As China struggles to deal with the slowdown of the world’s second-largest economy, it has embarked on a new strategy of placing financial experts in provinces to manage risks and rebuild regional economies.

Since last year, Chinese President Xi Jinping (習近平) has put 12 former executives at state-run financial institutions or regulators in top posts across the nation’s 31 provinces, regions and municipalities, including some who have grappled with banking and debt difficulties that have raised fears of a financial meltdown.

Only two top provincial officials had such financial background before the last leadership reshuffle in 2012, according to Reuters research.

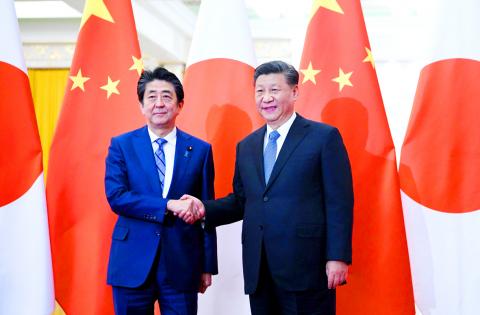

Photo: AFP

Among the experts promoted is Beijing Vice Mayor Yin Yong (應勇) a former deputy central bank governor, and Shandong Deputy Provincial Governor Liu Qiang (劉強), who rose through the nation’s biggest commercial banks, from Agricultural Bank of China (中國農業銀行) to Bank of China (中國銀行).

Another newly promoted official, Chongqing Vice Mayor Li Bo (李波), had until this year led the central bank’s monetary policy department.

The appointments — overseeing economies larger than those of small countries — would appear to put those officials in the fast lane as China prepares a personnel reshuffle in 2022, when about half of the 25 members of the Politburo could be replaced, including Chinese Vice Premier Liu He (劉鶴), who is leading economic reform while doubling as chief negotiator in trade talks with the US.

“Bankers are now in demand, as local governments are increasingly exposed to financial risks,” said Feng Chucheng, a partner at Plenum, an independent research platform in Hong Kong.

“These ex-bankers and regulators are given the task of preventing and mitigating major financial risks,” he said.

The appointments have come as economic growth has slowed to its weakest in nearly three decades, while government infrastructure investment has fallen.

Five regional banks were hit with management or liquidity problem this year, raising the prospect of devastating debt bombs lurking in unexpected corners.

“We need to be well-prepared with contingency plans,” Xinhua news agency said after a major annual economic meeting headed by Xi this month.

The economy faced “increasing downward economic pressure amid intertwined structural, institutional and cyclical problems,” it said.

With pressures mounting, local governments are expecting to take the lead in managing their financial scares and cutting the cost of rescue with local intervention, analysts said.

“Appointing financial vice governors to provinces can help better integrate financial policies into local practice, and to prevent financial risks beforehand,” said He Haifeng (何海峰), director of Institute of Financial Policy at the Chinese Academy of Social Science, a government think tank.

“Such appointments have also showcased a change of manner in official appointments,” He said.

Financial executives were long shunned for leadership positions.

Banks were nationalized after the Chinese Communist Party took power in 1949 and many bankers were purged during the Cultural Revolution.

Xi started to stress the importance of financial expertise and to elevate the status of executives in 2017.

“Political cadres, especially the senior ones, must work hard to learn financial knowledge and be familiar with financial sectors,” Xi said in a national meeting on financial affairs.

Half of the 12 former financial executives elevated to provincial leadership posts under Xi were born after 1970.

Liaoning Vice Governor Zhang Lilin ( 張酈林), 48, a veteran banker who spent two decades in the nation’s third-largest lender, Agricultural Bank of China, was appointed days after three state-controlled financial institutions announced investment in the then-troubled Bank of Jinzhou (錦州銀行).

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Taiwan has enough crude oil reserves for more than 100 days and sufficient natural gas reserves for more than 11 days, both above the regulatory safety requirement, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday, adding that the government would prioritize domestic price stability as conflicts in the Middle East continue. Overall, energy supply for this month is secure, and the government is continuing efforts to ensure sufficient supply for next month, Kung told reporters after meeting with representatives from business groups at the ministry in Taipei. The ministry has been holding daily cross-ministry meetings at the Executive Yuan to ensure

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

HORMUZ ISSUE: The US president said he expected crude prices to drop at the end of the war, which he called a ‘minor excursion’ that could continue ‘for a little while’ The United Arab Emirates (UAE) and Kuwait started reducing oil production, as the near-closure of the crucial Strait of Hormuz ripples through energy markets and affects global supply. Abu Dhabi National Oil Co (ADNOC) is “managing offshore production levels to address storage requirements,” the company said in a statement, without giving details. Kuwait Petroleum Corp said it was lowering production at its oil fields and refineries after “Iranian threats against safe passage of ships through the Strait of Hormuz.” The war in the Middle East has all but closed Hormuz, the narrow waterway linking the Persian Gulf to the open seas,