European shares on Friday slipped from near record highs after a US airstrike in Iraq that killed a top Iranian commander increased Middle East tensions and spurred moves out of risk assets, while an oil price surge hammered airline stocks.

Iranian Supreme Leader Ayatollah Ali Khamenei vowed harsh revenge after major general Qassem Soleimani, commander of the Islamic Revolutionary Guard Corps’ Quds Force and architect of the country’s spreading military influence in the Middle East, was killed in the airstrike in Baghdad.

Leaders from many other countries urged restraint.

However, City Index Group market analyst Ken Odeluga said: “As such, chances that a further escalation of tensions with Washington can be avoided, appear to be low.”

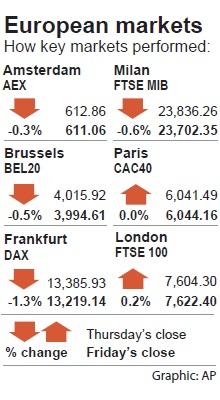

The pan-European STOXX 600 on Friday fell 1.80 points, or 0.4 percent, to 417.92, dropping 0.4 percent from a close of 419.74 on Dec. 27, with German shares having their worst day in a month as Deutsche Lufthansa AG slumped 6.5 percent.

Along with losses by Societe Air France SA and EasyJet Europe Airline GmbH, the travel and leisure sector shed 1.6 percent on fuel price concerns as oil jumped more than 3 percent.

The jump in oil prices lifted the regional energy sector index to a seven-week high, which tied in with a weaker pound to help London’s bourse buck the trend.

The FTSE 100 on Friday rose 18.10 points, or 0.2 percent, to 7,622.40, but slid 0.3 percent from 7,644.90 a week earlier.

“Even if we hear nothing over the weekend, the events have shown that this is a complex geopolitical situation and the ongoing uncertainty will have to be dealt with for a while,” Commerzbank AG head of equity research Ingo Schachel said.

Global financial markets had started the new decade on a high note on improving US-China trade relations, further monetary easing in China and a brightening economic outlook.

However, data released on Friday showed that unemployment in Germany rose more than expected last month, while US manufacturing for the same period saw a bigger-than-expected dip.

Friday’s moves tipped an otherwise flat week for European equities into the red.

In corporate news, tobacco companies Swedish Match AB and British American Tobacco PLC rose to the top of the STOXX 600 after the US Food and Drug Administration exempted menthol and tobacco from a list of popular e-cigarette flavors that it had banned under new guidelines.

Cellnex Telecom SA rose 2.3 percent after agreeing to buy Portuguese telecommunications tower operator OMTEL for about 800 million euros (US$892.8 million).

Trading for the first time this year, Swiss stocks rose 0.8 percent after a nearly 26 percent rise last year as investors bought into consumer goods.

Additional reporting by staff writer

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia