The Ministry of Finance yesterday announced that it will levy an anti-dumping tax of 43.46 percent on footwear imported from China, retroactive to March 16 when the ministry started slapping provisional anti-dumping duties on the products.

The finance ministry's announcement came after the economic affairs ministry's International Trade Commission ruled on June 29 that imported Chinese footware was substantially damaging the domestic industry.

The finance ministry's ruling applies to six categories, including men's footwear, high heels, boots, children's shoes, sandals and informal footwear. It does not include sports shoes and flip flops, a press statement said yesterday.

The anti-dumping tax will be imposed for five years until March 15, 2012, the ministry said.

Local footwear manufacturers filed a complaint with the government last August, saying that low-priced Chinese shoe imports had substantially damaged the domestic industry, which prompted the two ministries to launch investigations in October.

An integrated report released by the economic affairs ministry last month showed that imposing anti-dumping taxes on the Chinese imports would not have a negative impact on the nation's economy, which led to the decision announced yesterday.

This is the second time Taiwan has initiated an anti-dumping action against China since the countries joined the WTO in 2002.

On June 1 last year, the finance ministry levied a 204.1 percent anti-dumping tax on Chinese towels for five years.

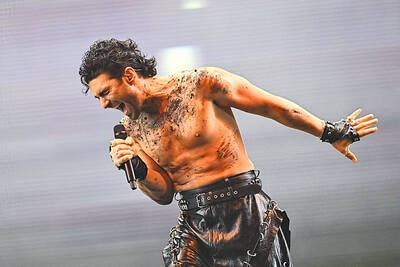

The Eurovision Song Contest has seen a surge in punter interest at the bookmakers, becoming a major betting event, experts said ahead of last night’s giant glamfest in Basel. “Eurovision has quietly become one of the biggest betting events of the year,” said Tomi Huttunen, senior manager of the Online Computer Finland (OCS) betting and casino platform. Betting sites have long been used to gauge which way voters might be leaning ahead of the world’s biggest televised live music event. However, bookmakers highlight a huge increase in engagement in recent years — and this year in particular. “We’ve already passed 2023’s total activity and

BIG BUCKS: Chairman Wei is expected to receive NT$34.12 million on a proposed NT$5 cash dividend plan, while the National Development Fund would get NT$8.27 billion Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, yesterday announced that its board of directors approved US$15.25 billion in capital appropriations for long-term expansion to meet growing demand. The funds are to be used for installing advanced technology and packaging capacity, expanding mature and specialty technology, and constructing fabs with facility systems, TSMC said in a statement. The board also approved a proposal to distribute a NT$5 cash dividend per share, based on first-quarter earnings per share of NT$13.94, it said. That surpasses the NT$4.50 dividend for the fourth quarter of last year. TSMC has said that while it is eager

‘IMMENSE SWAY’: The top 50 companies, based on market cap, shape everything from technology to consumer trends, advisory firm Visual Capitalist said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) was ranked the 10th-most valuable company globally this year, market information advisory firm Visual Capitalist said. TSMC sat on a market cap of about US$915 billion as of Monday last week, making it the 10th-most valuable company in the world and No. 1 in Asia, the publisher said in its “50 Most Valuable Companies in the World” list. Visual Capitalist described TSMC as the world’s largest dedicated semiconductor foundry operator that rolls out chips for major tech names such as US consumer electronics brand Apple Inc, and artificial intelligence (AI) chip designers Nvidia Corp and Advanced

Pegatron Corp (和碩), an iPhone assembler for Apple Inc, is to spend NT$5.64 billion (US$186.82 million) to acquire HTC Corp’s (宏達電) factories in Taoyuan and invest NT$578.57 million in its India subsidiary to expand manufacturing capacity, after its board approved the plans on Wednesday. The Taoyuan factories would expand production of consumer electronics, and communication and computing devices, while the India investment would boost production of communications devices and possibly automotive electronics later, a Pegatron official told the Taipei Times by telephone yesterday. Pegatron expects to complete the Taoyuan factory transaction in the third quarter, said the official, who declined to be