Deep in the red for the first two months of this year, Wall Street enters March with frayed nerves in anticipation of more weak data as investors look for any signs of an end to the horrific economic slump.

With some indexes at 12-year lows, the market remains cautious about the economic outlook, despite reassuring comments in the past week from Federal Reserve chairman Ben Bernanke suggesting the worst crisis in decades could ease this year.

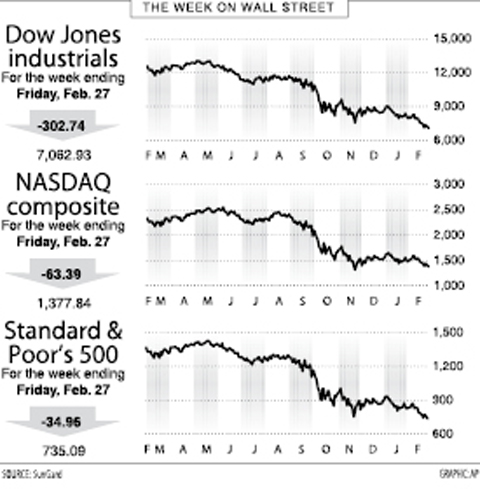

The Dow Jones Industrial Average of 20 blue-chips slid 4.1 percent to end Friday at 7,062.93, its lowest level since 1997.

The broad-market Standard & Poor’s 500 sank to its lowest close since December 1996, losing 4.5 percent to 735.09.

The technology-heavy NASDAQ composite fell 4.4 percent over the week to 1,377.84, near its lows from last November.

With a bear market in full force, the Dow has dropped 19.52 percent so far this year after a slide of more than 11 percent for last month. The S&P is off 18.62 percent in the year and the NASDAQ down 12.63 percent.

Al Goldman at Wachovia Securities acknowledged that he was wrong in suggesting the market had established a low point in November but still held out hope for a rebound soon.

“In hindsight, our timing may have been too optimistic; the bottoming out for the bear could start somewhat lower,” he said. “However, history shows that the economy and the stock market will recover.”

The market got a brief lift early in the week after Bernanke suggested the recession could end this year — but added that this was contingent on a series of rescues and stimulus efforts working as intended.

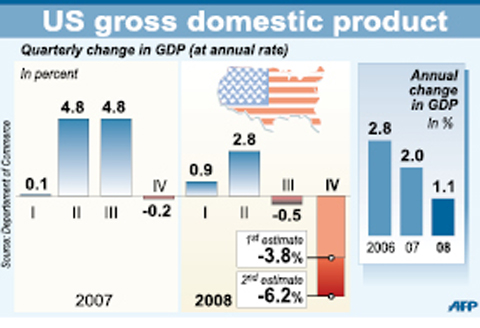

Investors had to cope with more grim economic news including a downward revision showing a stunning 6.2 percent annualized drop in fourth quarter economic activity, highlighting a deepening recession.

A government plan to boost its stake in troubled banking giant Citigroup to as much as 36 percent through a stock conversion also roiled the market and sparked further debate over whether the move was an effective nationalization.

Sal Guatieri at BMO Capital Markets said it was unclear whether this type of action, which could be extended to other banks, would revive them or simply keep them alive as “zombie” banks.

“An ongoing concern is that the toxic assets held by ‘zombie’ banks on government life-support could continue to bleed value from the illiquid assets held by still-healthy banks,” he said.

The coming week could bring more bad news, with last month’s auto sales expected to be weak and a payrolls survey expected to show further massive job losses — perhaps as many as 600,000, according to some analysts.

Yet some analysts say the stock market is “oversold,” having already discounted the worst economic scenario.

When Lika Megreladze was a child, life in her native western Georgian region of Guria revolved around tea. Her mother worked for decades as a scientist at the Soviet Union’s Institute of Tea and Subtropical Crops in the village of Anaseuli, Georgia, perfecting cultivation methods for a Georgian tea industry that supplied the bulk of the vast communist state’s brews. “When I was a child, this was only my mum’s workplace. Only later I realized that it was something big,” she said. Now, the institute lies abandoned. Yellowed papers are strewn around its decaying corridors, and a statue of Soviet founder Vladimir Lenin

UNCERTAINTIES: Exports surged 34.1% and private investment grew 7.03% to outpace expectations in the first half, although US tariffs could stall momentum The Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) yesterday raised its GDP growth forecast to 3.05 percent this year on a robust first-half performance, but warned that US tariff threats and external uncertainty could stall momentum in the second half of the year. “The first half proved exceptionally strong, allowing room for optimism,” CIER president Lien Hsien-ming (連賢明) said. “But the growth momentum may slow moving forward due to US tariffs.” The tariff threat poses definite downside risks, although the scale of the impact remains unclear given the unpredictability of US President Donald Trump’s policies, Lien said. Despite the headwinds, Taiwan is likely

UNIFYING OPPOSITION: Numerous companies have registered complaints over the potential levies, bringing together rival automakers in voicing their reservations US President Donald Trump is readying plans for industry-specific tariffs to kick in alongside his country-by-country duties in two weeks, ramping up his push to reshape the US’ standing in the global trading system by penalizing purchases from abroad. Administration officials could release details of Trump’s planned 50 percent duty on copper in the days before they are set to take effect on Friday next week, a person familiar with the matter said. That is the same date Trump’s “reciprocal” levies on products from more than 100 nations are slated to begin. Trump on Tuesday said that he is likely to impose tariffs

HELPING HAND: Approving the sale of H20s could give China the edge it needs to capture market share and become the global standard, a US representative said The US President Donald Trump administration’s decision allowing Nvidia Corp to resume shipments of its H20 artificial intelligence (AI) chips to China risks bolstering Beijing’s military capabilities and expanding its capacity to compete with the US, the head of the US House Select Committee on Strategic Competition Between the United States and the Chinese Communist Party said. “The H20, which is a cost-effective and powerful AI inference chip, far surpasses China’s indigenous capability and would therefore provide a substantial increase to China’s AI development,” committee chairman John Moolenaar, a Michigan Republican, said on Friday in a letter to US Secretary of