Platinum prices spiked this week as deadly violence costing the lives of 34 people struck a platinum mine in South Africa.

Oil prices hit three-month highs on a number of factors, including positive US economic data and growing hopes of fresh economic stimulus by global central banks.

PRECIOUS METALS: Platinum prices hit the highest level since early last month, at US$1,462.50 an ounce, owing to the violence at a platinum mine in South Africa run by London-listed miner Lonmin. The metal’s price has risen about 4 percent since Thursday.

South African police on Friday said they fired only in self-defense in a clash with striking mineworkers, in which 34 people died. The workers at the Marikana mine were on a weeklong wildcat strike demanding a tripling of their wages from the current 4,000 rand (US$486) a month.

Gold prices, meanwhile, fell after an industry body said global demand for the precious metal had fallen to its lowest level in two years on weaker buying in main markets India and China, despite rising demand from central banks.

Worldwide demand fell 7 percent year-on-year in the second quarter, the World Gold Council said in a report.

By late Friday on the London Bullion Market, gold fell to US$1,614.75 an ounce from US$1,618.50 a week earlier.

Silver climbed to US$28.20 an ounce from US$27.88.

On the London Platinum and Palladium Market, platinum surged to US$1,455 an ounce from US$1,399.

Palladium gained to US$592 an ounce from US$578 an ounce.

OIL: World oil prices hit three-month highs before cooling on Friday on profit-taking.

Crude futures on Thursday reached the highest levels since May on encouraging economic figures in top crude consumer the US, traders said. New York oil hit US$95.69 a barrel and Brent US$117.03. The Brent price was for its September contract which expired at the close of trading on Thursday.

By Friday on London’s Intercontinental Exchange, Brent North Sea crude for delivery in October stood at US$114 a barrel compared with US$111.84 for the September contract a week earlier.

On the New York Mercantile Exchange, West Texas Intermediate (WTI) or light sweet crude for September jumped to US$95.21 a barrel from US$92.30.

BASE METALS: Aluminum hit a near three-year low at US$1827.25 a tonne on Thursday.

By late Friday on the London Metal Exchange, copper for delivery in three months jumped to US$7,537 a tonne from US$7,440 a week earlier.

Three-month aluminum fell to US$1,857 a tonne from US$1,877. Three-month lead dropped to US$1,872 a tonne from US$1,898. Three-month tin rose to US$18,460 a tonne from US$17,785. And three-month nickel grew to US$15,467 a tonne from US$15,305.

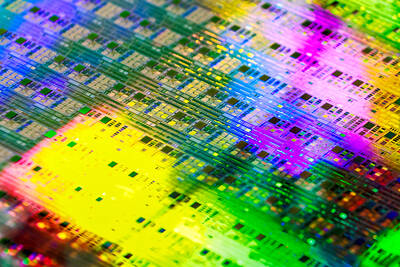

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs