The improved relationship across the Taiwan Strait since President Ma Ying-jeou (馬英九) took office last May has drawn capital inflows into the local bourse that market watchers said symbolize the return of retail investors at the expense of foreign investors.

“Flush with their inward cash remittances, retail investors have returned to the market aggressively, explaining why it has rallied so strongly this year with little foreign institutional participation,” Peter Kurz, head of Taiwan equity research at Citigroup Global Markets Inc, said in a report on Friday.

Based on Citigroup’s tallies, retail investors accounted for 94 percent of local stock market turnover 10 years ago. The figure dropped to 65 percent at the end of last year and has climbed back to 80 percent.

The benchmark TAIEX has risen 40.8 percent this year but it was still 17.3 percent lower than a year earlier because of the global financial crisis, Taiwan Stock Exchange data showed.

Even so, the worldwide credit crunch has tipped major economies into recession and undercut equity returns in their markets, which Kurz said would induce more capital repatriation from Taiwanese citizens to supplement the weakened foreign institutional investors balking at rising valuations of Taiwanese shares.

“Capital repatriation may be sufficient to reverse the 10 years of Taiwan’s stock market underperformance,” he said in the report.

Citigroup estimated that Taiwanese still own about US$500 billion in offshore capital holdings.

Historically, retail investors have a tendency to bid up the so-called small-capitalization companies with high volatility — even though retail investors could not generate enough daily turnover to absorb shares dumped by institutional investors en masse.

But Citigroup has found an interesting tendency in the past few months that could imply a likely market trend: investors’ interest in small capitalization stocks are back, despite concerns that weak corporate earnings could keep further gains in check.

“The small caps beat out the big caps in 16 out of 22 sectors” based on Citigroup’s own market categorization, Kurz said in the report.

That includes small-cap stocks in the semiconductor, computer hardware, financials, materials and domestic demand sectors.

Using the small-cap foundry stocks as an example, they have increased 78 percent since the beginning of the year, outperforming a 20 percent rise on their big-cap counterparts over the same period, the report showed. Small caps in the flat-panel display sector have also witnessed a 102 percent rise in share prices so far this year, compared with an increase of 36 percent in their big rivals at the same time, the report said.

But in the telecommunications, notebook computers and transportation sectors, they are still dominated by the big caps, while MediaTek Inc (聯發科), Hon Hai Precision Industry Co (鴻海精密) and Epistar Corp (晶元光電) remain the most favored in their prospective sectors, the report said.

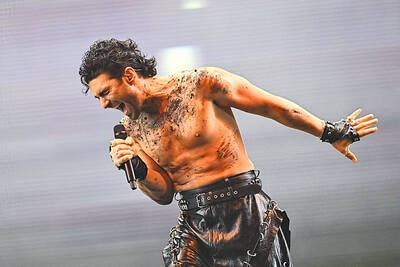

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

Nvidia Corp CEO Jensen Huang (黃仁勳) today announced that his company has selected "Beitou Shilin" in Taipei for its new Taiwan office, called Nvidia Constellation, putting an end to months of speculation. Industry sources have said that the tech giant has been eyeing the Beitou Shilin Science Park as the site of its new overseas headquarters, and speculated that the new headquarters would be built on two plots of land designated as "T17" and "T18," which span 3.89 hectares in the park. "I think it's time for us to reveal one of the largest products we've ever built," Huang said near the

China yesterday announced anti-dumping duties as high as 74.9 percent on imports of polyoxymethylene (POM) copolymers, a type of engineering plastic, from Taiwan, the US, the EU and Japan. The Chinese Ministry of Commerce’s findings conclude a probe launched in May last year, shortly after the US sharply increased tariffs on Chinese electric vehicles, computer chips and other imports. POM copolymers can partially replace metals such as copper and zinc, and have various applications, including in auto parts, electronics and medical equipment, the Chinese ministry has said. In January, it said initial investigations had determined that dumping was taking place, and implemented preliminary

Intel Corp yesterday reinforced its determination to strengthen its partnerships with Taiwan’s ecosystem partners including original-electronic-manufacturing (OEM) companies such as Hon Hai Precision Industry Co (鴻海精密) and chipmaker United Microelectronics Corp (UMC, 聯電). “Tonight marks a new beginning. We renew our new partnership with Taiwan ecosystem,” Intel new chief executive officer Tan Lip-bu (陳立武) said at a dinner with representatives from the company’s local partners, celebrating the 40th anniversary of the US chip giant’s presence in Taiwan. Tan took the reins at Intel six weeks ago aiming to reform the chipmaker and revive its past glory. This is the first time Tan