Germany has suggested the creation of an EU-wide unemployment insurance system to make the eurozone more resilient to future economic shocks, German Minister of Finance Olaf Scholz said in an interview published yesterday.

The proposal, outlined in an interview with Der Spiegel magazine, is part of Germany’s efforts to seal a reform package together with France ahead of this month’s European Council meeting.

“I’m in favor of supplementing national systems for unemployment insurance with a reinsurance for the overall euro zone,” Scholz said in the interview.

If a eurozone member faces an economic crisis that leads to massive job losses and a heavy burden on its social-security system, the country could borrow from this joint reinsurance fund, Scholz said.

“Once the recession is over, the country would pay back the funds it borrowed. At the same time, all countries should make efforts that their safety nets are as prepared for crisis as possible,” he said.

Asked whether Germany would bear the risk of this new scheme, Scholz replied: “No, Germany profits. The German Federal Employment Agency’s reserves would remain untouched, and no debts will be communitized.”

The minister said the step would strengthen the financial stability of the eurozone as a whole, without disadvantages for the German unemployment insurance system.

“It’s similar to how things work in the US. There, individual states fund unemployment insurance, but pay into a federal fund. In times of crisis, they can borrow money from it to better share the burden — without running into problems,” Scholz said.

Scholz, who is also vice chancellor and a former labor minister, pointed to Germany’s labor market experiences during the financial crisis in 2008, when the government prevented massive job cuts through a state-subsidized program to finance reduced working hours — the so-called Kurzarbeit scheme.

“Why shouldn’t we apply this same experience to the eurozone? In my view, we need further solidarity-based elements in the eurozone,” Scholz said.

Scholz also underlined his determination to introduce a financial transaction tax in Europe — a plan he outlined in a Reuters interview last month.

He said he backs a French proposal that revenues from such a tax on all kinds of stock market transactions should flow into the EU budget if it was implemented by all countries.

“Brussels could, for example, use those revenues to finance development work,” he said.

Many eurozone countries have doubts about such a tax, but Scholz said the idea of turning the tax into a source of European revenue could change the debate.

“The timing is good for a project like this,” he said, pointing to upcoming negotiations about the EU’s future budget and the “significant revenue shortfall” caused by Britain’s departure from the bloc.

“We are also discussing the creation of an additional fund for investments. As such, it makes sense in this context to consider whether funding for these efforts should be collected at the European level,” Scholz added.

Asked how much money such a financial transaction tax could contribute to the EU budget, Scholz said it could bring in 5 billion to 7 billion euros (US$5.89 billion to US$8.25 billion) if it was introduced in the EU as a whole.

“That is not enough on its own to cover the financial requirements, but it is a substantial contribution,” he said.

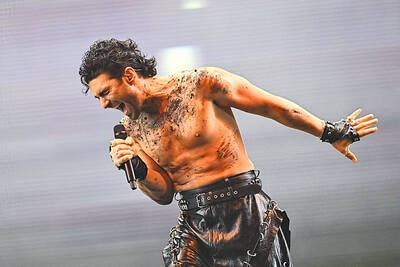

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan