Emerging economies such as China and India are growing faster than the rest of the world, but still lack the firepower to offset weaker growth in the US and the EU, Fitch Ratings said yesterday.

The main emerging markets commonly known as BRIC — Brazil, Russia, India, and China — remain very dependent on exports to the industrialized economies with a combined trade surplus of US$500 billion, said James McCormack, head of sovereign ratings in Asia for Fitch.

“The trade flows do not support the emerging markets contributing to offset a recession in the US and weakness elsewhere,” McCormack said at a Fitch conference in Singapore.

Many economists say the US, the world’s largest economy, is effectively in recession.

Some analysts have seen the rapid economic expansion in India and China as reasons for optimism even if the US and other advanced economies weaken.

But Fitch Ratings argues otherwise.

“They [BRIC economies] are running very large combined trade surpluses in the order of US$500 billion ... so if there’s weakness in the advanced economies, you are going to see weakness in the emerging markets,” McCormack said.

“The trade flows are going the other way, so the conclusion that we reached is that strong growth in the emerging markets is not really going to help offset weakness in the advanced economies,” he said.

India and China still account for a relatively small portion of global imports, which means their economies’ influence on global growth is limited, the US ratings agency said.

India only accounts for 2 percent of the world’s GDP, McCormack said.

“So in some sense, it doesn’t matter how fast India grows and it’s not a very open economy,” he said.

IN THE AIR: While most companies said they were committed to North American operations, some added that production and costs would depend on the outcome of a US trade probe Leading local contract electronics makers Wistron Corp (緯創), Quanta Computer Inc (廣達), Inventec Corp (英業達) and Compal Electronics Inc (仁寶) are to maintain their North American expansion plans, despite Washington’s 20 percent tariff on Taiwanese goods. Wistron said it has long maintained a presence in the US, while distributing production across Taiwan, North America, Southeast Asia and Europe. The company is in talks with customers to align capacity with their site preferences, a company official told the Taipei Times by telephone on Friday. The company is still in talks with clients over who would bear the tariff costs, with the outcome pending further

A proposed 100 percent tariff on chip imports announced by US President Donald Trump could shift more of Taiwan’s semiconductor production overseas, a Taiwan Institute of Economic Research (TIER) researcher said yesterday. Trump’s tariff policy will accelerate the global semiconductor industry’s pace to establish roots in the US, leading to higher supply chain costs and ultimately raising prices of consumer electronics and creating uncertainty for future market demand, Arisa Liu (劉佩真) at the institute’s Taiwan Industry Economics Database said in a telephone interview. Trump’s move signals his intention to "restore the glory of the US semiconductor industry," Liu noted, saying that

STILL UNCLEAR: Several aspects of the policy still need to be clarified, such as whether the exemptions would expand to related products, PwC Taiwan warned The TAIEX surged yesterday, led by gains in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), after US President Donald Trump announced a sweeping 100 percent tariff on imported semiconductors — while exempting companies operating or building plants in the US, which includes TSMC. The benchmark index jumped 556.41 points, or 2.37 percent, to close at 24,003.77, breaching the 24,000-point level and hitting its highest close this year, Taiwan Stock Exchange (TWSE) data showed. TSMC rose NT$55, or 4.89 percent, to close at a record NT$1,180, as the company is already investing heavily in a multibillion-dollar plant in Arizona that led investors to assume

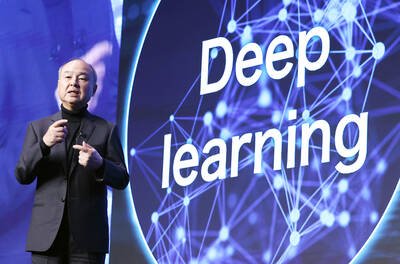

AI: Softbank’s stake increases in Nvidia and TSMC reflect Masayoshi Son’s effort to gain a foothold in key nodes of the AI value chain, from chip design to data infrastructure Softbank Group Corp is building up stakes in Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the latest reflection of founder Masayoshi Son’s focus on the tools and hardware underpinning artificial intelligence (AI). The Japanese technology investor raised its stake in Nvidia to about US$3 billion by the end of March, up from US$1 billion in the prior quarter, regulatory filings showed. It bought about US$330 million worth of TSMC shares and US$170 million in Oracle Corp, they showed. Softbank’s signature Vision Fund has also monetized almost US$2 billion of public and private assets in the first half of this year,