Asian stocks slumped for a third week amid mounting concern the financial crisis is “reigniting” as the deepening global recession cut into corporate profits.

HSBC Holdings PLC, Europe’s largest bank, lost 11 percent for the week after the UK and US governments were forced to provide new bailouts for banks and New York University professor Nouriel Roubini said credit losses could surpass US$3 trillion. Sony Corp plunged 13 percent after forecasting a record loss, while Samsung Electronics Co, the world’s largest liquid-crystal display TV maker, dropped 5.8 percent after posting its first quarterly loss.

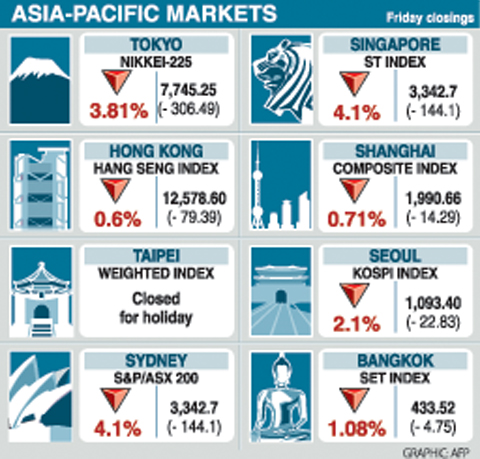

The MSCI Asia Pacific Index slid 5.2 percent last week to 80.32, the lowest level since Dec. 5. The benchmark measure fell for a third consecutive week, the first time since October it has done so.

Financial companies posted the biggest declines on the benchmark index, which slumped by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid slumping profits.

Japan’s Nikkei 225 Stock Average lost 5.9 percent in the week as the yen’s climb to the highest since 1995 against the dollar added to exporters’ woes. Most benchmark indexes retreated across the region, except in China, where the central government unveiled additional measures to support the economy.

Concerns banks will be nationalized weighed on shares of lenders throughout the world. The UK government moved to raise its stake in Royal Bank of Scotland Group PLC, while Bank of America Corp received a bailout and was forced to slash its dividend to US$0.01.

HSBC tumbled 11 percent to HK$57.45 (US$7.40). Morgan Stanley and Goldman Sachs Group Inc have predicted the bank, which gets about a fifth of its revenue in North America, may have to raise additional capital.

US financial losses from the credit crisis may reach US$3.6 trillion, suggesting the banking system is “effectively insolvent,” Roubini, who predicted last year’s economic crisis, said on Tuesday. Institutions worldwide have so far reported writedowns and losses of more than US$1 trillion.

Mizuho Financial Group Inc, Japan’s second-largest listed lender, dropped 15 percent to ¥212 (US$2.39). National Australia Bank Ltd., the country’s biggest by assets, slumped 12 percent to A$16.94.

Sony, the maker of PlayStation3 game consoles, lost 13 percent to ¥1,802. The company said it expects a record ¥260 billion operating loss for the year ending in March amid falling demand, the strong yen and costs to restructure its business.

“Sony’s loss forecast was an order of magnitude greater than what some analysts had estimated,” Soichiro Monji, chief strategist at Daiwa SB Investments Ltd, which manages the equivalent of US$53 billion, said in an interview with Bloomberg Television. “The bad news about earnings and economies is accumulating.”

China last week reported its slowest rate of growth in seven years as the economy grew at an annualized 6.8 percent pace in the fourth quarter. South Korea’s central bank also said the country’s economy shrank a 5.6 percent last quarter, the biggest decline since the Asian financial crisis.

Samsung lost 5.8 percent to 442,000 won (US$323) as it reported a fourth-quarter net loss amid slumping demand for its computer chips, televisions and mobile-phone handsets.

TAIPEI

The TAIEX closed up 0.13 percent to 4,247,97 on Wednesday before the Lunar New Year holiday. Markets will reopen on Feb. 2.

Other regional markets:

KUALA LUMPUR: Down 0.7 percent. The Kuala Lumpur Composite Index fell 6.33 points to close at 872.69 points with a turnover of 277.13 million shares worth 388.36 million ringgit (US$107.43 million).

JAKARTA: Down 0.9 percent. The Jakarta Composite Index dropped 11.74 points to 1,315.59 in thin volume.

MANILA: Down 0.3 percent. The composite index lost 6.18 points to 1,857.34, while the all shares index shed 0.5 percent to 1,202.41.

WELLINGTON: Down 1.07 percent. The NZX-50 index fell 29.33 points to close at 2,705.09. Turnover was NZ$92.4 million (US$48.8 million).

MUMBAI: Down 1.58 percent. The benchmark 30-share SENSEX index was 139.49 points

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

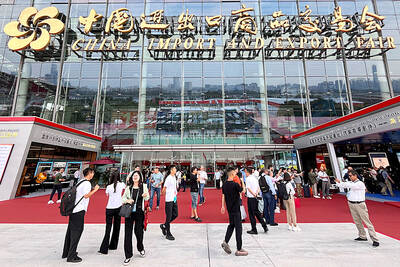

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College