Democratic Progressive Party Legislator Lin Chun-hsien (林俊憲) yesterday urged the Financial Supervisory Commission (FSC) to curb bad debts stemming from fraud and loan sharking on Internet-based peer-to-peer lending platforms.

Lin made the remark during an event at the Legislative Yuan that charged the commission of failing to regulate peer-to-peer financial activities.

FSC officials were invited to the event to offer a response.

Most borrowers on online peer-to-peer lending platforms have trouble securing loans from banks because of poor credit scores, Lin said, adding that as they are more likely to end up in arrears, lenders often impose extremely high interest rates.

Online lending platforms have existed for years in other nations and have caused many problems, Lin said, adding that in China they are blamed for generating an estimated 60 billion yuan (US$9.2 billion) of bad debt.

Chinese students who lack means are taking out so-called “campus loans” online, sometimes in exchange for sexually explicit photographs as collateral, he said.

The British, US and Chinese governments have been taking steps to regulate online peer-to-peer lending, with the UK drafting laws and regulations that specifically tackle the issue, he added.

“In Taiwan, peer-to-peer lending remains a legal gray area that harbors bad debt, fraud and usurious interest rates, and has serious implications to our society. Enforcement of financial regulations should be carried out in accordance with an entity’s functional behavior, not its institutional type,” Lin said.

“New FSC Chairman Wellington Koo (顧立雄) should do things in a way that differs from the business-as-usual approach of the past,” he added.

FSC official Chou Cheng-shan (周正山) said peer-to-peer lending platforms are online service providers, not financial service providers that the commission is empowered to regulate.

However, the agency has discussed the matter with platform operators and believes that existing laws provide it with the legal leverage to regulate some peer-to-peer exchanges, he said.

For example, platforms are not authorized to issue bonds or financial products, charge lenders before loans are made, violate legal protections on privacy, collect debts illegally or market their services in ways that contravene the law, he added.

The commission has encouraged platform operators to work with established financial institutions and has called on the Bankers Association of the Republic of China to draft trade rules to regulate online lending, Chou said.

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

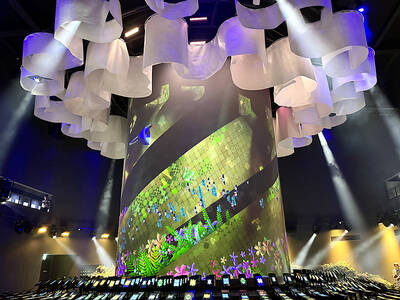

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by