Asian stocks rose, led by financial companies and automakers, after G20 finance ministers vowed to combat the global recession and OPEC refrained from cutting output quotas to bolster economic growth.

Mitsubishi UFJ Financial Group Ltd, Japan’s biggest publicly traded bank, rose 6 percent as corporate bond risk fell following a pledge by G20 officials for coordinated action to clean up banks’ toxic assets. Mazda Motor Corp, Japan’s No. 4 carmaker, jumped 9.8 percent on optimism that production will rebound.

“People in the market have calmed down and started noticing authorities worldwide are doing what they can to revive the global economy and restore the financial system,” said Kiyoshi Ishigane, a strategist at Tokyo-based Mitsubishi UFJ Asset Management Co, which oversees about US$61 billion.

The MSCI Asia Pacific Index rose 1.4 percent to 75.77 as of 1:47pm in Tokyo, with about three stocks gaining for each one that declined. Japan’s Nikkei 225 Stock Average climbed 2 percent to 7,722.41, while Hong Kong’s Hang Seng Index gained 1 percent.

Markets in Asia rose except in South Korea, China, Singapore, Indonesia, Malaysia, Thailand and the Philippines.

Foxconn International Holdings Ltd (富士康), the world’s biggest contract maker of mobile phones, gained 7.7 percent in Hong Kong following a brokerage upgrade.

Futures on the Standard & Poor’s 500 Index fell 0.9 percent. The benchmark gauge rose 0.8 percent on Friday, capping an 11 percent rally for the week, as takeover speculation lifted health care companies.

The MSCI Asia Pacific Index rose 3.9 percent last week, its best performance this year. The gauge is down 16 percent this year, extending last year’s record 43 percent drop as the global recession decimated profits at companies from Mazda to Canon Inc, the world’s top maker of digital cameras.

Estimated earnings for companies included in the benchmark are down 66 percent from a year ago, data compiled by Bloomberg show. Companies on the index trade at an average of 1.1 times book value, near its October record low of 1 times book.

The Bank of Japan is considering buying subordinated debt from banks to shore up capital, the Nikkei Shimbun reported.

The cost of protecting investors in Asian bonds from default fell after the G20’s weekend pledges. The Markit iTraxx Japan index of credit-default swaps dropped 5 basis points, Barclays Capital prices showed. The Markit iTraxx Asia index of 50 investment-grade borrowers outside Japan also lost 5 basis points, ICAP Plc said.

Mazda, partly owned by Ford Motor Co, climbed 9.1 percent to ¥156 (US$1.59). The company will resume full production at two domestic plans in July, the Nikkei Shimbun said on Saturday.

Foxconn gained 7.7 percent to HK$2.66 (US$0.34) in Hong Kong after Macquarie Group raised its rating for the stock to “outperform” from “neutral” because it expects the company to return to profit this year.

HSBC, which is raising US$17.7 billion from a rights offering, rose 1.2 percent to HK$38.70 in Hong Kong.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

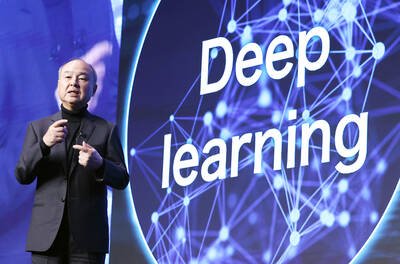

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,