State-controlled bank employees are planning to take to the streets and hold a vote on Saturday on joint industrial action in opposition to the government's industrial consolidation plan, the association of bank unions said.

"[The move] is to voice our protest against the second-stage financial reform ... that the government has vowed to push forward," said Han Shih-shian (

Unions of Central Trust of China (

A strike would take place if more than half of the employees at the three banks cast ballots in favor of taking action, he added.

The government has vowed to consolidate the crowded banking sector with the aim of halving the number of state banks to six by year's end and financial holding firms to seven by the end of next year.

But this plan outraged state bank employees and resulted in a four-day strike by employees at the state-run Taiwan Business Bank (

Employees at Central Trust and ICBC oppose mergers before signing collective agreements to secure their rights, while employees at First Financial are resisting being taken over by rivals, Han said.

Central Trust is likely to be put up for sale, while First Financial is rumored to be up for sale to rivals including Cathay Financial Holding Co (國泰金控). ICBC is slated to merge with Chiao Tung Bank (交通銀行) in March next year.

Leading Taiwanese bicycle brands Giant Manufacturing Co (巨大機械) and Merida Industry Co (美利達工業) on Sunday said that they have adopted measures to mitigate the impact of the tariff policies of US President Donald Trump’s administration. The US announced at the beginning of this month that it would impose a 20 percent tariff on imported goods made in Taiwan, effective on Thursday last week. The tariff would be added to other pre-existing most-favored-nation duties and industry-specific trade remedy levy, which would bring the overall tariff on Taiwan-made bicycles to between 25.5 percent and 31 percent. However, Giant did not seem too perturbed by the

Foxconn Technology Co (鴻準精密), a metal casing supplier owned by Hon Hai Precision Industry Co (鴻海精密), yesterday announced plans to invest US$1 billion in the US over the next decade as part of its business transformation strategy. The Apple Inc supplier said in a statement that its board approved the investment on Thursday, as part of a transformation strategy focused on precision mold development, smart manufacturing, robotics and advanced automation. The strategy would have a strong emphasis on artificial intelligence (AI), the company added. The company said it aims to build a flexible, intelligent production ecosystem to boost competitiveness and sustainability. Foxconn

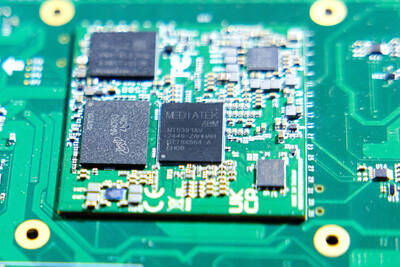

TARIFF CONCERNS: Semiconductor suppliers are tempering expectations for the traditionally strong third quarter, citing US tariff uncertainty and a stronger NT dollar Several Taiwanese semiconductor suppliers are taking a cautious view of the third quarter — typically a peak season for the industry — citing uncertainty over US tariffs and the stronger New Taiwan dollar. Smartphone chip designer MediaTek Inc (聯發科技) said that customers accelerated orders in the first half of the year to avoid potential tariffs threatened by US President Donald Trump’s administration. As a result, it anticipates weaker-than-usual peak-season demand in the third quarter. The US tariff plan, announced on April 2, initially proposed a 32 percent duty on Taiwanese goods. Its implementation was postponed by 90 days to July 9, then

AI SERVER DEMAND: ‘Overall industry demand continues to outpace supply and we are expanding capacity to meet it,’ the company’s chief executive officer said Hon Hai Precision Industry Co (鴻海精密) yesterday reported that net profit last quarter rose 27 percent from the same quarter last year on the back of demand for cloud services and high-performance computing products. Net profit surged to NT$44.36 billion (US$1.48 billion) from NT$35.04 billion a year earlier. On a quarterly basis, net profit grew 5 percent from NT$42.1 billion. Earnings per share expanded to NT$3.19 from NT$2.53 a year earlier and NT$3.03 in the first quarter. However, a sharp appreciation of the New Taiwan dollar since early May has weighed on the company’s performance, Hon Hai chief financial officer David Huang (黃德才)