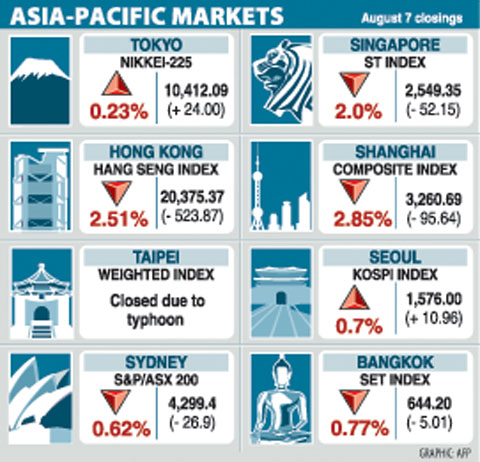

Asian stocks dropped, snapping three weeks of gains, on concern China will curb lending to avert a bubble in equities and after Nikon Corp and DBS Group Holdings Ltd reported declining earnings.

China’s Shanghai Composite Index fell the most since February. Nikon, Japan’s biggest maker of steppers used in microchip production, slumped 12 percent after forecasting a record loss. DBS, Southeast Asia’s biggest bank, sank 7.5 percent in Singapore as provisions for bad loans surged.

HSBC Holdings PLC, Europe’s biggest bank, climbed 8.7 percent in Hong Kong on better-than-estimated profit.

The MSCI Asia-Pacific Index declined 1 percent to 110.74 this week, with about twice as many stocks retreating as gaining. The gauge has climbed 57 percent from its March 9 five-year low on speculation a recovering global economy will boost earnings. Japan’s Nikkei 225 Stock Average added 0.5 percent to a 10-month high, and most Asian benchmark indexes advanced.

“I’m a bit more cautious, as valuations have run ahead of fundamentals following the recent rally,” said Ivan Tham, Singapore-based head of fund management at state-backed Kuwait Finance House, which has about US$24 billion in assets. “There are early indications that the economy is bottoming out.”

Better-than-estimated earnings and economic reports worldwide have driven stocks higher since March, lifting the average valuation of companies on the MSCI Asia-Pacific Index to 24 times estimated profit as of yesterday, near this year’s high of 26 reached in March.

Data this week showed Australian employers unexpectedly added jobs and pointed to improving manufacturing industries in China, Europe and the US.

The Shanghai Composite sank 4.4 percent as the People’s Bank of China said in a quarterly report released on Thursday that it would fine-tune monetary policy, sparking concern the central bank will rein in lending to avert bubbles in equities and property.

Taiwanese share prices are seen consolidating in the week ahead as investors remain cautious over negative economic data, analysts said..

For the week to Thursday, the weighted index fell 209.06 points, or 2.95 percent, to 6,868.65 after a 1.50 percent increase a week earlier. Average daily turnover stood at NT$138.87 billion (US$4.23 billion), compared with NT$146.38 billion a week ago.

Taiwan’s financial markets were closed on Friday as Typhoon Marakot hit. Trading will resume tomorrow.

“The sentiment is cautious as July consumer prices fell steepest in nearly 39 years ... which showed a lackluster consumption willingness,” said the Chinese-language Liberty Times (the Taipei Times’ sister newspaper).

The Taipei bourse is expected to consolidate in the near term although companies with a positive earning outlook are likely to stage a rebound, the paper said.

Taiwan’s consumer price last month fell for the sixth consecutive month by 2.33 percent year-on-year, while June unemployment hit a record high of 5.94 percent, the government said.

Rainfall is expected to become more widespread and persistent across central and southern Taiwan over the next few days, with the effects of the weather patterns becoming most prominent between last night and tomorrow, the Central Weather Administration (CWA) said yesterday. Independent meteorologist Daniel Wu (吳德榮) said that based on the latest forecast models of the combination of a low-pressure system and southwesterly winds, rainfall and flooding are expected to continue in central and southern Taiwan from today to Sunday. The CWA also warned of flash floods, thunder and lightning, and strong gusts in these areas, as well as landslides and fallen

WAITING GAME: The US has so far only offered a ‘best rate tariff,’ which officials assume is about 15 percent, the same as Japan, a person familiar with the matter said Taiwan and the US have completed “technical consultations” regarding tariffs and a finalized rate is expected to be released soon, Executive Yuan spokeswoman Michelle Lee (李慧芝) told a news conference yesterday, as a 90-day pause on US President Donald Trump’s “reciprocal” tariffs is set to expire today. The two countries have reached a “certain degree of consensus” on issues such as tariffs, nontariff trade barriers, trade facilitation, supply chain resilience and economic security, Lee said. They also discussed opportunities for cooperation, investment and procurement, she said. A joint statement is still being negotiated and would be released once the US government has made

SOUTH CHINA SEA? The Philippine president spoke of adding more classrooms and power plants, while skipping tensions with China over disputed areas Philippine President Ferdinand Marcos Jr yesterday blasted “useless and crumbling” flood control projects in a state of the nation address that focused on domestic issues after a months-long feud with his vice president. Addressing a joint session of congress after days of rain that left at least 31 dead, Marcos repeated his recent warning that the nation faced a climate change-driven “new normal,” while pledging to investigate publicly funded projects that had failed. “Let’s not pretend, the people know that these projects can breed corruption. Kickbacks ... for the boys,” he said, citing houses that were “swept away” by the floods. “Someone has

‘CRUDE’: The potential countermeasure is in response to South Africa renaming Taiwan’s representative offices and the insistence that it move out of Pretoria Taiwan is considering banning exports of semiconductors to South Africa after the latter unilaterally downgraded and changed the names of Taiwan’s two representative offices, the Ministry of Foreign Affairs (MOFA) said yesterday. On Monday last week, the South African Department of International Relations and Cooperation unilaterally released a statement saying that, as of April 1, the Taipei Liaison Offices in Pretoria and Cape Town had been renamed the “Taipei Commercial Office in Johannesburg” and the “Taipei Commercial Office in Cape Town.” Citing UN General Assembly Resolution 2758, it said that South Africa “recognizes the People’s Republic of China (PRC) as the sole