Germany’s Constitutional Court yesterday said a last-minute legal challenge by a leading euroskeptic politician would not delay its hotly awaited verdict on key euro crisis tools.

“The date fixed for the ruling” on the European Stability Mechanism (ESM) rescue fund and EU fiscal pact today “will go ahead as planned,” the court said in a statement.

That means that at 10am today, the eight scarlet-robed judges of the Verfassungsgericht will decide whether German President Joachim Gauck can sign into law the ESM and the European fiscal pact.

Photo: EPA

The German parliament already voted in favor of both with a two-thirds majority at the end of June.

However, Gauck held off from completing the ratification process in the face of legal challenges filed by the far-left Die Linke party, a citizens’ initiative group called “More Democracy” and a well-known euroskeptic from German Chancellor Angela Merkel’s CSU Bavarian sister party, Peter Gauweiler.

In an attempt to delay today’s ruling, Gauweiler filed a new complaint at the weekend, arguing that the European Central Bank’s decision to launch a new bond-buying program had moved the goalposts and that the court must now first decide whether the bond purchase program is legal before it can rule on the constitutionality of the ESM rescue fund.

The Constitutional Court held an emergency session on Monday to decide whether to delay its planned ruling today in the face of Gauweiler’s latest challenge.

Gauweiler and the other groups argue that the ESM — the EU’s permanent 500 billion euro (US$630-billion) rescue fund — and the fiscal pact are incompatible with Germany’s Grundgesetz, or Basic Law, because they are effectively forcing Germany to surrender its budgetary sovereignty without the necessary democratic backing.

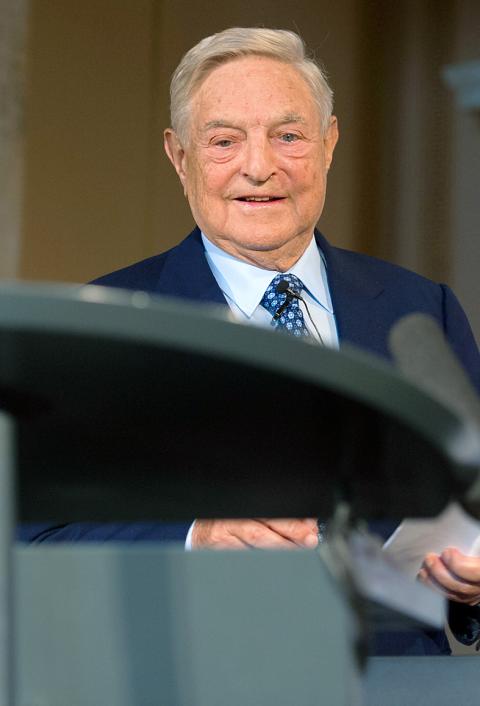

Meanwhile, billionaire financier George Soros said on Monday that the eurozone was edging ever closer to a solution to its debt crisis.

Speaking in Berlin at an event organized by the Institute for Media and Communications Policy, Soros said: “I am happy to note that the political debate in Germany has shifted in favor of saving the euro.”

He was referring to the EU summit in June, where leaders agreed to allow the eurozone bailout fund to help stricken banks, and the European Central Bank’s decision last week to buy the bonds of debt-wracked countries.

“Both were made possible by the support of Chancellor Angela Merkel,” Soros said.

In an essay appearing in several publications over the weekend, the 82-year-old suggested that Germany should either accept its role as de facto leader of the eurozone or leave the bloc altogether.

If Germany left the euro, the value of the currency shared by the rest of the bloc would depreciate sharply, Soros said, making their exports more attractive and slowly becoming more competitive.

“Europe would escape from the looming depression,” he said.

Soros added that today’s decision by Germany’s Constitutional Court on the legality of the ESM bailout fund and the EU’s fiscal pact for greater budget discipline might prevent the German leadership role he recommends.

“In that case, Germany would have to hold a referendum to decide whether to lead or leave,” he said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.