The hum of 102 rooftop air conditioners and a chorus of beeping electric carts provide the acoustic backdrop in Amazon.com’s 56,000m2 distribution facility on Phoenix’s west side. But the center’s employees can almost always hear Terry Jones.

On a recent summer afternoon, Jones, an “inbound support associate” making US$12 an hour, steered a hand-pushed cart through the packed aisles and shouted his location to everyone in earshot: “Cart coming through. Yup! Watch yourself, please!”

Jones explained that he was just making his time at Amazon “joyful and fun” while complying with the company’s rigorous safety rules.

PHOTO: NY TIMES NEWS SERVICE

But his cries might double as a warning to the retail world: Amazon, the Web’s largest retailer, wants you to step aside.

Fifteen years after Jeffrey Bezos founded the company as an online bookstore, Amazon is set to cross a significant threshold. Sometime later this year, if current trends continue, worldwide sales of media products — the books, movies and music that Amazon started with — will be surpassed for the first time by sales of other merchandise on the site. That transition already occurred this year in its North American business.

In other words, in an increasingly digital age, Amazon is quickly becoming the world’s general store. Alongside the books and CDs and DVDs are diapers, Legos and power drills, not to mention replacement car clutches and more arcane items like the Jackalope Buck taxidermy mount available for US$69.97.

“Amazon has gone from ‘that bookstore’ in people’s mind to a general online retailer, and that is a great place to be,” said Scot Wingo, chief executive of ChannelAdvisor, an eBay-backed company that helps stores like Wal-Mart and J.C. Penney sell online.

Wingo envisions e-commerce growing to 15 percent of overall retail in the next decade from around 7 percent.

“If Amazon grows their market share throughout that period, and honestly I don’t see anything stopping it, that is pretty scary,” he said.

Indeed, Amazon has been gobbling e-commerce market share since 2006, taking away customers from eBay in particular. But its advances are shaking up the entire retail world. Giants like Wal-Mart are warily replicating elements of its strategy, while small independent retailers in sporting goods and jewelry now worry their fate will be similar to that of small bookstores and independent video rental shops (remember those?).

Amazon’s expansion strategy has allowed it, almost alone among retailers, to thrive during the recession, even while its own media business has stagnated. Over the last year, shoppers have bought fewer books, CDs and DVDs, in many cases opting for cheaper digital downloads. In the quarter ending in June, for example, Amazon’s worldwide media sales grew only 1 percent, to US$2.4 billion, highlighted by a slowdown in video games.

But during the same quarter, sales of other products, which the company lumps together on its balance sheet in a grouping dubbed “electronics and general merchandise,” grew by 35 percent, to US$2.07 billion.

Its relentless ambition to sell more of everything is constantly on display these days. In July alone, Amazon introduced separate hubs on its site for outdoor sporting goods and cell phones and wireless plans. Then it capped the month by buying an emerging competitor, the online shoe and apparel retailer Zappos.com, in a stock exchange now worth more than US$930 million.

Aside from using its stock and US$3.1 billion in cash and marketable securities to make acquisitions, Amazon has fueled its growth as a general retailer by nudging loyal customers to buy a greater variety of products by offering free shipping and speedy delivery with clubs like the US$79-a-year Amazon Prime.

Amazon executives are nonchalant about the shift to general retailing, regarding the moment as preordained destiny ever since the company announced its ambition to offer the biggest selection of goods on earth, before going public in 1997. But they have reason to feel vindicated: After the dot-com bust, some analysts thought the company could go broke trying to stock such a wide array of merchandise.

“It means we are becoming increasingly important in the lives of our customers, which has been our mission from the beginning,” said Jeff Wilke, Amazon’s senior vice president of North American retail. “We had the chance to earn the trust of the customer beyond media, and we took it.”

Inside Amazon’s vast shipping centers, the company’s growing capability as a general retailer is nearly invisible. What is clear is that the normal rules of retail don’t apply here.

Instead of storing similar items next to each other — televisions with other electronics, shampoo with other personal care items — randomness abounds. In the warehouse where Terry Jones loudly roams the aisles, which the company somewhat randomly dubs Phoenix 3, Star Wars action figures are stocked next to sleeping bags; bagel chips sit next to the Beatles: Rock Band video game.

In one high-risk valuables area, monitored by overhead video cameras, a single Impulse Jack Rabbit sex toy is wedged between a Rosetta Stone Spanish CD and an iPod Nano.

In nearby Goodyear, Arizona, at an even larger distribution center known as Phoenix 5, Amazon stores and ships more unwieldy items. Samsung 54-inch plasma HDTVs are stacked three high on the floor, next to crates of Pampers. Across the aisle, a kayak (US$879) sits alone on the floor, wrapped tightly in cardboard and plastic.

Amazon says it stores dissimilar products next to each other on purpose, to minimize the possibility that employees select the wrong item. That seems unlikely: Every product, shelving unit, forklift, roller cart and employee badge in these shipping centers has a bar code. Each physical move is orchestrated by software that calculates the most efficient path from shelf to the shipping area, telling employees on their wireless bar code readers which aisle and palette to go to next.

“Imagine how many customers we serve and if they were all here now,” said Bert Wegner, Amazon’s director of North American fulfillment, gesturing over the open space in Phoenix 5. “We are doing the heavy lifting for all of them in a hyper-efficient manner.”

Amazon also benefits greatly from its advanced inventory management methods and ability to negotiate beneficial payment terms with vendors. The company sells such a large volume of merchandise, and can predict customer demand so accurately, that it generally sells products within 65 days, before it has to pay suppliers for them.

