The government will not hesitate to act if the new labor insurance pension system goes in the red 19 years from now, Council of Labor Affairs (CLA) Minister Wang Ju-hsuan (王如玄) said.

“It is just conjecture that the labor pension fund risks incurring debts 19 years after the system takes effect,” said Wang on Friday.

Noting that the assumption was based on hypothetical scenarios — such as up to 80 percent of wage earners choosing to receive monthly pension payments and the pension fund’s return on investment being 4 percent or less — Wang said this depressing forecast might not necessarily be correct.

“There are many variables to decide the future of the labor pension fund, so we need not be too pessimistic,” Wang said, adding that if the fund did begins to incur deficits, the government would enact bailout measures.

Wang’s assurances came after the Legislative Yuan approved a package of amendments to the Labor Insurance Act (勞工保險條例) that will allow the country’s 8 million-plus wage earners to receive pension payments in monthly installments rather than in one lump sum.

Under the existing system, retired wage earners can only receive their pension in a lump sum, the value of which risks being eaten up by inflation and failed investment.

The new system, which will come into force on Jan. 1, will permit retired workers from the age of 60 on to choose to collect their pension in a lump sum or to receive monthly payouts until death.

Wang encouraged wage earners to choose the monthly payout system, which she said would benefit pensioners far more than the lump sum alternative.

“For pensioners who opt for monthly payments, the amount they receive after eight years and one month will outstrip the amount they receive in one lump sum,” Wang said, adding that if a pensioner died and the accumulated monthly amount received is lower than the lump sum, the surviving family would be given the difference.

Also, the insurance premium rate would be raised from the current 6.5 percent to 7.5 percent initially, increasing year by year to a maximum of 13 percent by 2027.

Pensioners opting for monthly payouts will receive an amount equaling the number of years they have participated in the labor insurance system times their monthly salary (calculated by taking the average of a worker’s 60 highest monthly salaries) times the income substitution factor of 1.55 percent.

A retired worker with a monthly insured wage of NT$43,900 would be entitled to receive a pension of NT$20,414 per month after being in the system for 30 years.

Stressing that the main purpose of the new system was to enable workers to lead dignified lives after retiring, Wang said the increase in the premium rate was necessary.

Chinese Nationalist Party (KMT) Chairman Eric Chu (朱立倫), spokeswoman Yang Chih-yu (楊智伃) and Legislator Hsieh Lung-chieh (謝龍介) would be summoned by police for questioning for leading an illegal assembly on Thursday evening last week, Minister of the Interior Liu Shyh-fang (劉世芳) said today. The three KMT officials led an assembly outside the Taipei City Prosecutors’ Office, a restricted area where public assembly is not allowed, protesting the questioning of several KMT staff and searches of KMT headquarters and offices in a recall petition forgery case. Chu, Yang and Hsieh are all suspected of contravening the Assembly and Parade Act (集會遊行法) by holding

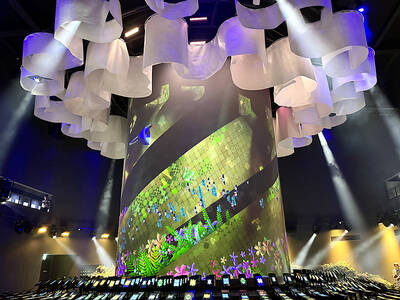

PRAISE: Japanese visitor Takashi Kubota said the Taiwanese temple architecture images showcased in the AI Art Gallery were the most impressive displays he saw Taiwan does not have an official pavilion at the World Expo in Osaka, Japan, because of its diplomatic predicament, but the government-backed Tech World pavilion is drawing interest with its unique recreations of works by Taiwanese artists. The pavilion features an artificial intelligence (AI)-based art gallery showcasing works of famous Taiwanese artists from the Japanese colonial period using innovative technologies. Among its main simulated displays are Eastern gouache paintings by Chen Chin (陳進), Lin Yu-shan (林玉山) and Kuo Hsueh-hu (郭雪湖), who were the three young Taiwanese painters selected for the East Asian Painting exhibition in 1927. Gouache is a water-based

Taiwan would welcome the return of Honduras as a diplomatic ally if its next president decides to make such a move, Minister of Foreign Affairs Lin Chia-lung (林佳龍) said yesterday. “Of course, we would welcome Honduras if they want to restore diplomatic ties with Taiwan after their elections,” Lin said at a meeting of the legislature’s Foreign Affairs and National Defense Committee, when asked to comment on statements made by two of the three Honduran presidential candidates during the presidential campaign in the Central American country. Taiwan is paying close attention to the region as a whole in the wake of a

OFF-TARGET: More than 30,000 participants were expected to take part in the Games next month, but only 6,550 foreign and 19,400 Taiwanese athletes have registered Taipei city councilors yesterday blasted the organizers of next month’s World Masters Games over sudden timetable and venue changes, which they said have caused thousands of participants to back out of the international sporting event, among other organizational issues. They also cited visa delays and political interference by China as reasons many foreign athletes are requesting refunds for the event, to be held from May 17 to 30. Jointly organized by the Taipei and New Taipei City governments, the games have been rocked by numerous controversies since preparations began in 2020. Taipei City Councilor Lin Yen-feng (林延鳳) said yesterday that new measures by