Chi Mei Optoelectronics Corp (奇美電子), the nation's second-largest maker of flat panels for computers and TVs, posted its first quarterly earnings in the past three quarters as a price decline slowed on falling inventory.

Chi Mei expects inventory to shrink to a healthy level in the first quarter due to reduced output, which may trigger an early price hike for liquid-crystal-display (LCD) computer panels in the middle of next quarter.

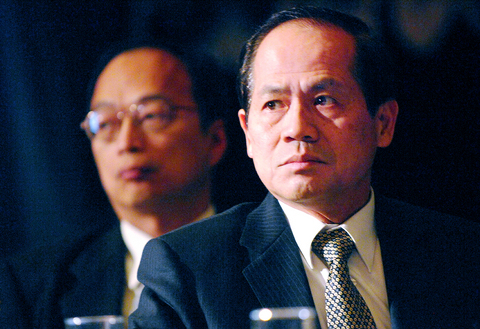

"The business will hit the bottom in the second quarter and start to pick up in the third quarter ? The downturn will be more moderate this time," Chi Mei president Ho Jau-yang (

PHOTO: AFP

"We will not rule out the possibility of a shortage [of panels] in the fourth quarter," Ho said.

QUARTERLY RESULTS

During the fourth quarter of last year, Chi Mei eked out NT$436 million (US$13.22 million), or NT$0.05 per share, ending two straight quarterly losses since the second quarter last year, according to a company statement.

This represented a 95 percent decline from NT$8.34 billion, or NT$1.71 a share, a year earlier.

Drastic price correction has driven bigger rival LG Philips LCD Co, based in Seoul, into its third quarterly loss in a row last quarter at US$187 million in losses.

Average selling price (ASP) plunged 23 percent year on year to US$169 per unit in the final quarter of last year, but rose by 8 percent on quarterly basis, Chi Mei said.

Chi Mei expects blended ASP to drop by 3 percent to 5 percent at a quarterly rate in the first three months on seasonal factors, Ho said.

Panel shipments would fall 15 percent quarter-on-quarter, he said.

ANALYST REACTION

"Chi Mei's gross margin largely matches my expectation, but the increase in operating expense surprises me," said Frank Su (

Gross margin decreased to 10.9 percent last quarter from 24.6 percent a year ago, or a rebound from 4.6 percent last quarter.

Operating expenses, however, jumped 54 percent to NT$4.74 billion from the third quarter.

The one-time spike in operating expense would not be an obstacle on Chi Mei's progress toward a recovery in the second quarter, earlier than the company's forecast in the third quarter, said Su, who gave a "buy" on Chi Mei.

Overall, Ho said "it will be a challenging period this year and yet a high-growth year for Chi Mei."

2007 FORECAST

TV panel shipments should grow 45 percent annually to 13.3 million units this year on fast-growing demand for LCD TVs with bigger screens, Ho said.

Computer panels should increase 30 percent year-on-year to 30 million units, he said.

Chi Mei slightly cut its capital spending for this year to NT$75 billion compared to its earlier estimate of NT$80 billion and the NT$110 billion spent last year.

ISSUES: Gogoro has been struggling with ballooning losses and was recently embroiled in alleged subsidy fraud, using Chinese-made components instead of locally made parts Gogoro Inc (睿能創意), the nation’s biggest electric scooter maker, yesterday said that its chairman and CEO Horace Luke (陸學森) has resigned amid chronic losses and probes into the company’s alleged involvement in subsidy fraud. The board of directors nominated Reuntex Group (潤泰集團) general counsel Tamon Tseng (曾夢達) as the company’s new chairman, Gogoro said in a statement. Ruentex is Gogoro’s biggest stakeholder. Gogoro Taiwan general manager Henry Chiang (姜家煒) is to serve as acting CEO during the interim period, the statement said. Luke’s departure came as a bombshell yesterday. As a company founder, he has played a key role in pushing for the

China has claimed a breakthrough in developing homegrown chipmaking equipment, an important step in overcoming US sanctions designed to thwart Beijing’s semiconductor goals. State-linked organizations are advised to use a new laser-based immersion lithography machine with a resolution of 65 nanometers or better, the Chinese Ministry of Industry and Information Technology (MIIT) said in an announcement this month. Although the note does not specify the supplier, the spec marks a significant step up from the previous most advanced indigenous equipment — developed by Shanghai Micro Electronics Equipment Group Co (SMEE, 上海微電子) — which stood at about 90 nanometers. MIIT’s claimed advances last

EUROPE ON HOLD: Among a flurry of announcements, Intel said it would postpone new factories in Germany and Poland, but remains committed to its US expansion Intel Corp chief executive officer Pat Gelsinger has landed Amazon.com Inc’s Amazon Web Services (AWS) as a customer for the company’s manufacturing business, potentially bringing work to new plants under construction in the US and boosting his efforts to turn around the embattled chipmaker. Intel and AWS are to coinvest in a custom semiconductor for artificial intelligence computing — what is known as a fabric chip — in a “multiyear, multibillion-dollar framework,” Intel said in a statement on Monday. The work would rely on Intel’s 18A process, an advanced chipmaking technology. Intel shares rose more than 8 percent in late trading after the

GLOBAL ECONOMY: Policymakers have a choice of a small 25 basis-point cut or a bold cut of 50 basis points, which would help the labor market, but might reignite inflation The US Federal Reserve is gearing up to announce its first interest rate cut in more than four years on Wednesday, with policymakers expected to debate how big a move to make less than two months before the US presidential election. Senior officials at the US central bank including Fed Chairman Jerome Powell have in recent weeks indicated that a rate cut is coming this month, as inflation eases toward the bank’s long-term target of two percent, and the labor market continues to cool. The Fed, which has a dual mandate from the US Congress to act independently to ensure