The Taichung City Government yesterday fined the Taichung Power Plant NT$20 million (US$647,962) for poor management of industrial wastewater.

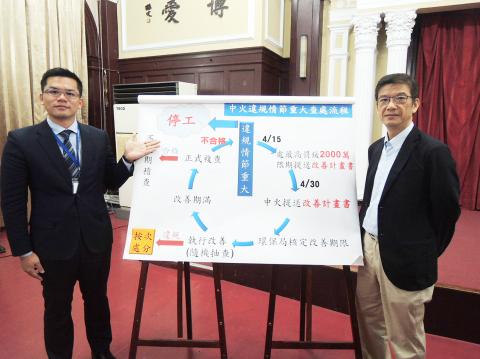

The Taichung Environmental Protection Bureau gave the coal-fired plant until April 30 to come up with a proposal to ameliorate the situation, bureau Director-General Wu Chih-chao (吳志超) said in a statement posted on the city government’s Web site.

The plant, which is run by state-owned Taiwan Power Co (Taipower, 台電), was fined in accordance with Section 40 of the Water Pollution Control Act (水污染防治法), Wu said.

Photo: CNA

It is the highest fine ever imposed on a state-owned enterprise, the statement said.

A test conducted on March 21 by the bureau found that wastewater from the plant’s No. 1 to No. 4 generators contained nitrate nitrogen levels that exceeded the allowable limit, Wu said.

Two other tests carried out earlier this year on generators No. 5 to No. 8 also turned up levels that exceeded the limit, he said.

Taipower in a statement said that high nitrate nitrogen levels were mainly caused by the plant’s focus on preventing air pollution, resulting in a lack of capacity to manage water pollution.

The utility said it respects the city government’s decision.

“We need to resolve the problem of wastewater first. We have yet to discuss whether to appeal the fine,” Taipower spokesman Hsu Tsao-hua (徐造華) told the Taipei Times by telephone.

The company must pay the fine by May 15, the Chinese-language Liberty Times (sister newspaper of the Taipei Times) reported, citing Taichung Information Bureau Director-General Wu Huang-sheng (吳皇昇).

To demonstrate its willingness to lower nitrate nitrogen levels in wastewater, the plant has halved the output of generators No. 1 to No. 4, Taipower said.

The plant has also readjusted an operating meter for flue gas desulfurization equipment to reduce the level of nitrogen oxides, it said, adding that round-the-clock supervision of the generators is being enforced to regulate the quantity of ammonia injection.

Generator No. 4 would be shut down to test equipment and improve wastewater management, Taipower said, adding that adjustments would be made to generator No. 3 to improve air pollution controls.

Taipower reiterated the importance of the plant, which it said plays a key role in ensuring a steady power supply for the nation.

The timing for the generators to return to normal generation levels would depend on wastewater conforming to regulations, it said.

The company said it hopes that improvements to the plant’s wastewater management could be made by early next month, as the nation’s electricity consumption is to greatly increase afterward.

It would maintain a low operating reserve margin of 6 percent over the next 10 days, as there have been no forecasts of abnormally hot weather, Taipower said, adding that and adjustments would be made according to the weather and electricity consumption.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth