Taiwan’s key economic indicators moved sideways along the bottom of an L-shaped line in the first half of the year and may fail to pick up significantly if exports to China continue to fall in the second half, UBS Securities Asia said in a recent report.

The nation’s growth momentum neither picked up nor deteriorated in the second quarter as a result of two opposing forces — a resilient US and a surprisingly weak China — driving external demand for Taiwan’s exports, the Swiss financial services provider said.

“We see a downside to our prediction of 3 percent growth for Taiwan this year if Chinese growth fails to stabilize in the second half,” USB economist Silvia Liu said.

China accounts for 40 percent of Taiwanese exports, which have a value equivalent to 70 percent of nominal GDP.

Headline exports remained lackluster in May at US$26.34 billion, expanding by a mere 0.9 percent compared with the same period last year, the Ministry of Finance said in a report. The ministry is slated to release last month’s data today.

Taiwan’s exports to the US are stabilizing, driven by a stronger US economy and increased US demand for communication products after the release of a new smartphone by HTC Corp (宏達電), the world’s No. 5 smartphone brand.

For the first five months of the year, the US was the destination for 10.6 percent of Taiwanese exports, while Europe accounted for 9 percent, according to ministry data.

A recovering US and — to a lesser degree — continued stabilization in Europe in the form of no renewed deterioration should put a floor under external demand, UBS said.

While the cyclical nature of the figures is unexciting, UBS said it spotted a positive development in Taiwan’s macroeconomic situation this year after the country made more concerted efforts to diversify its industrial base, particularly by growing its service exports and negotiating agreements with its trading partners.

The number of newly registered manufacturing factories has been on the rise since 2010, reversing a downward trend seen since 2004, Liu said, adding that the increase seen over the past few months has been particularly eye-catching.

This echoes news reports on the return of Taiwanese manufacturers from China to open up factories and the peaking of Taiwan’s overseas production ratio since 2010, the economist said.

“The drag on Taiwan’s economy caused by the hollowing out of the manufacturing sector should fade soon,” Liu wrote.

Furthermore, the contribution of services exports to GDP has kept growing, from 7 percent in 2005 to more than 10 percent this year, Liu said.

The nation started to run a surplus on its services trade in 2008, but there is ample room for the country to expand and catch up with the key services providers in the region, namely Hong Kong and Singapore, Liu said.

UBS painted the recent signing of the service trade agreement between China and Taiwan as a major, positive step toward liberalization and said it expects the conclusion of a free-trade agreement (FTA) with Singapore to be Taipei’s next major economic achievement.

While an FTA with Singapore may not produce material benefits, it would serve as a template for more efficient FTA negotiations between Taiwan and other ASEAN countries in the future, Liu said.

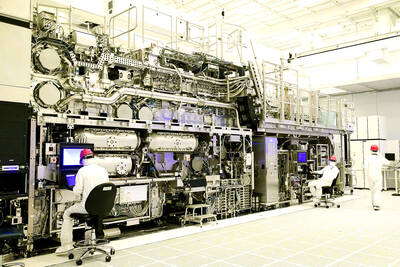

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt

Quanta Computer Inc (廣達), which makes servers and laptop computers on a contract basis, yesterday said it expects artificial intelligence (AI) devices to bring explosive growth to Taiwan’s electronics industry, as AI applications are starting to run on edge devices such as AI PCs. Taiwanese electronics manufacturers such as chipmakers, component suppliers and hardware assemblers are likely to benefit from a rapid uptake of AI applications, Mike Yang (楊麒令), president of Quanta Cloud Technology Inc (雲達科技), a server manufacturing arm of Quanta, told reporters on the sidelines of a technology forum in Taipei yesterday. “I believe the growth potential is promising once

RETALIATION: Beijing is investigating Taiwan, the EU, the US and Japan for dumping, following probes of its market, as well as tariff hikes on its imports The Chinese Ministry of Commerce yesterday said it had launched a dumping investigation into imports of an important engineering chemical from Taiwan, the EU, the US and Japan. It would probe imports of polyoxymethylene copolymer, a thermoplastic used in many precision parts used in phones, auto parts and medical equipment, the Chinese commerce ministry said. The ministry is reviewing materials provided by six Chinese companies that applied for assistance on behalf of the industry on April 22, it said. The probe will target polyformaldehyde copolymer imported from suppliers in the EU, the US, Taiwan and Japan last year, and will assess any damage