Many have said that if a Vespa and a smartphone had a lovechild, it would be the Gogoro Inc (睿能創意) scooter.

However, Gogoro is more about pushing forward “a revolutionary way to reinvent the way people consume energy” than making battery-powered intelligent scooters, marketing vice president Peng Ming-i (彭明義) said.

The company’s ambition also goes beyond what is suggested by its motto: “Tesla on two wheels,” Peng added.

Photo: Chien Jung-fong, Taipei Times

Gogoro strives to be a frontrunner in the transportation industry with a smart power grid for swappable batteries, Peng said in a recent interview.

However, before that energy network can be facilitated, Gogoro must prove that its futuristic scooter can make gains among Taiwan’s nearly 14 million motorcyclists.

This summer, Gogoro is to start scooter sales — and make public its retail prices for the greater Taipei area — before adding services elsewhere in Taiwan or in 230 other interested cities in the world.

The vehicle is a “charming enough high-performance electric vehicle to accelerate the switch to green energy,” Environmental Protection Administration Department of Air Quality Protection and Noise Control Director-General Chen Hsien-heng (陳咸亨) said.

The agency has been promoting electric vehicles because from 20 to 35 percent of PM2.5 pollution — airborne particles measuring 2.5 micrometers or less that can enter deeply into human lungs — in metropolitan areas is produced by gasoline-powered vehicles.

The rate of adoption of electric scooters in Taiwan has been slow since 2008. Last year, just 4,482 electronic scooters were sold nationwide, mainly in the public sector, compared with annual sales of more than 40,000 electric bicycles, according to statistics provided by the Electric Vehicle Development Association in Taipei.

The biggest hurdle to rapid adoption is not a high price, but rather the lackluster performance of electric vehicles, Chen said.

Despite the bureau’s subsidies of up to NT$20,000 per vehicle, motorcyclists have been hesitant to switch to electric scooters, as performance often falls short of expectations when it comes to battery capacity, charging time and hill-climbing capabilities, as well as the lack of charging or battery exchange stations, Chen said.

Gogoro’s scooter might hold the answer to all these problems, as the company claims its product’s performance is equal to that of a 125cc motorcycle, he said.

The Gogoro Smartscooter, 1.73m long and weighing 94kg, can accelerate from zero to 50kph in 4.2 seconds toward a maximum speed of 96.6kph, according to Gogoro, which was founded in 2011 by former HTC Corp (宏達電) executives Horace Luke (陸學森) and Matt Taylor.

The vehicle has a maximum range of 96.6km at an average speed of 40kph per battery swap, the company said.

The proprietary battery design employs 18650-size, cylindrical, automotive-grade lithium ion energy cells supplied by strategic partner Panasonic Corp, Gogoro said.

The electric scooter has a central processing unit that can process data collected by its 80 embedded sensors, including 25 for the batteries, within six seconds, Gogoro said.

Riding data is uploaded to the cloud every 10 minutes through Gogoro’s mobile app on a user’s smartphone or when a battery is exchanged at a GoStation through near-field communication connectivity, the company added.

The Smartscooter is so technically complicated that even the nation’s three top motorcycle makers would have a hard time reproducing it, senior manager of product management Troy Shih (施宜亨) said.

“All of these smart features are the reasons behind the positive feedback from those who have had a test ride on our scooter recently; most of them agreed Gogoro is ‘so much fun’ and ‘fierce’ to ride,” Shih said.

However, industry watchers, drawing on experience, have not been optimistic about the revolution Gogoro is attempting to begin.

“It is a global trend to be green, but the government has to take the initiative and impose a ban on gasoline-powered vehicles,” Electric Vehicle Development Association secretary-general Chang Chen-lung (張振隆) said. “Otherwise, it will be an uphill battle.”

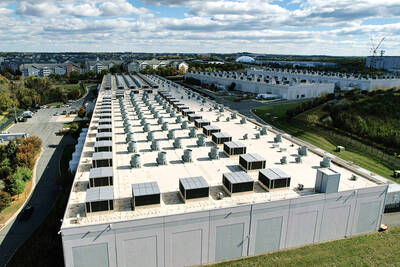

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

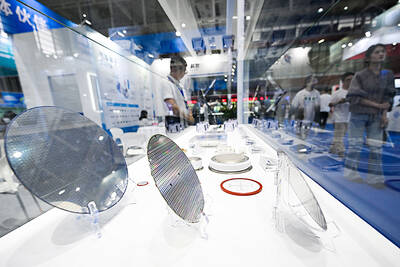

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia