In a hot, concrete hut filled with acetylene fumes, an elderly Mongolian miner struggles to contain her excitement as she plucks a sizzling inch-long nugget of gold from a grubby cooling pot and raises it to the light.

Khorloo, 65, and her sons spent the day scrutinizing half a dozen CCTV screens as workers at the Bornuur gold processing plant whittled 1.2 tonnes of ore down to 123g of pure gold that could earn the family as much as US$6,000.

Near the plant, separated from Mongolia’s capital, Ulan Bator, by 100km of rocky pasture and mostly unpaved road, life has remained largely unchanged since Genghis Khan’s “golden horde” rampaged across Asia nine centuries ago.

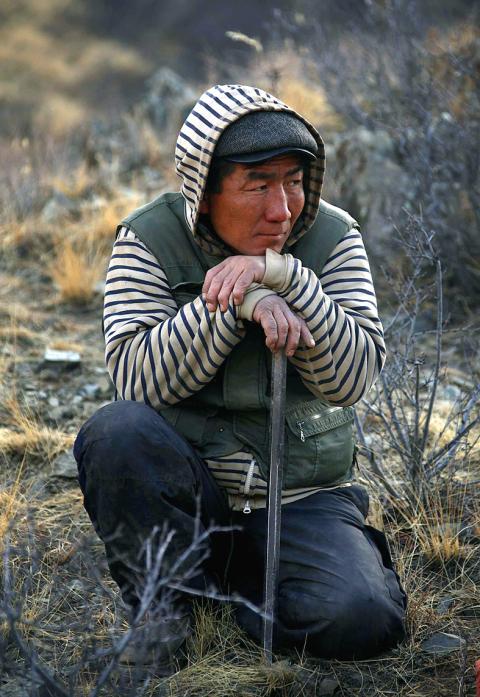

Photo: Reuters

However, Khorloo is a member of a new horde of at least 60,000 herders, farmers and urban unemployed trying to extract the riches buried in the vast steppe with metal detectors, shovels and home-made smelters.

GREEN PANS

In the past five years, dwindling legal gold supplies and a spike in black market demand from China have made work much more lucrative for Mongolia’s “ninja miners” — so named because of the large green pans carried on their backs that look like turtle shells. For thousands of dirt-poor herders, the soaring prices alone are enough to justify years of harassment, abuse and hard labor.

“It took us a week to dig this out,” Khorloo said, holding the nugget. “But we dug for three years to reach the vein.”

China’s annual gold output reached a record 361 tonnes last year, but demand continues to outstrip supply. While Beijing doesn’t publish full import figures, deliveries from Hong Kong hit 428 tonnes last year, three times more than a year earlier.

Spot international gold prices hit a record high of US$1,920.30 an ounce in September, as investors bought the metal as a safe haven amid uncertainties surrounding the eurozone and its debt. The price has fallen back to about US$1,636, but gold remains at historically high levels after a decade-long rally.

China has certainly driven the gold rush in Mongolia — from the giant $6 billion Oyu Tolgoi copper-gold project currently being developed by Ivanhoe Mines and Rio Tinto to the makeshift holes that honeycomb the hills and valleys of Bornuur.

While the government in Ulan Bator hopes to use growing mineral output to drag its largely pastoral economy into the 21st century, many lawmakers are wary about turning Mongolia into “Minegolia” — a choking, resource-dependent blackspot tearing itself apart to deliver raw materials to China.

However, policies aimed at cutting output to more sustainable levels have played into the hands of the ninjas and a shadowy network of black market traders.

Two decades of ninja activity have already nurtured scores of middlemen linking the underpopulated steppe with the Chinese market. And it hasn’t been difficult to encourage Mongolia’s struggling crop farmers and once-nomadic herders to supply them.

‘CHANGERS’

One English word appears regularly in the ninjas’ Mongolian: The “changers” are a motley group of smugglers who trade black market gold, much of which ends up in China.

“The changers smuggle it to China — the miners do all the work, but those who buy the gold make the money,” said Urantsetseg, one of the many female miners in Zamaar, a gold-producing district south of Ulan Bator.

While all producers are legally obliged to sell their gold to the central bank, the black market is often a better option. Changers can offer prices above the official rate, and they can also avoid the 10 percent tax on sales.

“[Workers] are requested to sell everything to the bank, but they are not really ordered to do so,” said Erdenechimeg Belhkuu, an accountant at Bornuur.

“Some of the supply that goes through our plant is bought officially, but some goes on to the black market, which sometimes just offers higher prices,” the accountant said.

Mongolia’s overall trading volume with China has soared in recent years, primarily in bulk shipments like coal and copper. Mining company officials in Ulan Bator said it was easy — and virtually untraceable — to smuggle a few ounces of gold in one of the thousands of coal trucks heading south.

“For buyers, gold is gold,” said Patience Singo of the Sustainable Artisanal Mining Project run by the Swiss Agency for Development and Cooperation (SDC), which is trying to help the ninjas clean up their production methods and get organized.

