The stock market made a dramatic U-turn yesterday, with the TAIEX surging 5.82 percent following a decline of 2.74 percent in the previous session, but analysts said the rebound could be short-lived.

The TAIEX shot up 328.43 points to close at 5,970.38 yesterday on rallies in Wall Street and major Asian equity markets after six central banks around the world adopted measures to rein in financial turmoil.

Turnover grew to NT$105.58 billion (US$3.28 billion) for the first time since the middle of last month.

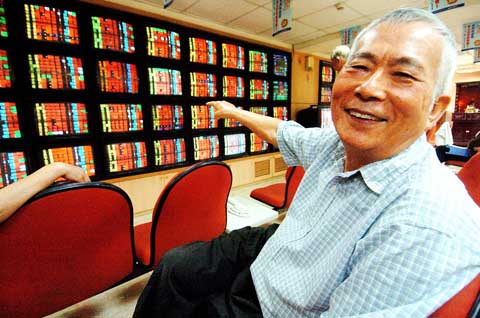

PHOTO: GEORGE TSORNG, TAIPEI TIMES

But analysts advised caution, saying the global financial environment remained little changed despite the government interventions.

Alan Tseng (曾炎裕), an analyst at Capital Securities Corp (群益證券), branded the rally “a technical rebound” that is frequently seen following days of slump.

The benchmark index opened high and then fluctuated between 5,858.19 and 5,982.64 points during the session, Taiwan Stock Exchange data showed. All eight categories of stocks reported gains, with 591 listed companies closing limit up.

Tseng said the rebound could last into early next week after the Cabinet decided on Thursday to activate the National Stabilization Fund (國安基金) to buoy the local bourse

“The decision surely helped boost investors’ confidence,” Tseng said by telephone. “But its size [NT$500 billion] is not big enough to sway the market and such intervention hasn’t proven a solid cure in the past.”

The analyst said he believed the Wall Street showing and other international factors had more impact on the TAIEX.

The series of rescue measures taken by the US, EU and Japan could help prevent the sudden collapse of other major investment institutions, Tseng said.

Foreign fund managers, who recently pulled sizable amounts of funds from Asian markets, bought a net NT$10.28 billion in local shares yesterday, compared with a net selling of NT$960 million by domestic investment trust companies, stock exchange data showed.

Despite the 5.82 percent rally, the second steepest single-day advance in almost eight years, the index declined 5.4 percent this week and 15.3 percent so far this month.

Winson Wang (王榮旭), an analyst at Marbo Securities Consultant Co (萬寶證券投顧), said it remained to be seen if the rebound would end up as a one-day phenomenon.

“It is premature to conclude the TAIEX had hit the bottom,” Wang said in a telephone interview. “It is better to observe a few more days, because international financial markets remain volatile.”

But the analyst said he felt more optimistic this time given the trade volume, which indicated investors seeking to sell shares but unable to trade earlier had done so.

Finance and insurance stocks showed some volatility yesterday because some investors took the rebound as a good opportunity to reduce positions.

But the depressed sentiment on this sector had eased somewhat compared with days before, analysts said.

US sports leagues rushed to get in on the multi-billion US dollar bonanza of legalized betting, but the arrest of an National Basketball Association (NBA) coach and player in two sprawling US federal investigations show the potential cost of partnering with the gambling industry. Portland Trail Blazers coach Chauncey Billups, a former Detroit Pistons star and an NBA Hall of Famer, was arrested for his alleged role in rigged illegal poker games that prosecutors say were tied to Mafia crime families. Miami Heat guard Terry Rozier was charged with manipulating his play for the benefit of bettors and former NBA player and

The DBS Foundation yesterday announced the launch of two flagship programs, “Silver Motion” and “Happier Caregiver, Healthier Seniors,” in partnership with CCILU Ltd, Hondao Senior Citizens’ Welfare Foundation and the Garden of Hope Foundation to help Taiwan face the challenges of a rapidly aging population. The foundation said it would invest S$4.91 million (US$3.8 million) over three years to foster inclusion and resilience in an aging society. “Aging may bring challenges, but it also brings opportunities. With many Asian markets rapidly becoming super-aged, the DBS Foundation is working with a regional ecosystem of like-minded partners across the private, public and people sectors

BREAKTHROUGH TECH: Powertech expects its fan-out PLP system to become mainstream, saying it can offer three-times greater production throughput Chip packaging service provider Powertech Technology Inc (力成科技) plans to more than double its capital expenditures next year to more than NT$40 billion (US$1.31 billion) as demand for its new panel-level packaging (PLP) technology, primarily used in chips for artificial intelligence (AI) applications, has greatly exceeded what it can supply. A significant portion of the budget, about US$1 billion, would be earmarked for fan-out PLP technology, Powertech told investors yesterday. Its heavy investment in fan-out PLP technology over the past 10 years is expected to bear fruit in 2027 after the technology enters volume production, it said, adding that the tech would

YEAR-END BOOST: The holiday shopping season in the US and Europe, combined with rising demand for AI applications, is expected to drive exports to a new high, the NDC said Taiwan’s business climate monitor improved last month, transitioning from steady growth for the first time in five months, as robust global demand for artificial intelligence (AI) products and new iPhone shipments boosted exports and corporate sales, the National Development Council (NDC) said yesterday. The council uses a five-color system to measure the nation’s economic state, with “green” indicating steady growth, “red” suggesting a boom and “blue” reflecting a recession. “Yellow-red” and “yellow-blue” suggest a transition to a stronger or weaker condition. The total score of the monitor’s composite index rose to 35 points from a revised 31 in August, ending a four-month