Manchester United has picked the New York Stock Exchange to make its stock market debut, ending months of speculation over where the world’s best-supported soccer club would list.

After first eyeing a Hong Kong initial public offering (IPO), the former English Premier League champions had planned a US$1 billion listing in Singapore in the second half of last year before putting plans on hold because of market turmoil.

The US-owned club filed with the Securities and Exchange Commission on Tuesday to raise up to US$100 million in an IPO of its Class A ordinary shares in New York.

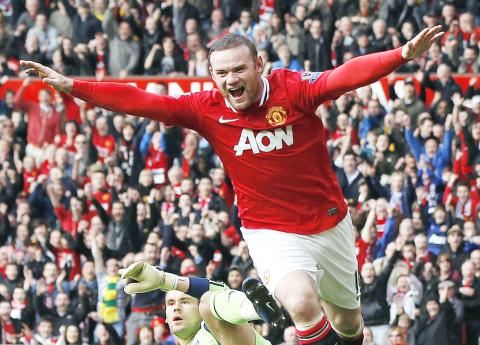

Photo: Reuters

In the US, the amount of money a company says it plans to raise in its first IPO filings is used to calculate registration fees. The final size of the IPO could be different.

The club has been English champions a record 19 times and features players such as England’s Wayne Rooney. The company filing for a much lower amount than the US$1 billion originally expected does not come as much of a surprise, said Josef Schuster, founder of Chicago-based financial services firm IPOX Schuster LLC.

“The smaller the float, the higher the relative valuation can be ... This may just be a strategy initially to make it appear like a low float IPO,” Schuster said. “Traders may believe if the deal is very low, then the company can pop at the opening.”

Manchester United has a global fan base of 659 million, according to a survey commissioned by the club and carried out last year by market researcher Kantar. Almost half of United’s supporters were in the Asia-Pacific region.

“It remains to be seen how much the football [soccer] club is going to benefit in the US where the sport is not very popular ... The perfect place for it to have listed should have been London,” said Jay Ritter, a University of Florida IPO expert.

The club, founded in 1878 as Newton Heath LYR Football Club, plays its home games at Old Trafford in Greater Manchester. The club’s proprietors, the Glazer family, are well known in the US as owners of the US football team the Tampa Bay Buccaneers.

However, they have faced opposition from United fans after taking over the club in 2005 in a leveraged buyout that left it saddled with hefty debt repayments.

The club’s total debt as on March 31 was £423.3 million (US$663.67 million), according to the filing. It intends to use the net proceeds from the offering to repay debt.

United did not reveal how many shares it plans to sell or the expected price.

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Huawei Technologies Co’s (華為) latest smartphones carry a version of the advanced made-in-China processor it revealed last year, results from an independent analysis showed. This underscored the Chinese company’s ability to sustain production of the controversial chip. The Pura 70 series unveiled last week sports the Kirin 9010 processor, research firm TechInsights found during a teardown of the device. This is a newer version of the Kirin 9000s, made by Semiconductor Manufacturing International Corp (SMIC, 中芯) for the Mate 60 Pro, which had alarmed officials in Washington who thought a 7-nanometer chip was beyond China’s capabilities. Huawei has enjoyed a resurgence since

purpose: Tesla’s CEO sought to meet senior Chinese officials to discuss the rollout of its ‘full self-driving’ software in China and approval to transfer data they had collected Tesla Inc CEO Elon Musk arrived in Beijing yesterday on an unannounced visit, where he is expected to meet senior officials to discuss the rollout of "full self-driving" (FSD) software and permission to transfer data overseas, according to a person with knowledge of the matter. Chinese state media reported that he met Premier Li Qiang (李強) in Beijing, during which Li told Musk that Tesla's development in China could be regarded as a successful example of US-China economic and trade cooperation. Musk confirmed his meeting with the premier yesterday with a post on social media platform X. "Honored to meet with Premier Li