The global shortfall in trade financing has expanded by up to four times since November to around US$100 billion, with emerging markets feeling the pinch due to the credit crunch, a trade source said on Wednesday.

“The magnitude of the gap has increased by three-fold or four-fold,” said the source after a WTO meeting that brought together experts and bankers on trade financing.

A similar meeting in November estimated the shortfall in cash to finance trade at US$25 billion, or 0.25 percent of the overall market, which is worth US$10 trillion.

A drought in liquidity is now not only affecting industrialized markets such as the US but also hitting emerging markets including India and South Korea.

“What started as a problem on Wall Street and London that was directly linked to the liquidity crisis — that problem has moved gradually to emerging markets,” the source said. “It’s no longer about north-north trade financing, it’s about north-south, and south-south trade financing.”

Trade financing has been described as the “lifeblood” without which global trade would stall. It comes in the form of credit issued and guaranteed by banks to importers and exporters.

Key banks active in the field of trade finance such as HSBC, JP Morgan, Royal Bank of Scotland and Commerzbank sent representatives to Wednesday’s meeting, sources said.

Amid the liquidity crunch, trade financing has dried up, with financiers now requiring more collateral before issuing credit and charging higher interest rates.

The trade source said that while interest rates averaged 15 basis points above central bank rates in the past, charges now ranged from “120 basis points for the best bank in India to several thousand basis points for central Asia.”

Governments and international institutions have been taking action to fill gaps, the source noted, saying that there has been a “mushrooming of initiatives.”

“At the same time, as they manage to fill that gap, then another gap is created somewhere else around the globe,” the source said.

One plan led by the World Bank and its associates is a “global trade finance liquidity pool” that would offer a US$10 billion to US$11 billion package in financing at the G20 summit in April, he said.

“In terms of gap filling, it’s a race against time,” he said.

He noted however that the situation has improved lately in China, but there is a “huge need for support to Africa.”

Meanwhile, EU leaders were set to rebuff calls to pump more taxpayer money into their ailing economies at a summit yesterday and today focused on tackling the increasingly dire economic crisis.

European governments have mostly turned a deaf ear to calls for more action, insisting next month’s G20 London summit should have a firm focus on revamping the global financial architecture they put at the heart of current problems.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

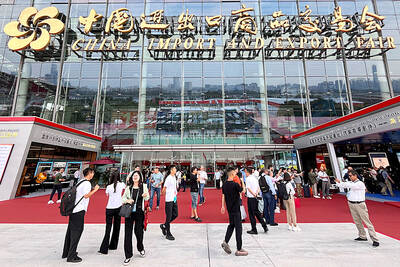

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College