Merida Industry Co (美利達) could see revenue contribution from electric bicycles rise to 30 percent of its total revenue this year, from 20 percent last year and 10 percent in 2016, as the electric models have become very versatile, analysts said.

“Currently, there are many ways to use electric bicycles, such as for mountain climbing, carrying stuff and passengers, and daily commuting. The new smart model is expected to hit the market in 2020, with more efficient batteries, and we expect the market demand to increase gradually,” Jih Sun Securities Investment Consulting Co (日盛投顧) researcher Satin Lin (林子楹) said on Thursday.

Merida shipped 93,300 electric bicycles last year, up from 57,000 in 2016.

In the first seven months of the year, the company’s e-bike shipments reached 90,000 units and the figure for the whole of this year could amount to 150,000-160,000 units, Lin said in a client note.

“Merida’s orders for electric bicycles could grow by 40 to 50 percent in 2019, compared with this year’s,” Lin said. “E-bike sales are also to increase by 40 percent in 2019.”

In the first seven months of the year, Merida posted cumulative sales of NT$15.33 billion (US$498.84 million), up 26.36 percent from the same period of last year.

Net income for the first half of the year was NT$550.13 million, up 22.98 percent from NT$447.32 million a year earlier. Earnings per share rose from NT$1.5 to NT$1.84 over the same period.

Gross margin fell to 12.04 percent, compared with 12.55 percent a year earlier, while operating margin also dropped from 5.04 percent to 4.62 percent, company data showed.

The European anti-dumping duties do not affect Merida, as none of the firm’s electric bicycles or high-end bikes are made in China, Yuanta Securities Investment Consulting Co (元大投顧) said.

“However, with the US-China trade war escalating, the likelihood that the US will impose an additional 25 percent tariff on bikes that are exported from China is increasing. With trade tension intensifying, Merida’s margins may end up being pressured,” Yuanta analyst Peggy Shih (施姵帆) said in a separate note on Aug. 13.

Merida shares have advanced 18 percent this year, compared with the broader market’s 3.96 percent rise, while bigger rival Giant Manufacturing Co’s (巨大機械) shares have declined 18.96 percent over the period, Taiwan Stock Exchange data showed.

Merida’s share price has been stronger than Giant’s due to Merida’s strong electric bicycle sales, lower capacity in China, and overall less negative impact from the US-China trade war, Shih said.

However, Yuanta remains neutral on the company’s stock in view of its weaker margins and its relatively high valuation, she said.

Merida shares on Friday closed at NT$147.5 and Giant ended at NT$132.5 in Taipei trading.

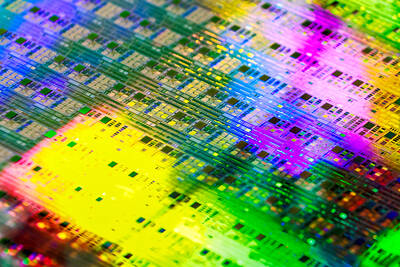

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The

India’s ban of online money-based games could drive addicts to unregulated apps and offshore platforms that pose new financial and social risks, fantasy-sports gaming experts say. Indian Prime Minister Narendra Modi’s government banned real-money online games late last month, citing financial losses and addiction, leading to a shutdown of many apps offering paid fantasy cricket, rummy and poker games. “Many will move to offshore platforms, because of the addictive nature — they will find alternate means to get that dopamine hit,” said Viren Hemrajani, a Mumbai-based fantasy cricket analyst. “It [also] leads to fraud and scams, because everything is now