US stocks have staged five consecutive weeks of gains, but analysts asked investors to brace for a tough ride as earnings results of key recession-battered companies emerge in the coming weeks.

Shares ended the holiday-shortened week on a high note with the blue chip Dow index posting a stunning three-digit gain on Thursday on the back of projections by banking giant Wells Fargo of a record first-quarter profit.

Friday was a market holiday.

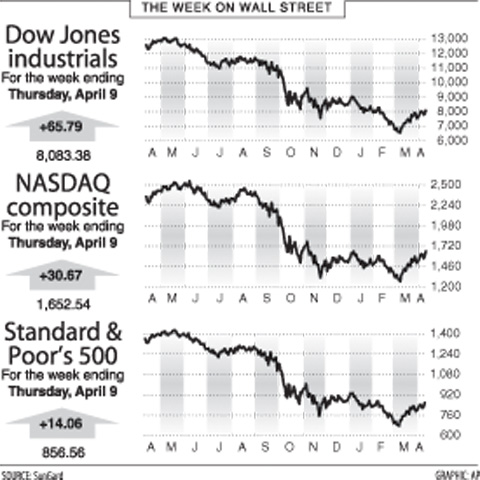

The Dow Jones Industrial Average rose 0.82 percent to finish the week at 8,083.38, its highest closing level in two months.

The Dow’s fifth weekly gain is the best performance since fall 2007.

The broad Standard & Poor’s 500 index rose 1.67 percent to 856.56 over the week, while the tech-heavy NASDAQ was up 1.89 percent to 1,652.54.

The corporate earnings reporting season for the first quarter began on Tuesday with US aluminum giant Alcoa declaring a hefty US$497 million net loss on plunging prices for the key metal amid the global economic downturn.

Its second consecutive quarterly loss was higher than expected by most analysts and underscored the depth of the 16-month-old US recession flooding listed companies with red ink.

Following Alcoa’s result, the markets turned cautious on light trading ahead of financial results of other key companies, including financial institutions such as Citigroup, JPMorgan Chase and Goldman Sachs the coming week.

But Wells Fargo, scheduled to announce its results on April 22, made a surprise announcement on Thursday that it expected a “record” net income of some US$3 billion for the first quarter, trouncing Wall Street estimates and sparking a rally before market closed the week.

The US budget deficit accelerated last month to hit a record nearly US$1 trillion just halfway through the current fiscal year, as the US government moved to bail out troubled institutions, government data showed on Friday.

The deficit for the first six months of the fiscal year which began on Oct. 1 was US$956.8 billion, according to the Treasury’s monthly statement of receipts and outlays.

Receipts during the six-month period to last month were US$989.83 billion, while outlays amounted to nearly US$1.95 trillion, the data showed.

Last month’s US deficit of US$192.27 billion was higher than the US$160 billion expected by most analysts, coming on the back of money poured by US President Barack Obama’s administration to rescue financial institutions.

All six months of the fiscal year so far recorded red ink. The last time the US plunged into a consecutive six month deficit was during the October 2003 to March 2004 period, officials said.

AIR SUPPORT: The Ministry of National Defense thanked the US for the delivery, adding that it was an indicator of the White House’s commitment to the Taiwan Relations Act Deputy Minister of National Defense Po Horng-huei (柏鴻輝) and Representative to the US Alexander Yui on Friday attended a delivery ceremony for the first of Taiwan’s long-awaited 66 F-16C/D Block 70 jets at a Lockheed Martin Corp factory in Greenville, South Carolina. “We are so proud to be the global home of the F-16 and to support Taiwan’s air defense capabilities,” US Representative William Timmons wrote on X, alongside a photograph of Taiwanese and US officials at the event. The F-16C/D Block 70 jets Taiwan ordered have the same capabilities as aircraft that had been upgraded to F-16Vs. The batch of Lockheed Martin

GRIDLOCK: The National Fire Agency’s Special Search and Rescue team is on standby to travel to the countries to help out with the rescue effort A powerful earthquake rocked Myanmar and neighboring Thailand yesterday, killing at least three people in Bangkok and burying dozens when a high-rise building under construction collapsed. Footage shared on social media from Myanmar’s second-largest city showed widespread destruction, raising fears that many were trapped under the rubble or killed. The magnitude 7.7 earthquake, with an epicenter near Mandalay in Myanmar, struck at midday and was followed by a strong magnitude 6.4 aftershock. The extent of death, injury and destruction — especially in Myanmar, which is embroiled in a civil war and where information is tightly controlled at the best of times —

China's military today said it began joint army, navy and rocket force exercises around Taiwan to "serve as a stern warning and powerful deterrent against Taiwanese independence," calling President William Lai (賴清德) a "parasite." The exercises come after Lai called Beijing a "foreign hostile force" last month. More than 10 Chinese military ships approached close to Taiwan's 24 nautical mile (44.4km) contiguous zone this morning and Taiwan sent its own warships to respond, two senior Taiwanese officials said. Taiwan has not yet detected any live fire by the Chinese military so far, one of the officials said. The drills took place after US Secretary

THUGGISH BEHAVIOR: Encouraging people to report independence supporters is another intimidation tactic that threatens cross-strait peace, the state department said China setting up an online system for reporting “Taiwanese independence” advocates is an “irresponsible and reprehensible” act, a US government spokesperson said on Friday. “China’s call for private individuals to report on alleged ‘persecution or suppression’ by supposed ‘Taiwan independence henchmen and accomplices’ is irresponsible and reprehensible,” an unnamed US Department of State spokesperson told the Central News Agency in an e-mail. The move is part of Beijing’s “intimidation campaign” against Taiwan and its supporters, and is “threatening free speech around the world, destabilizing the Indo-Pacific region, and deliberately eroding the cross-strait status quo,” the spokesperson said. The Chinese Communist Party’s “threats