Since Mongolia abandoned Soviet-style economic planning in 1990, gold miners large and small have scoured the countryside in search of profit, damaging water supplies with untreated mercury and leaving dunes of toxic tailings in their wake.

ENVIRONMENT

Parliament eventually sought to address Mongolia’s laissez-faire mineral laws, enacting new rules in 2009 that banned mining near rivers and forests and revoking or suspending hundreds of licences. Official gold output fell from a record 21.9 tonnes in 2005 to just more than six tonnes in 2010.

However, the reduction in official supplies has driven up prices, providing incentives for the ninjas to dig away despite growing restrictions on land use. Data is hard to come by, but ninjas continue to supply at least 7 tonnes a year, according to non-governmental organizations.

“The policies have — pardon the pun — driven mining underground,” an executive at a foreign mining firm with interests in Mongolia said.

“You can ban mining and try to protect the environment, but the ninjas don’t listen. I think the only way you can deal with them is by decriminalizing and organizing them, but whether this government is capable of that is another matter,” the executive said.

Mining firms and ninjas forged an uneasy, but often symbiotic relationship. The companies had to defend themselves against raids from ninja crews, sometimes using brute force, but they would also track ninja activity for new discoveries.

Ninjas for their part would gather in their thousands around established mining sites like Zaamar, home at its peak to more than 40 large-scale mining companies.

“In 2007, about 10,000 ninjas came to Zaamar and their situation was like hell, but the government launched a campaign to chase them back to their own areas. Now we have fewer people, but still they come,” Zaamar Governor Bolormaa Dorj said.

Since the crackdown on large-scale mining, Mongolia’s ninjas are now returning to old and abandoned properties and have even started ransacking tailings dams for gold.

Tsetsgee Munkhbayar, an environmental activist who has fired arrows at Mongolia’s parliamentary buildings and attacked mining concessions in protest at the government’s mining policies, said scores of abandoned mines had allowed the ninjas to thrive.

“The ninjas emerged in empty holes excavated by mining companies that ran away without rehabilitating the land — if we can’t deal with the mining companies, we can’t deal with the ninjas,” he said.

purpose: Tesla’s CEO sought to meet senior Chinese officials to discuss the rollout of its ‘full self-driving’ software in China and approval to transfer data they had collected Tesla Inc CEO Elon Musk arrived in Beijing yesterday on an unannounced visit, where he is expected to meet senior officials to discuss the rollout of "full self-driving" (FSD) software and permission to transfer data overseas, according to a person with knowledge of the matter. Chinese state media reported that he met Premier Li Qiang (李強) in Beijing, during which Li told Musk that Tesla's development in China could be regarded as a successful example of US-China economic and trade cooperation. Musk confirmed his meeting with the premier yesterday with a post on social media platform X. "Honored to meet with Premier Li

Dutch brewing company Heineken NV on Friday announced an investment of NT$13.5 billion (US$414.62 million) over the next five years in Taiwan. The first multinational brewing company to operate in Taiwan, Heineken made the statement at a ceremony held at its brewery in Pingtung County. It also outlined its efforts to make the brewery “net zero” by 2030. Heineken has been in the Taiwanese market for 20 years, Heineken Taiwan managing director Jeff Wu (吳建甫) said. With strong support from local consumers, the Dutch brewery decided to transition from sales to manufacturing in the country, Wu said. Heineken assumed majority ownership and management rights

ARTIFICIAL INTELLIGENCE: The chipmaker last month raised its capital spending by 28 percent for this year to NT$32 billion from a previous estimate of NT$25 billion Contract chipmaker Powerchip Semiconductor Manufacturing Corp (力積電子) yesterday launched a new 12-inch fab, tapping into advanced chip-on-wafer-on-substrate (CoWoS) packaging technology to support rising demand for artificial intelligence (AI) devices. Powerchip is to offer interposers, one of three parts in CoWoS packaging technology, with shipments scheduled for the second half of this year, Powerchip chairman Frank Huang (黃崇仁) told reporters on the sidelines of a fab inauguration ceremony in the Tongluo Science Park (銅鑼科學園區) in Miaoli County yesterday. “We are working with customers to supply CoWoS-related business, utilizing part of this new fab’s capacity,” Huang said, adding that Powerchip intended to bridge

coverage expansion: The industrial PC maker has proposed to acquire 3.938 million Aures shares to strengthen its global smart retail presence Leading industrial PC maker Advantech Co (研華) plans to acquire Aures Technologies SA, a French company known for its point-of-sale (POS) and kiosk equipment, to expand its global coverage in smart retail products and services. Advantech proposed to acquire 3.938 million Aures shares from the French firm’s major shareholder and through a public tender offer at up to 6.7 euros per share, the PC maker said in a statement after announcing the deal at the Taiwan Stock Exchange late on Friday. The company aims to acquire up to 100 percent equity of Aures, a well-known brand in the western market with a