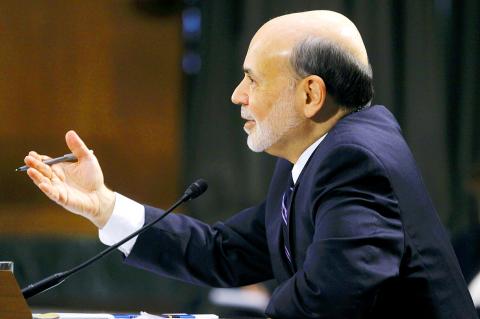

US Federal Reserve Chairman Ben Bernanke strongly defended the central bank’s monetary stimulus before the US Congress on Tuesday, easing financial market worries over a possible early retreat from bond purchases.

Bernanke said Fed policymakers are cognizant of the potential risks of their extraordinary support for the economy, including the possibility that it might fuel unwanted inflation or stoke asset bubbles.

However, in testimony on the central bank’s semi-annual report on monetary policy, he said the risks did not seem material at the moment, adding that the bank has all the tools it needs to retreat from its monetary support in a timely fashion.

Photo: Reuters

“We do not see the potential costs of the increased risk-taking in some financial markets as outweighing the benefits of promoting a stronger economic recovery and more rapid job creation,” Bernanke told the US Senate Committee on Banking, Housing and Urban Affairs.

The Fed chairman also urged lawmakers to avoid sharp spending cuts set to take effect tomorrow, warning that they could combine with earlier tax increases to create a “significant headwind” for the US’ modest economic recovery.

In response to the financial crisis and deep recession of 2007 to 2009, the Fed not only slashed official interest rates effectively to zero, but also bought more than US$2.5 trillion in mortgage and US Treasury debt in an effort to push down long-term interest rates and spur hiring.

The Fed is currently buying US$85 billion in bonds each month and has said it plans to keep purchasing assets until it sees a substantial improvement in the outlook for the labor market.

Bernanke’s testimony and stronger-than-expected data on housing and consumer confidence helped settle jitters in US stock markets over the EU’s debt crisis, with the Dow Jones industrial average closing up nearly 116 points, or 0.8 percent.

“What Bernanke is saying, bottom line, indicates that there will not be a reversal anytime soon in the stimulus program,” Rockwell Global Capital chief market economist Peter Cardillo said in New York.

When asked pointedly by Republican Senator Bob Corker whether the Fed’s easy policies were contributing to competitive currency devaluations globally and laying the groundwork for inflation, Bernanke was unequivocal.

“My inflation record is the best of any Federal Reserve chairman in the post-war period,” he retorted. “We are not engaged in a currency war.”

Democrats seized on Bernanke’s remarks to fuel their argument that looming budget cuts could have a dire economic impact, as they sought to gain political advantage over Republicans, who prefer spending cuts over higher taxes.

Committee newcomer Elizabeth Warren, a Democrat, pressed Bernanke on what she said is an implicit subsidy that large banks enjoy in the form of lower borrowing costs from being perceived as too big to fail.

Bernanke replied that the Dodd–Frank Wall Street Reform and Consumer Protection Act had given regulators more power to wind down failing financial institutions, making the issue less of a concern.

“The subsidy is coming because of market expectations that the government would bail out these firms if they fail. Those expectations are incorrect,” Bernanke said.

In unusually direct remarks on fiscal policy, Bernanke warned that the spending cuts known as the sequester that are set to take hold later this week would threaten an already challenged economic expansion.

“The Congress and the administration should consider replacing the sharp, frontloaded spending cuts required by the sequestration, with policies that reduce the federal deficit more gradually in the near term, but more substantially in the longer run,” Bernanke said.

The US economy braked sharply in the fourth quarter, but is forecast to grow about 2 percent or more this year. The unemployment rate has remained elevated and registered 7.9 percent last month.

ISSUES: Gogoro has been struggling with ballooning losses and was recently embroiled in alleged subsidy fraud, using Chinese-made components instead of locally made parts Gogoro Inc (睿能創意), the nation’s biggest electric scooter maker, yesterday said that its chairman and CEO Horace Luke (陸學森) has resigned amid chronic losses and probes into the company’s alleged involvement in subsidy fraud. The board of directors nominated Reuntex Group (潤泰集團) general counsel Tamon Tseng (曾夢達) as the company’s new chairman, Gogoro said in a statement. Ruentex is Gogoro’s biggest stakeholder. Gogoro Taiwan general manager Henry Chiang (姜家煒) is to serve as acting CEO during the interim period, the statement said. Luke’s departure came as a bombshell yesterday. As a company founder, he has played a key role in pushing for the

China has claimed a breakthrough in developing homegrown chipmaking equipment, an important step in overcoming US sanctions designed to thwart Beijing’s semiconductor goals. State-linked organizations are advised to use a new laser-based immersion lithography machine with a resolution of 65 nanometers or better, the Chinese Ministry of Industry and Information Technology (MIIT) said in an announcement this month. Although the note does not specify the supplier, the spec marks a significant step up from the previous most advanced indigenous equipment — developed by Shanghai Micro Electronics Equipment Group Co (SMEE, 上海微電子) — which stood at about 90 nanometers. MIIT’s claimed advances last

EUROPE ON HOLD: Among a flurry of announcements, Intel said it would postpone new factories in Germany and Poland, but remains committed to its US expansion Intel Corp chief executive officer Pat Gelsinger has landed Amazon.com Inc’s Amazon Web Services (AWS) as a customer for the company’s manufacturing business, potentially bringing work to new plants under construction in the US and boosting his efforts to turn around the embattled chipmaker. Intel and AWS are to coinvest in a custom semiconductor for artificial intelligence computing — what is known as a fabric chip — in a “multiyear, multibillion-dollar framework,” Intel said in a statement on Monday. The work would rely on Intel’s 18A process, an advanced chipmaking technology. Intel shares rose more than 8 percent in late trading after the

GLOBAL ECONOMY: Policymakers have a choice of a small 25 basis-point cut or a bold cut of 50 basis points, which would help the labor market, but might reignite inflation The US Federal Reserve is gearing up to announce its first interest rate cut in more than four years on Wednesday, with policymakers expected to debate how big a move to make less than two months before the US presidential election. Senior officials at the US central bank including Fed Chairman Jerome Powell have in recent weeks indicated that a rate cut is coming this month, as inflation eases toward the bank’s long-term target of two percent, and the labor market continues to cool. The Fed, which has a dual mandate from the US Congress to act independently to ensure