Hong Kong Disneyland will celebrate its birthday on Friday after three difficult years, as its new managing director juggles a grab for Chinese visitors with a battle over how to fund expansion.

The theme park has struggled to attract enough visitors since it opened to great fanfare in 2005, and has faced criticism it failed to understand both the local and Chinese markets.

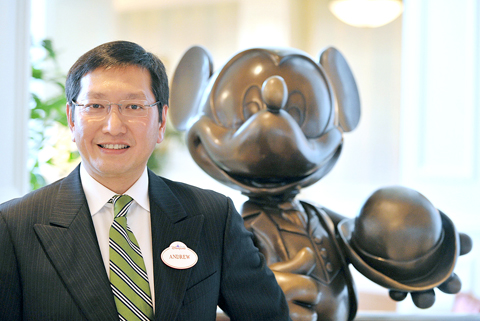

But a shift to more Chinese-friendly marketing earlier this year was reinforced by the appointment of managing director Andrew Kam (金民豪), whose career has been spent selling another US icon, Coca-Cola, to China.

PHOTO: AFP

“I have yet to go into the details of the plan we will set for next year, but it will be fairly aggressive in terms of [visitor] growth,” Kam told a small group of reporters last week just two days after starting his job.

“We are going to invest more resources in developing these markets ... China is probably the single largest market outside Hong Kong for us — we are looking for expansion there,” he said.

Kam said Disneyland would be employing more staff to market the park in China and build better relationships with travel agents. He is also hoping the Chinese and Hong Kong governments will agree a special visa scheme for visitors from Guangdong Province.

But cooperation with the local government, which owns 57 percent of the park, has been strained.

Legislators have criticized the US$3 billion park for being a bad deal for taxpayers who paid the vast majority of the start-up costs.

And they have balked at further investment when more pressing concerns, such as inflation, are vexing residents.

“Disney has a huge credibility gap ... They got too good an original deal,” said John Ap, a specialist on tourism at Hong Kong’s Polytechnic University.

Kam insists new attractions are necessary, but there is no sign 18 months of funding negotiations will end soon.

“[Both shareholders] have an interest in making this park work and expansion is part of the strategy,” he said.

The biggest question mark remains attendance figures.

The management has repeatedly refused to confirm figures despite the huge public investment, but a recent newspaper report said visitor numbers were expected to hit 5.6 million in the third year.

WEAKER ACTIVITY: The sharpest deterioration was seen in the electronics and optical components sector, with the production index falling 13.2 points to 44.5 Taiwan’s manufacturing sector last month contracted for a second consecutive month, with the purchasing managers’ index (PMI) slipping to 48, reflecting ongoing caution over trade uncertainties, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. The decline reflects growing caution among companies amid uncertainty surrounding US tariffs, semiconductor duties and automotive import levies, and it is also likely linked to fading front-loading activity, CIER president Lien Hsien-ming (連賢明) said. “Some clients have started shifting orders to Southeast Asian countries where tariff regimes are already clear,” Lien told a news conference. Firms across the supply chain are also lowering stock levels to mitigate

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

Six Taiwanese companies, including contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), made the 2025 Fortune Global 500 list of the world’s largest firms by revenue. In a report published by New York-based Fortune magazine on Tuesday, Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), ranked highest among Taiwanese firms, placing 28th with revenue of US$213.69 billion. Up 60 spots from last year, TSMC rose to No. 126 with US$90.16 billion in revenue, followed by Quanta Computer Inc (廣達) at 348th, Pegatron Corp (和碩) at 461st, CPC Corp, Taiwan (台灣中油) at 494th and Wistron Corp (緯創) at

NEGOTIATIONS: Semiconductors play an outsized role in Taiwan’s industrial and economic development and are a major driver of the Taiwan-US trade imbalance With US President Donald Trump threatening to impose tariffs on semiconductors, Taiwan is expected to face a significant challenge, as information and communications technology (ICT) products account for more than 70 percent of its exports to the US, Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) president Lien Hsien-ming (連賢明) said on Friday. Compared with other countries, semiconductors play a disproportionately large role in Taiwan’s industrial and economic development, Lien said. As the sixth-largest contributor to the US trade deficit, Taiwan recorded a US$73.9 billion trade surplus with the US last year — up from US$47.8 billion in 2023 — driven by strong