The euro dropped to within US$0.01 of an 11-month low against the US dollar this week as rising yields on Greece’s debt fueled speculation the nation would default, damping investor appetite for the European currency.

The Australian and New Zealand dollars gained as stocks gained for the sixth straight week, spurring investor demand for currencies linked to growth. The euro trimmed its five-day losses on Friday as Europe said it was ready to rescue Greece. Data next week may show a rise in core US consumer prices slowed, dimming chances for an interest-rate increase.

“The market had no confidence in Greece and thought default was imminent,” said Richard Franulovich, a senior currency strategist at Westpac Banking Corp in New York.

The euro dropped 1.5 percent to ¥125.79, from ¥127.75 on April 2, a loss trimmed by a rise of 0.8 percent on Friday. The European currency weakened less than 0.1 percent to US$1.35, compared with US$1.3504 on April 2, after climbing 1 percent on Friday. It reached US$1.3283 on Thursday, less than US$0.01 above the US$1.3268 of May 7 last year.

The US dollar depreciated 1.5 percent, the biggest weekly drop since Feb. 26, to ¥93.18.

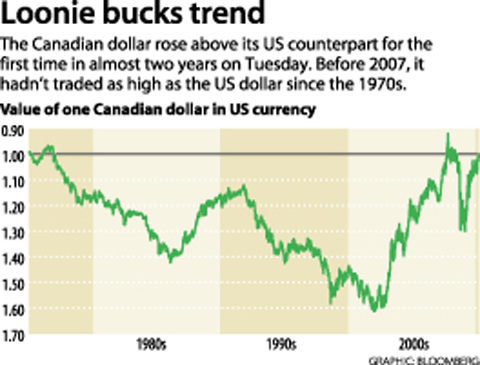

The Canadian dollar strengthened to parity with its US counterpart this week for the first time in 20 months on speculation the nation’s central bank will raise borrowing costs faster than the Federal Reserve.

Canada’s currency, nicknamed the loonie, gained 0.8 percent this week to C$1.0027 per US dollar and strengthened on Wednesday to as much as C$0.9978.

The pound climbed against the dollar for a second straight week. A report showed UK producer prices rose last month faster than economists predicted, adding to signs the recovery is gathering pace. The currency appreciated 1.1 percent to US$1.5370.

Asian currencies extended the year’s gains this week, led by Malaysia’s ringgit and the Indian rupee, on mounting speculation China is moving closer to loosening its grip on the exchange rate.

The New Taiwan dollar rose the most in a month on speculation China will resume gains in the yuan and as international investors plowed more funds into local stocks.

“People are watching the development in the yuan,” said Tarsicio Tong, a currency trader at Union Bank of Taiwan (聯邦銀行) in Taipei. “There’s some hot money coming in.”

The NT dollar appreciated 0.3 percent to NT$31.615 against its US counterpart as of the 4pm close on Friday, according to Taipei Forex Inc. The currency rose 0.5 percent this week.

Tong said the central bank would slow gains in the currency. The NT dollar reached NT$31.534 on Friday, the strongest level since Sept. 8, 2008.

The ringgit strengthened 1.8 percent this week to 3.1900 per US dollar in Kuala Lumpur, according to data compiled by Bloomberg. India’s rupee climbed 1.4 percent to 44.2938 and South Korea’s won appreciated 0.7 percent to 1,118.15.

The Thai baht rose to a 22-month high as speculation the yuan will strengthen helped counter concern that anti-government protests will escalate. The baht strengthened 0.3 percent for the week to 32.25 per US dollar and reached 32.24, the strongest level since May 2008.

Elsewhere, the Singapore dollar increased 0.3 percent in the five days to S$1.3928, the Indonesian rupiah gained 0.5 percent to 9,033 and the Philippine peso advanced 0.5 percent to 44.96.

Authorities have detained three former Taiwan Semiconductor Manufacturing Co (TMSC, 台積電) employees on suspicion of compromising classified technology used in making 2-nanometer chips, the Taiwan High Prosecutors’ Office said yesterday. Prosecutors are holding a former TSMC engineer surnamed Chen (陳) and two recently sacked TSMC engineers, including one person surnamed Wu (吳) in detention with restricted communication, following an investigation launched on July 25, a statement said. The announcement came a day after Nikkei Asia reported on the technology theft in an exclusive story, saying TSMC had fired two workers for contravening data rules on advanced chipmaking technology. Two-nanometer wafers are the most

NEW GEAR: On top of the new Tien Kung IV air defense missiles, the military is expected to place orders for a new combat vehicle next year for delivery in 2028 Mass production of Tien Kung IV (Sky Bow IV) missiles is expected to start next year, with plans to order 122 pods, the Ministry of National Defense’s (MND) latest list of regulated military material showed. The document said that the armed forces would obtain 46 pods of the air defense missiles next year and 76 pods the year after that. The Tien Kung IV is designed to intercept cruise missiles and ballistic missiles to an altitude of 70km, compared with the 60km maximum altitude achieved by the Missile Segment Enhancement variant of PAC-3 systems. A defense source said yesterday that the number of

A bipartisan group of US representatives have introduced a draft US-Taiwan Defense Innovation Partnership bill, aimed at accelerating defense technology collaboration between Taiwan and the US in response to ongoing aggression by the Chinese Communist Party (CCP). The bill was introduced by US representatives Zach Nunn and Jill Tokuda, with US House Select Committee on the Chinese Communist Party Chairman John Moolenaar and US Representative Ashley Hinson joining as original cosponsors, a news release issued by Tokuda’s office on Thursday said. The draft bill “directs the US Department of Defense to work directly with Taiwan’s Ministry of National Defense through their respective

Tsunami waves were possible in three areas of Kamchatka in Russia’s Far East, the Russian Ministry for Emergency Services said yesterday after a magnitude 7.0 earthquake hit the nearby Kuril Islands. “The expected wave heights are low, but you must still move away from the shore,” the ministry said on the Telegram messaging app, after the latest seismic activity in the area. However, the Pacific Tsunami Warning System in Hawaii said there was no tsunami warning after the quake. The Russian tsunami alert was later canceled. Overnight, the Krasheninnikov volcano in Kamchatka erupted for the first time in 600 years, Russia’s RIA