-made) Evoque they can get their hands on. The waiting list stretches for months.

China’s industrial revolution has created hundreds of thousands of US dollar millionaires, and more than 400 billionaires, second only to the US. That translates into extraordinary sales of luxury goods, although much of that is in Hong Kong as wealthy consumers skirt import tariffs that make prices in Shanghai 40 percent higher than abroad.

The vulgar display of new wealth is beginning to worry the communist (in name) leaders. Income inequality is among the world’s worst. Median wages for rural workers were, according to the National Bureau of Statistics, just £608 last year, and £1,877 for workers in the cities. Yet Gucci, Louis Vuitton, Burberry and Bottega Veneta stores dominate shopping malls. Last year authorities banned the use of the word “luxury” in advertisements, but to little effect. Sales surged, with revenue at Burberry shops up 30 percent last year.

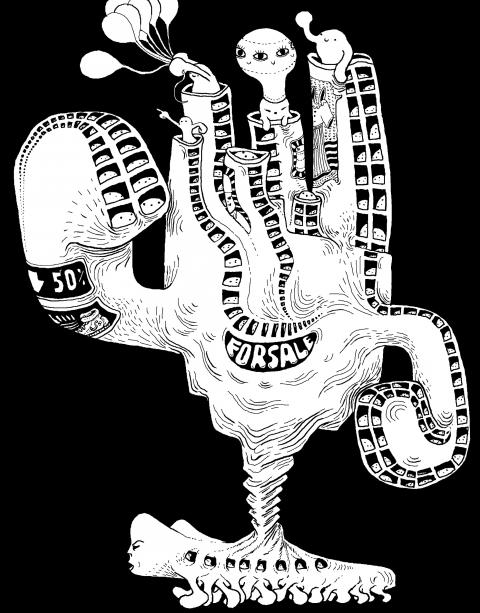

The millions of migrant workers flooding into the cities, their only possessions stuffed into a battered suitcase, are greeted by the sight of a £3,000 monogrammed Louis Vuitton bag in a shop window. Discontent is rising: In Guangdong, where, on paper, earnings are among the highest in China, riots in June last year continued for three days. Clashes erupted over unpaid wages, but behind the violence lies the fact that a huge underclass has gained little from the new China they built, mostly with their own hands.

At the Master Kong factory in Tianjin production line workers, we are told, earn £300 a month. However, they have to work six days a week, receive just one week’s holiday a year, and sleep in a factory-controlled dorm. And this is one of the plants where management is happy to receive foreign visitors (but we were banned from taking photographs). In Shanghai, the glitziest and richest city in China, with 23 million residents, factory workers rarely take home more than £200 a month.

Worried Chinese leaders have put spreading the country’s wealth at the heart of the latest “five-year plan.” It is this that mandates the coming 15 percent a year increase in the minimum wage, although how much of that will be eaten by price inflation is a moot point.

Westerners who mock the concept of the five-year plans lamentably misunderstand China, William Fung of Li & Fung said. It is a company virtually unknown in the west, but is the biggest supplier of clothes to Europe and America, with Walmart and Marks and Spencer among its customers.

“You report the five-year plan in the West as a one-day wonder ... then people are surprised that growth is falling to 7.5 percent — but it is in the plan. All the time we are told that China is old and complex to understand — but it is the easiest country in the world to understand,” Fung said.

“They tell you what they are going to do. Every official knows the five-year plan. The plan calls for slower growth, but a 15 percent per annum increase in domestic consumption. All the evidence is there that we are going to grow consumption,” Fung said.

His company, whose clothing and toy exports are so vast it is regarded as the bellwether of the global economy, will continue selling huge quantities overseas, but sees the home consumer as perhaps its greatest opportunity.

Just off outer ring road five in Beijing, a mundane average-income district, the Wu Mart hypermarket is perhaps an early indicator of how domestic consumption will grow.

Unlike the oddly deserted luxury shops in the city center, it is teeming. It is instantly apparent that mid-range Western brands are phenomenally popular with middle-income Chinese consumers. Shelf after shelf stocks the likes of Colgate toothpaste, Nivea, Quaker Oats and Snickers bars.

