A newly revived Wall Street faces a fresh test of momentum in the coming week with a wave of corporate results that may indicate whether the latest rebound is for real.

The results and profit guidance will be scrutinized for signs of whether companies are able to remain profitable in the face of a housing meltdown and credit squeeze that is weighing on economic growth.

The blue-chip Dow Jones Industrial Average rallied 3.57 percent to 11,496.57 in the week to Friday, bouncing back from four weeks of heavy losses.

The tech-rich NASDAQ climbed 1.95 percent for the week to 2,282.78 and the broad-market Standard & Poor’s 500 index added 1.71 percent to 1,260.68.

The market saw a strong snapback after four moribund weeks, managing to overcome fears about a collapse at Fannie Mae and Freddie Mac, the mortgage finance giants which underpin trillions of dollars in the mortgage market.

Actions by the US Federal Reserve to open credit to Fannie and Freddie and statements of support from the US Treasury eased fears about a new financial shock, helping the stock market recover.

Economist Ethan Harris at Lehman Brothers said the response to the crisis was encouraging.

“The good news is that now monetary, fiscal and regulatory authorities are taking action to prevent a deeper shock to the economy,” he said. “Fannie Mae and Freddie Mac are at the heart of a functioning US housing and financial market.”

Yet analysts are still cautious on whether the stock market move is sustainable.

“It was a nice bounce in stocks, but it’s too early to declare ‘Morning in America,’” said Douglas Porter, economist at BMO Capital Markets.

“A theme through the rest of earnings season may be that nonfinancials are now grappling with the tag team of lofty energy costs and weak economic growth. After a two-year slide, the US housing sector has not quite hit bottom yet, and will require a prolonged period of healing. At least for now, though, it appears the market has moved past another point of extreme bearishness,” he said.

The rebound was led by the banking sector, which some analysts say may have hit bottom after posting tens of billions of dollars of losses from bets on US real estate.

Despite hefty losses for some banks and more big writedowns, the results for the big US banks have been generally better than expected on Wall Street.

“Investors should feel at least slightly relieved that while several global or major money center national banks delivered lousy earnings, the mortgage or credit market related write-offs weren’t nearly as bad as expected and appear to be lessening,” said Fred Dickson, market strategist at DA Davidson & Co.

“Analysts appeared to have overestimated the losses of these banks or misjudged the ability of the banks to offset some of the write-offs with income from fees and normal lending activities. Predictably, short-sellers of these banks moved to partially cover their positions and natural buyers stepped in once the earnings reports hit the tape,” he said.

Another key for Wall Street was a big drop in oil prices, which tumbled below US$130 in the past week, well off records of about IS$147 a barrel.

“Oil more than any other single item could be a positive catalyst for the market as lower energy costs would help to relieve pressure on consumers,” said Gregory Drahuschak, analyst at Janney Montgomery Scott.

“Long term, we have major doubts that the price of crude oil can slide precipitously, but crude at US$100 would not be shocking, which would have a significantly positive effect on stocks,” he said.

In the coming week, the market will focus on quarterly reports from big financial firms including Bank of America and Wachovia. Also on tap are quarterly results from key firms like Apple, Yahoo and Boeing.

On the economic calendar are reports on new and existing home sales and orders for durable manufactured goods.

Bonds fell on the shift to equities. The yield on the 10-year Treasury bond rose to 4.081 percent from 3.940 percent a week earlier and that on the 30-year bond climbed to 4.662 from 4.517 percent. Bond yields and prices move in opposite directions.

SECURITY: As China is ‘reshaping’ Hong Kong’s population, Taiwan must raise the eligibility threshold for applications from Hong Kongers, Chiu Chui-cheng said When Hong Kong and Macau citizens apply for residency in Taiwan, it would be under a new category that includes a “national security observation period,” Mainland Affairs Council (MAC) Minister Chiu Chui-cheng (邱垂正) said yesterday. President William Lai (賴清德) on March 13 announced 17 strategies to counter China’s aggression toward Taiwan, including incorporating national security considerations into the review process for residency applications from Hong Kong and Macau citizens. The situation in Hong Kong is constantly changing, Chiu said to media yesterday on the sidelines of the Taipei Technology Run hosted by the Taipei Neihu Technology Park Development Association. With

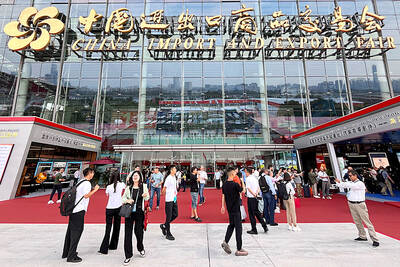

CARROT AND STICK: While unrelenting in its military threats, China attracted nearly 40,000 Taiwanese to over 400 business events last year Nearly 40,000 Taiwanese last year joined industry events in China, such as conferences and trade fairs, supported by the Chinese government, a study showed yesterday, as Beijing ramps up a charm offensive toward Taipei alongside military pressure. China has long taken a carrot-and-stick approach to Taiwan, threatening it with the prospect of military action while reaching out to those it believes are amenable to Beijing’s point of view. Taiwanese security officials are wary of what they see as Beijing’s influence campaigns to sway public opinion after Taipei and Beijing gradually resumed travel links halted by the COVID-19 pandemic, but the scale of

A US Marine Corps regiment equipped with Naval Strike Missiles (NSM) is set to participate in the upcoming Balikatan 25 exercise in the Luzon Strait, marking the system’s first-ever deployment in the Philippines. US and Philippine officials have separately confirmed that the Navy Marine Expeditionary Ship Interdiction System (NMESIS) — the mobile launch platform for the Naval Strike Missile — would take part in the joint exercise. The missiles are being deployed to “a strategic first island chain chokepoint” in the waters between Taiwan proper and the Philippines, US-based Naval News reported. “The Luzon Strait and Bashi Channel represent a critical access

Pope Francis is be laid to rest on Saturday after lying in state for three days in St Peter’s Basilica, where the faithful are expected to flock to pay their respects to history’s first Latin American pontiff. The cardinals met yesterday in the Vatican’s synod hall to chart the next steps before a conclave begins to choose Francis’ successor, as condolences poured in from around the world. According to current norms, the conclave must begin between May 5 and 10. The cardinals set the funeral for Saturday at 10am in St Peter’s Square, to be celebrated by the dean of the College