That arrangement, which analysts call “negative working capital,” is unusual outside of grocery stores and allows Amazon to avoid the huge capital charges associated with buying and storing such a broad line of inventory. It also boosts the company’s cash flow, which it has used to pay down its debt to US$109 million at the end of June from a hefty US$2 billion in 2000, and to add more product lines to its Web site.

Amazon’s profit and margins have always been slender; it earned only US$645 million last year, up 36 percent from the year before, compared to Wal-Mart’s US$13.4 billion, up 5 percent. But Wall Street is more enamored by the promise of the online retailer, valuing Amazon at around 60 times earnings and Wal-Mart at 15 times earnings.

“They don’t have to incur huge inventory carrying costs and can add product categories almost ad infinitum,” said Jeffrey Lindsay, an analyst at Sanford C. Bernstein. “Amazon has an almost magical business model in terms of inventory management.”

Amazon’s incursion into general retail has rivals scurrying to regroup and stop its advance.

Last month, Target, which allowed Amazon to run its Web site for the last decade, announced it would end the affiliation when its contract was up in 2011, following other one-time Amazon partners like Borders and Toys “R” Us. This month, Wal-Mart said it would allow other retailers to sell their products on Walmart.com, mimicking Amazon’s third-party marketplace and trying to match its vast selection. Analysts believe Sears, which owns Kmart, is preparing to allow outside sellers on its sites as well.

But the Amazon effect may be most deeply felt by small independent stores, which cannot hope to compete with Amazon’s selection and prices and recall in fear how the company hastened the fate of both independent booksellers and prominent electronics chains like Circuit City.

Like many small business owners, Ken Lombardi, the CEO of his family’s 60-year-old Lombardi Sports in San Francisco, views Amazon as a source of some of his business troubles. Though his store has been hit hard by the recession and the expansion of a sporting goods chain, REI, in the Bay Area, Lombardi says that it is Amazon that has helped depress profit margins and snagged sales for basics like silicone swim caps, undershirts and running shoes — which, he adds, Amazon can offer without California’s 8.25 percent sales tax.

“People used to come in to buy a pair of running shoes and we would sell them a shirt or a workout outfit. We’re losing that,” said Lombardi, who was recently forced to lay off a quarter of his 75-member staff.

In response to the gathering storm, Lombardi has overhauled his store, shrinking space for lagging items like Crocs clogs — which are offered cheaply on Amazon. He has added space for newer, hotter-selling items like Sanuk sandals, which are for sale on Amazon at about the same price. He also recently commissioned a new Web site to replace the static old one, which had not changed much over the years

“All we can do is tell a story physically and let people touch and smell and feel the product, which they can’t do online,” Lombardi said, lamenting his store’s future. “I think we are doing everything we can.”

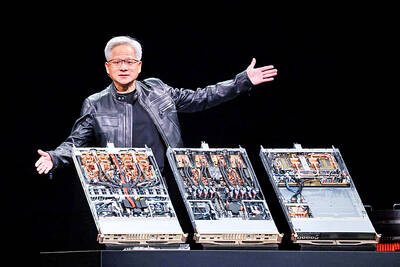

Nvidia Corp yesterday unveiled its new high-speed interconnect technology, NVLink Fusion, with Taiwanese application-specific IC (ASIC) designers Alchip Technologies Ltd (世芯) and MediaTek Inc (聯發科) among the first to adopt the technology to help build semi-custom artificial intelligence (AI) infrastructure for hyperscalers. Nvidia has opened its technology to outside users, as hyperscalers and cloud service providers are building their own cost-effective AI chips, or accelerators, used in AI servers by leveraging ASIC firms’ designing capabilities to reduce their dependence on Nvidia. Previously, NVLink technology was only available for Nvidia’s own AI platform. “NVLink Fusion opens Nvidia’s AI platform and rich ecosystem for

WARNING: From Jan. 1 last year to the end of last month, 89 Taiwanese have gone missing or been detained in China, the MAC said, urging people to carefully consider travel to China Lax enforcement had made virtually moot regulations banning civil servants from making unauthorized visits to China, the Control Yuan said yesterday. Several agencies allowed personnel to travel to China after they submitted explanations for the trip written using artificial intelligence or provided no reason at all, the Control Yuan said in a statement, following an investigation headed by Control Yuan member Lin Wen-cheng (林文程). The probe identified 318 civil servants who traveled to China without permission in the past 10 years, but the true number could be close to 1,000, the Control Yuan said. The public employees investigated were not engaged in national

CAUSE AND EFFECT: China’s policies prompted the US to increase its presence in the Indo-Pacific, and Beijing should consider if this outcome is in its best interests, Lai said China has been escalating its military and political pressure on Taiwan for many years, but should reflect on this strategy and think about what is really in its best interest, President William Lai (賴清德) said. Lai made the remark in a YouTube interview with Mindi World News that was broadcast on Saturday, ahead of the first anniversary of his presidential inauguration tomorrow. The US has clearly stated that China is its biggest challenge and threat, with US President Donald Trump and US Secretary of Defense Pete Hegseth repeatedly saying that the US should increase its forces in the Indo-Pacific region

ALL TOGETHER: Only by including Taiwan can the WHA fully exemplify its commitment to ‘One World for Health,’ the representative offices of eight nations in Taiwan said The representative offices in Taiwan of eight nations yesterday issued a joint statement reiterating their support for Taiwan’s meaningful engagement with the WHO and for Taipei’s participation as an observer at the World Health Assembly (WHA). The joint statement came as Taiwan has not received an invitation to this year’s WHA, which started yesterday and runs until Tuesday next week. This year’s meeting of the decisionmaking body of the WHO in Geneva, Switzerland, would be the ninth consecutive year Taiwan has been excluded. The eight offices, which reaffirmed their support for Taiwan, are the British Office Taipei, the Australian Office Taipei, the