Oil prices leapt above US$106 in New York on Friday as investor sentiment was driven by the weak US dollar, tight energy supplies and more bad news on the US economy.

New York’s main oil contract, light sweet crude for delivery in May, jumped US$2.40 to close at US$106.23 per barrel.

London’s Brent North Sea crude for May rallied US$2.38 to US$104.90 at the settlement.

“Crude futures were higher as the dollar weakened,” Sucden analyst Nimit Khamar said in London. The weak US currency tends to encourage demand for dollar-priced crude because it becomes cheaper for foreign buyers.

The dollar sank further against the euro on Friday after news that US employers cut a surprisingly large 80,000 jobs last month, the biggest decline in employment in five years, according to a government report.

The mounting job losses swelled the US unemployment rate to 5.1 percent last month, compared with 4.8 percent in February.

Last month’s nonfarm job losses marked the sharpest monthly decline since March 2003 and the start of the Iraq war, while the unemployment rate leapt to its highest level since September 2005.

Friday’s jobs report prompted many commodity fund investors to bet on fresh falls for the dollar, traders said.

“Commodity funds are in many ways ahead of the dollar,” Alaron Trading analyst Phil Flynn said. “The bad jobs number is basically reinforcing the idea that the [US] interest rates will come down.”

“Bad economic news is good for commodities” in the near term, Flynn said.

Mike Fitzpatrick at MF Global said that despite the speculative push, the trend should be lower for oil futures since slower economic growth will mean softer demand.

“Uncertainty over future demand has undermined every rally recently, and if the jobs number is any measure of the pulse of the economy, it certainly has to be disappointing relative to energy demand growth, particularly when coupled with the jump in crude oil stocks recently,” he said. “With stocks building and demand slipping, it is difficult to justify prices at current levels. Technically, the market’s upward momentum seems to be fading ... The US is not alone in experiencing a creeping economic malaise.”

This week, the oil market was gripped by volatility as traders weighed the likely slowing of global economic growth against concerns about tight energy supplies.

Many traders are concerned that slowing US growth could prompt a slowdown in demand.

On Wednesday, however, prices soared after news that US gasoline reserves tumbled 4.5 million barrels, compared with forecasts for a smaller drop of 2.5 million barrels.

The market is beginning to closely watch gasoline inventories ahead of the US peak demand season for motor fuel, which begins next month when Americans begin their summer vacations.

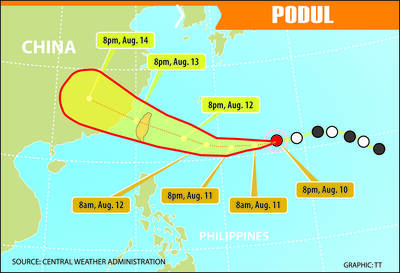

GET TO SAFETY: Authorities were scrambling to evacuate nearly 700 people in Hualien County to prepare for overflow from a natural dam formed by a previous typhoon Typhoon Podul yesterday intensified and accelerated as it neared Taiwan, with the impact expected to be felt overnight, the Central Weather Administration (CWA) said, while the Directorate-General of Personnel Administration announced that schools and government offices in most areas of southern and eastern Taiwan would be closed today. The affected regions are Tainan, Kaohsiung and Chiayi City, and Yunlin, Chiayi, Pingtung, Hualien and Taitung counties, as well as the outlying Penghu County. As of 10pm last night, the storm was about 370km east-southeast of Taitung County, moving west-northwest at 27kph, CWA data showed. With a radius of 120km, Podul is carrying maximum sustained

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

TALKS CONTINUE: Although an agreement has not been reached with Washington, lowering the tariff from 32 percent to 20 percent is still progress, the vice premier said Taiwan would strive for a better US tariff rate in negotiations, with the goal being not just lowering the current 20-percent tariff rate, but also securing an exemption from tariff stacking, Vice Premier Cheng Li-chiun (鄭麗君) said yesterday. Cheng made the remarks at a news conference at the Executive Yuan explaining the new US tariffs and the government’s plans for supporting affected industries. US President Donald Trump on July 31 announced a new tariff rate of 20 percent on Taiwan’s exports to the US starting on Thursday last week, and the Office of Trade Negotiations on Friday confirmed that it