Solar energy may finally get its day in the sun. The high costs that for years made it impractical as a mainstream source of energy are plummeting. Real-estate companies are racing to install solar panels on office buildings, utilities are erecting large solar panel “farms” near big cities and in desolate deserts and creative financing plans are making solar more realistic than ever for homes.

Solar power installations doubled in the US last year and are expected to double again this year. More solar energy is being planned than any other power source, including nuclear, coal, natural gas and wind.

“We are at the beginning of a turning point,” says Andrew Beebe, who runs global sales for Suntech Power Holdings Co (尚德), a manufacturer of solar panels.

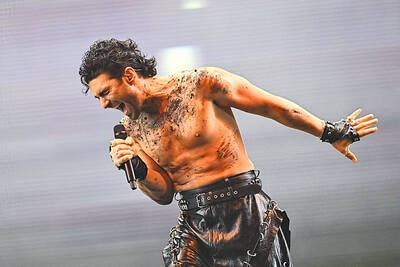

Photo: Reuters

Solar’s share of the power business remains tiny, but its promise is great. The sun splashes more clean energy on the planet in one hour than humans use in a year, and daytime is when power is needed most. Moreover, solar panels can be installed near where people use power, reducing or eliminating the costs of moving power through a grid.

Solar power has been held back by costs. It’s still about three times more expensive than electricity produced by natural gas, according to estimates by the US Energy Information Administration.

However, the financial barriers are falling fast. Solar panel prices have plunged by two-thirds since 2008, making it easier for installers to market solar’s financial benefits and not simply its environmental ones. Homeowners who want to go solar can do so for free and pay the same or less for their power.

Last month, two of the nation’s biggest utilities, Exelon Corp and NextEra Energy Inc, each acquired a large California solar power farm in the early stages of development. Another utility, NRG Energy Inc, has announced a plan with Bank of America and the real estate firm Prologis Inc to spend US$1.4 billion to install solar systems on 750 commercial rooftops.

Nationwide, solar power installations grew by 102 percent from 2009 to last year, by far the fastest rate in the past five years.

Making solar affordable still requires large tax breaks and other subsidies from federal and state governments. The main federal subsidy pays for 30 percent of the cost of a residential system. When state and other subsidies are added, as much as 75 percent of the cost can be covered.

However, prices of solar panels, the squares of crystalline silicon or thin layers of metal films that turn the sun’s rays into electricity, are falling so fast that its advocates now credibly claim that solar will be able to compete with fossil fuels even when the federal solar subsidy shrinks by two-thirds in 2016.

The falling prices have made it easier for solar installers to raise the money needed to grow. And they’ve made solar power systems so affordable they can appeal to homeowners who want to save on their electric bill, not just reduce their environmental impact.

Some installers are teaming up with big hardware chains Home Depot and Lowe’s in an effort to expose solar to customers who might not otherwise consider it.

Solar panel prices have been declining for years because of lower costs for polycrystalline silicon, the main raw material for most solar panels, and larger-scale manufacturing, especially in Asia. In the last six months, demand has dropped sharply in Germany, the world’s biggest solar market, in response to shrinking subsidies. This has created a global glut of solar panels and accelerated the decline in prices.

Solar panels, which are priced based on the amount of power they can produce during full sunshine, sold for US$1.34 per watt in the middle of last month, according to data from Bloomberg New Energy Finance. That’s down from US$1.90 at the beginning of last year. In 2008, they sold for US$4 a watt.

The glut has been gut-wrenching for companies that make solar panels. Many of them remain profitable and are growing, but three US panel makers have filed for bankruptcy in two months, including Solyndra, a solar panel maker that received a US$528 million federal loan.

Falling profit margins are scaring investors. The stock price of First Solar Inc has fallen from US$170 in April to US$53.77. Suntech has fallen from US$11 to US$2.07 over the same period.

The Solyndra bankruptcy has sparked a political uproar. Republicans have accused US President Barack Obama’s administration of pushing for Solyndra’s loan for political reasons and have used the bankruptcy to question Obama’s plan to help boost the economy by subsidizing clean energy projects.

The market will not get any easier for small solar panel makers. General Electric Co, Samsung Electronics Co and other big companies are entering the market.

However, what has been treacherous for solar panel makers has been a boon for companies that market and install solar systems, for companies that make electronics and other parts for solar systems, and for solar customers.

To be sure, solar is growing from a very small base. All of the panels now installed across the nation produce enough electricity to power 600,000 homes, or about as much electricity as one large coal-fired power plant.

There are 30,000 megawatts worth of solar projects awaiting approval in the US, according to the American Public Power Association. Not all of them will be built, either because of regulatory or financial hurdles. However, even if only half that is ultimately built, it would be five times what is already installed.

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary