There is growing anxiety in the recording industry about the future of its fundamental product, the CD, which is threatened with the same obsolescence that it long ago foisted on the LP and then the tape cassette.

Introduced in the US 20 years ago, the CD is losing its allure. From 2001 to 2002, some 62.5 million fewer of them were sold -- a decline of 9 percent to 649.5 million, according to Nielsen SoundScan. Online swapping of songs is growing at a crippling rate, forcing almost every corner of the music industry to try to divine exactly what role, if any, the CD will play in a future dominated by Internet delivery and competition from popular new technologies like the DVD.

Most analysts and industry executives agree that selling music online is the future. But they say it will take at least two years for companies to devise a business plan for it that makes financial sense. In the meantime, the CD will remain the biggest source of revenue for both music retailers and recording companies, who will try to squeeze as much profit as they can out of each and every sale.

PHOTO: NY TIMES

As a result, the CD is being rethought, repackaged and, in some cases, repriced.

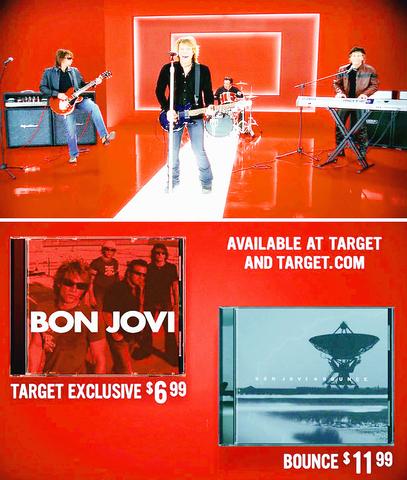

Experiments to resuscitate this ailing product are growing. In January, Bon Jovi created a compact disc, with eight previously unreleased songs, exclusively for Target stores. Priced at US$6.99, it was intended to help bolster sales of other Bon Jovi albums, including the newest, "Bounce."

Best Buy, the No. 1 electronics chain in the country, is selling prepaid cards good for 10 downloads that allow consumers to create compilations to play either on discs or on computers. And last year, the Interscope recording label gave a DVD to the first million buyers of "The Eminem Show" as an incentive to buy the CD.

All this is happening as the economic underpinnings of the CD continue to deteriorate, endangering the music business altogether. With the rising popularity of online music, much of it available free, technology-wise teenagers -- the industry's most voracious buyers -- can easily use CD-burning technology to make bootleg copies and sell them at school for as little as US$1.

Companies are showing signs of cracking. Two industry veterans have recently lost their jobs: Thomas D. Mottola, the head of Sony Music Entertainment, which lost more than US$132 million last year; and Jay Boberg, president of MCA Records. The music retailer Wherehouse Entertainment announced in January that it was filing for bankruptcy protection, partly because of lackluster sales. And the EMI Group, based in London, the only major music company that is not a part of a media conglomerate, is struggling with debt and is believed by analysts to be considering merger prospects.

"Large companies tend to wait until they feel pain to act," said Dan Hart, chief executive of Echo, a recently formed consortium of retailers that hope to sell music online. "Now they feel pain."

Doug Morris, chief executive of the Universal Music Group, said: "We are definitely in the middle of a transition. It was always a packaged-goods business, but that is changing. We are slowly moving forward."

Compact disc sales have slipped for several reasons, not all of them related to piracy or online music swapping. Critics complain that there is a dearth of blockbuster acts these days and that those with hits, like Britney Spears, often have short-lived careers. And with the average price of a compact disc at US$14.21, they contend that music is simply too expensive for frequent purchases.

But Hilary B. Rosen, chief executive of the Recording Industry Association of America, countered that a recent study by the association found that only 3 percent of the consumers polled said they were buying less music because prices were too high.

Still, there is no question that other activities are taking up listeners' time, thanks to the growth of electronic games and multichannel cable and satellite television. Perhaps most threatening is the popularity of the DVD, which emerged in the mid-1990s. By 1999, DVD players had gained mass-market appeal, and they now cost as little as US$50, about the same price as a portable boom box. In some retail stores, DVD sales have surpassed those of CDs.

"The DVD is moving into the bedrooms of the next generation of young kids," said Gary L. Arnold, senior vice president for entertainment at Best Buy, which announced in January that it was closing 107 stores. The next generation of young people has no affinity for the compact disc. For them, he said, "it's about gaming and PlayStation."