Whole aisles are devoted to disposable diapers. China’s one-child policy, rigorously enforced, means that spending on a sole child is proportionately huge. Hong Kong babies use 50 percent more diapers than those in the West, and mainland China is heading the same way. Want to invest in China? Maybe buy Procter and Gamble (Pampers) or Kimberly-Clark (Huggies) instead.

Back in Shanghai we meet Ji Qi, another entrepreneurial billionaire. He opened an Ibis-style budget hotel in 2002, called Home Inns, for the country’s emerging business and leisure market, and built it to a chain of more than 1,000. After a bust-up with his co-founder he’s set up Hanting Inns, has 639 hotels, and is opening a 140-bed inn every two days. Room rates range from £10 to £40 a night. He confidently expects Hanting to overtake Accor (Ibis, Mercure, Novotel and Sofitel) this year, and become, perhaps, the world’s biggest hotel chain by 2020.

He is the epitome of the ambition, drive and vision in China that is in such stark contrast to the miserable business outlook in Britain.

Do investors who buy the China story ever actually make any money? One of the remarkable facts is that its stock markets (the big exchanges are in Shanghai and Shenzhen) are a great way of turning a large fortune into a small one. Over the past five years the benchmark Shanghai Composite index has fallen by 41.4 percent. The Shenzhen market has been falling since mid-2010.

For British investors, the average China unit trust has lost 17 percent over the past year. Critics warn that many Chinese companies regard equity investment by Westerners as an interest-free loan never to be repaid. a few of the rich put their own cash into the stock market — expanding their businesses, and investing in property (no matter how super-charged prices appear) is what they see as the future.

Note: Patrick Collinson was a guest on a trip organized by Fidelity Investments. Fidelity’s China Special Situations investment trust is a holder of shares in Ping An, Master Kong and Wu Mart.

A series of strong earthquakes in Hualien County not only caused severe damage in Taiwan, but also revealed that China’s power has permeated everywhere. A Taiwanese woman posted on the Internet that she found clips of the earthquake — which were recorded by the security camera in her home — on the Chinese social media platform Xiaohongshu. It is spine-chilling that the problem might be because the security camera was manufactured in China. China has widely collected information, infringed upon public privacy and raised information security threats through various social media platforms, as well as telecommunication and security equipment. Several former TikTok employees revealed

For the incoming Administration of President-elect William Lai (賴清德), successfully deterring a Chinese Communist Party (CCP) attack or invasion of democratic Taiwan over his four-year term would be a clear victory. But it could also be a curse, because during those four years the CCP’s People’s Liberation Army (PLA) will grow far stronger. As such, increased vigilance in Washington and Taipei will be needed to ensure that already multiplying CCP threat trends don’t overwhelm Taiwan, the United States, and their democratic allies. One CCP attempt to overwhelm was announced on April 19, 2024, namely that the PLA had erred in combining major missions

At the same time as more than 30 military aircraft were detected near Taiwan — one of the highest daily incursions this year — with some flying as close as 37 nautical miles (69kms) from the northern city of Keelung, China announced a limited and selected relaxation of restrictions on Taiwanese agricultural exports and tourism, upon receiving a Chinese Nationalist Party (KMT) delegation led by KMT legislative caucus whip Fu Kun-chi (傅崑萁). This demonstrates the two-faced gimmick of China’s “united front” strategy. Despite the strongest earthquake to hit the nation in 25 years striking Hualien on April 3, which caused

The Constitutional Court on Tuesday last week held a debate over the constitutionality of the death penalty. The issue of the retention or abolition of the death penalty often involves the conceptual aspects of social values and even religious philosophies. As it is written in The Federalist Papers by Alexander Hamilton, James Madison and John Jay, the government’s policy is often a choice between the lesser of two evils or the greater of two goods, and it is impossible to be perfect. Today’s controversy over the retention or abolition of the death penalty can be viewed in the same way. UNACCEPTABLE Viewing the