Copy-protected format

To thwart online swapping, several music companies, including Sony and Universal, have experimented with copy-protected compact discs, much to the ire of paying consumers, who complain that they cannot listen to some of those discs on their computers. The industry does not use a standard copy-protected format, so consumers do not know what kind of disc they are buying. Fearing a consumer backlash, the industry has slowed down those copy-protection efforts.

Software makers are trying to come up with alternatives that address the needs of both consumers and recording companies. At a recent music conference in Cannes, France, Microsoft said it had developed technology to allow music companies to record two sets of identical songs on a compact disc, one that could be played on a home or car stereo and the other, called second session, that could be copied to a personal computer. The second-session songs would have limitations, perhaps barring consumers from sharing files or copying songs onto another disc.

Recording companies probably placed too much hope on super audio CDs, which are said to have superior sound compared with regular CDs. The technology, introduced two years ago, has not taken off because super audio CDs cost nearly four times as much to buy as regular CDs -- and they require a special machine to experience the full impact.

And super audios, championed by Sony and Philips, are not alone in offering sound quality that surpasses that of the typical CD: A dueling new technology in DVD audio, supported by Panasonic and Pioneer, is setting up a battle reminiscent of the VHS-Betamax video wars.

In the mean time

Until all these new technologies are sorted out, recording companies and retailers are betting on promotions and marketing deals to increase sales. Bruce Kirkland, a member of Bon Jovi's management team, said the album that Bon Jovi put together for Target had also increased sales of the "Bounce" album in its stores. In the first week of the promotion, Target's share of the market for "Bounce" for all retail stores jumped to 26.1 percent from 15.9 percent, he said.

"I think the onus is on the retailers to take care of this because the recording companies always shoot themselves in the foot," Kirkland said.

Arnold of Best Buy said he believed that DVDs could well replace the CD in the future because they play not only music but also video images. In the last 12 months, sales of DVDs have surpassed those of compact discs at Best Buy, he said.

But before they can become a new industry standard, he added, they will have to more adeptly meld music and video.

Music distributors and retailers, battered by the slump in compact disc sales, are embarking on their own efforts to give consumers more and easily accessible music. Last month, six music retailers, including major outlets like Best Buy, Wherehouse and Tower Records, said they would form the Echo consortium to sell music on the Internet through their retail Web sites. As recently as a year ago, that would have been unthinkable, as retailers and music companies were at odds about how best to tackle online distribution.

In another joint effort, Anderson Merchandisers, one of the largest magazine and music distributors in the US, bought technology from Liquid Audio, an online music pioneer that distributes 350,000 songs through retailers, in the hope of exploiting the growth in digital music.

Abnormal behavior

"It has not been the norm that retailers should be the ones helping us rethink our business," said John Esposito, president of US distribution for the Warner Music Group. "But retailers are telling us the current model does not work."

Best Buy has been one of the most active retailers in this regard. It recently began testing a program in 30 stores that allowed consumers to buy a card with a preset value that could be used to buy downloads to a computer or disc. Scott Young, vice president for digital distribution at Best Buy, said the experiment had had limited success and was under review. Hart of Echo said retailers would primarily seek to sell downloads over their Web sites that consumers could call up from their homes. But as well as selling digital downloads, partners of Echo are likely to explore several options, including the use of store kiosks where consumers can make personalized compact discs.

Such a venture, like any in the digital music world, is fraught with risk. In 1999, Sony Music Entertainment tried a similar strategy but consumers did not respond, analysts said.

There are, of course, other problems facing distributors and retailers, most notably acquiring the rights to distribute whole catalogs of music online. The music companies faced that issue early on, when starting their own Web sites. Competing companies declined to offer all their music on both PressPlay, a joint venture of Sony Music and Universal Music, and MusicNet, which was formed by Warner Music, EMI and BMG. It took months for them to begin sharing music, leaving consumers disillusioned and frustrated.

For all of these ventures, companies will still have to grapple with why consumers would pay for music they can easily get free. One major retailer, according to a music executive, has suggested to several recording companies that it might put a cap on the price of any compact disc it sold in its stores. Only a store like Wal-Mart would have the strength the pull that off, he added.

"I think the biggest problem is, the industry doesn't know how to get started and take steps where you get an incremental gain," said Phil Leigh, a digital-media analyst at Raymond James & Associates in Tampa, Florida.

"If compact disc sales continue to drop and there is no increase in online sales, then artists will be mad and your bosses are mad, too. There is an old expression that pioneers are the ones with arrows in their backs. The one thing executives don't get paid for is rocking the boat."

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,